Opening

As you may imagine, M&A deal flow within the PEO industry slowed immensely during the initial months of COVID-19. While a few transactions took place during the months of April, May, and June, it was a far cry from the aggressive pace we have seen in recent years. However, we are seeing a reemergence of interest in the space within the last thirty days and we expect deal flow to increase through the third and fourth quarter of 2020. This article will review some variables in the equation of deal flow and rationale as to why investor interest is picking back up in the PEO space quickly after the emergence of COVID-19.

.

Macro-Economic Factors

The COVID-19 pandemic was unexpected and unprecedented. No one knew, nor truly knows, the full impact this global shutdown will ultimately have on the economy or PEO space. However, let’s review some of the metrics within the PEO industry that will help shed some light on the impact of the pandemic in the short-term.

.

Revenue Impact

When COVID hit, we didn’t truly know what to expect as it pertained to revenues within the PEO model. While we don’t have full transparency across all PEOs, we can look to the publicly traded players to view the revenue impact during the COVID shutdown months. We will provide a synopsis of these results within this article, but if you want to view the full earnings release coverage with our independent commentary for the publicly traded players, you may view the articles by clicking on the PEO’s name below:

On an aggregate level, publicly traded PEOs fared relatively well in light of the global shutdown. On average, public PEOs only experienced around a 10% reduction in revenues. This is likely due to several factors, including Q1 new business growth which helped offset Q2 same store sales reductions, and macro client segmentation with the ability to work remotely during the pandemic.

.

Revenue Takeaway

Public PEOs did not experience a major reduction in revenues during the pandemic, which is a positive indicator to the investment community.

.

Client Retention

Again, we look to publicly available information to quantify the impact of COVID-19 as it pertains to PEO client retention. Publicly traded PEOs are reporting record client retention numbers coming out of Q1 and into Q2 releases. While the pandemic has hit small and medium sized businesses (SMBs) hard, PEOs have legitimized their business model through their technology suite and consultative resources. PEO clients were in a better position to understand regulatory shifts and receive government stimulus packages than SMBs whom weren’t in a PEO relationship. Moreover, PEOs helped SMBs navigate through layoffs, furloughs, PPP, PPP forgiveness, reporting requirements, etc. The resources and guidance that the PEOs provided during this unprecedented time were invaluable to SMBs and the subsequent result has been record high retention rates at public PEOs. In the last line of our 2019 Industry Statistics Article, Part 2, released in April of 2020, I noted the following:

Hopefully, the PEOs whom have stepped up for their clients will be rewarded with higher client retention rates as a result.

Rob Comeau, 2019 Industry Statistics Article – Part 2

This has proven to be the case for many publicly traded PEOs.

.

Client Retention Takeaway

PEOs are posting record-high client retention rates. This has legitimized the value proposition within the PEO industry and provides investors with a higher degree of confidence in the value and retention predictability. This is a positive sign for investors.

.

Insurance Liabilities

For many PEOs, insurance liabilities are down this year. Medical loss ratios (MLRs) are down for many PEOs due to the pandemic. Additionally, workers’ compensation loss ratios are also down for many PEOs. These stats are likely due to the shelter in place factor during the pandemic. With less workers at job sites, WC loss ratios are bound to be lower. With less employees and dependents visiting the doctor due to the shutdown, it makes sense that MLRs are down. While we may see an uptick in both when the shelter in place rules lighten, we have seen an emergence of ancillary factors that could have long-term effects on both ratios. For example, telemedicine has gained traction during the pandemic. Telemedicine is a more cost-effective point of care than doctor visits. Additionally, many businesses are considering a reduction in brick and mortar locations as it is more cost effective for workers to operate from home. This could equate to a longer-term reduction in workers’ compensation cases, though keep in mind that some jobs require a physical presence so the reduction may be minor. Although, if medical costs reduce due to automated and remote healthcare initiatives, this could have a favorable impact on workers’ compensation as well.

.

Insurance Liability Takeaway

Loss ratios are down both in health and workers’ compensation. Plus, there are new distribution models being adopted post-pandemic that could create more favorable outcomes with insurance liability in the PEO model. This could be viewed as a favorable development by investors.

.

