PEO Expectations During a Recession

As the United States begins its journey toward a recession, experienced PEOs will position themselves to weather the storm through a multitude of ways. PEOs may look to streamline efficiency, reduce headcount, renegotiate COGS, etc. While these are important, the most important facet of weathering a recessed economy is a proven organic sales engine.

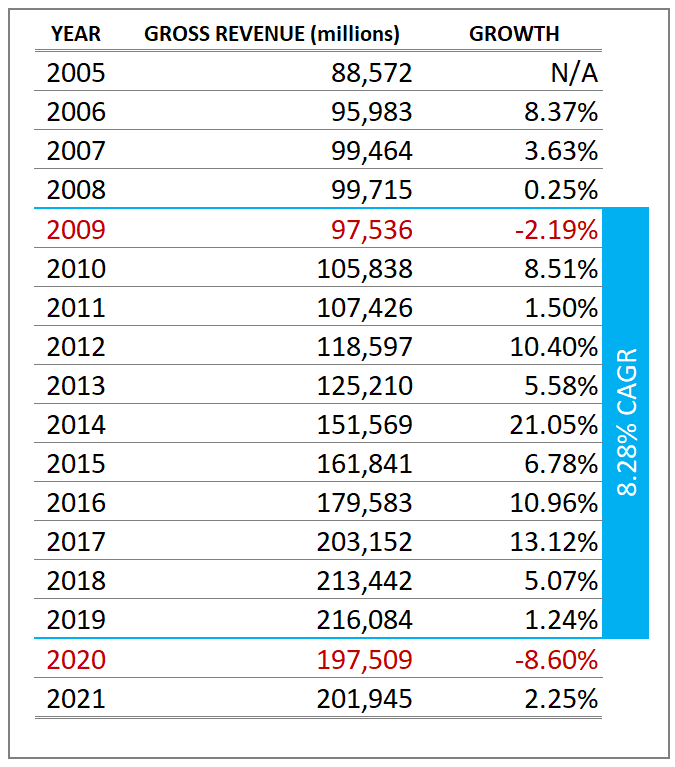

The good news for all PEOs is that the PEO industry has relatively mild economic cyclicality. As you will note in Figure 1, the PEO industry experienced one negative year over year growth in 2009, followed by an 8.28% CAGR over the next ten years, ended only by the COVID pandemic. As you will note, during the pandemic, the industry dropped year over year by -8.60%, largely due to work shutdowns. However, the industry rebounded in 2021 with a 2.25% positive year over year growth rate.

Figure 1

Drivers for Revenue Reduction

Historically, during a recession, PEO same stores sales will reduce (existing client base). This is due to reduction in wages, reduction in hours, and/or reduction in headcount at a WSE level. Moreover, PEOs experience pricing pressure from their clients for proposed rate reductions. In the beginning of a recession, it is the WSE reduction coupled with client-level pricing pressure that has a negative impact on existing revenue. As the recession progresses, a PEO may see an uptick in workers’ compensation claims and COBRA claims. As a result, their COGS may increase in subsequent years, thus putting additional pressure on thinning margins.

A PEO can respond in several ways to this margin erosion. It can reduce internal headcount, seek to reduce COGS, change the framework of master insurance plans, and/or grow organically. From our experience, organic growth should take precedence during a sluggish economy. This is not to say that the other levers to pull are irrelevant, but organic growth yields greater short- and long-term results.

Organic Growth

Why is organic growth the preferred method to mitigate a recessed economy? It is preferred for a number of reasons. Organic growth creates improvements in cash flow from operations. Additionally, organic growth mitigates against internal headcount reductions. Further, organic growth allows PEOs to help offset margin pressure through increased volume. Finally, organic growth contributes to a valuation increase for the PEO should it decide to sell.

As a recessed economy emerges, SMBs may reduce hours, wages, or headcounts of their WSE population. As a result, a PEO’s existing client base reduces. However, during a recessed economy, SMBs are also looking for cost effective solutions. A PEO’s model plays extremely well with cost and workforce efficiency. Therefore, SMBs are more apt to review the PEO model during a recession. As a PEO finds success with organic sales, the new business it adds helps offset same store sales reductions. As the economy flips, the PEO possesses a wider client base through organic growth. When SMBs begin to increase hours, wages, and headcount, it is applied across a larger client base, thus the PEO is better off post-recession than pre-recession. If the PEO solely relied on squeezing the turnip during the recession, they will find themselves at or below pre-recession levels.

Additional Key Variables

We are not just facing down another recession. The United States is experiencing its worst inflation since 1980. Moreover, the cost of capital continues to increase due to the Fed hikes, health insurance inflation continues its higher migration each year, taxes are up, cost of goods at an SMB level continue to increase, the stock market is dipping, and more. The list goes on. As we view the economic status of the U.S. and the increased variables at play, we may be looking at a deep recession or prolonged recession. PEOs that are able to grow during this season will be better equipped than those trying to tread water.

To learn more about current economic trending, click here.

Exit Valuation

The manner in which a PEO mitigates a recessed economy will play into its valuation upon exit. If a PEO solely reduces costs and headcounts, a buyer is less likely to pay a higher multiple. This is due to the fact that the PEO may have already squeezed out some of the cost synergies post-acquisition. Moreover, a buyer is looking to maximize its ROI post transaction. Organic growth plays into this strategy, allowing a buyer to move up the multiple level with justification. If a PEO lacks growth, it will not maximize its valuation.

Parting