Cyclicality

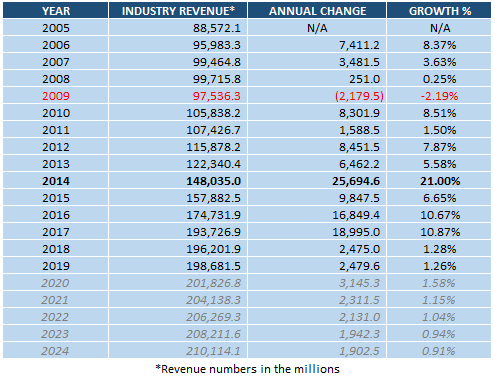

New investors often question a PEO’s resiliency during economic shifts. The impact of cyclicality is a question I often get from new investors as it relates to the PEO industry. As we have covered in our industry statistics articles, the PEO industry has rebounded more quickly than most industries during down economic cycles. An example of this is the industry revenues during the great recession as noted in Figure 1 below.

Figure 1

You may also read more on the impacts of cyclicality on the PEO industry in our article titled Cyclicality within the PEO Industry. However, cyclicality is one thing, a global shutdown is another. From my perspective, the PEO industry has performed exceptionally during this shutdown and should provide the investment community with renewed confidence in the industry’s ability to weather the toughest of storms.

.

Cyclicality Takeaway

PEOs have historically rebounded quickly with economic downturns and have performed better than expectations during this shutdown. This should give investors renewed confidence in a PEO’s ability to manage through difficult seasons.

.

SG&A

For PEOs that were prepared from a technology vantagepoint, this shutdown has shown us that the PEO model can operate effectively and efficiently from a remote workforce perspective. Many large PEOs are either considering or executing a physical location reduction plan. The result is a reduction in SG&A expenses, increased profit margins, and a PEO’s ability to recruit top talent from anywhere within the United States. This should equate to a healthier bottom-line and an increase in bench talent for the PEO.

.

SG&A Takeaway

Overhead reductions, profit increase, and increased talent recruitment capabilities should be viewed as a positive development from the investment community.

.

Closing

The variables covered in this article should provide an indicator as to why investment interest within the space has rebounded so quickly. While newer investors to the space may still be a bit gun-shy, seasoned PEO investors and strategic buyers see many positive developments which have arisen out of a truly unfortunate global situation. Plus, with EBITDA being somewhat suppressed during the pandemic, many knowledgeable investors may view the upcoming quarters as a positive opportunity to buy PEOs at a potentially reduced price. While the industry is fragmented, it has been in a state of consolidation for years. This trend is likely to continue, and we are already seeing tailwinds of increased investor interest within the space.

.

Author

.

Rob Comeau is the Founder & featured Author of this publication and the CEO of Business Resource Center, Inc., a business consulting and investment advisory firm to the PEO industry. You may contact him at rob.comeau@biz-rc.com or (949) 510-1126. To view BRC’s offering, please click on the PEO Consulting | M&A Advisory section at the top menu of this site.

2 thoughts on “Deal Flow in the PEO Industry”

Comments are closed.

I would argue that workers’ compensation rates are headed upwards. The rates have long since been deflated and the possible effect of COVID on work comp experience is very uncertain at this time. Smart PEO operators know how to pass rate increases along to their clients historically, however, in post covid world the SMB is facing increased pricing in all other aspects of their world so i suspect the SMB’s will push back more than ever on rate increases and even go looking for another PEO. Plenty going on in this area. Rob hope you are doing well. Call if you want to connect. 407-230-6953

In the mid- to long-term, I agree. I think we will see a potential spike with MLRs (medical) when the shelter in place loosens due to an increase in non-essential procedures. I too agree on the WC front. Rates have been suppressed. I believe their are multiple variables that will play into a hard market emergence in states, inclusive of workers returning to work, stimulus packages for unemployment reductions, COVID potential claims,, post termination claims due to SMB downsizing, downward economic cycle, etc. However, in the short-term, and based on recent results we’ve seen, we are seeing a reduction. Moreover, if companies can help streamline medical costs through point of care reductions, we could see some improved cost ratios in WC as well as medical. If/when WC markets harden, loss ratios will see an uptick, but new sales should increase as well for PEOs as a hard market typically bodes well for new SMB growth, especially in the blue- and grey-collar client segmentation. Thanks for the comment. I think we are on the same page, but were just referring to different timelines.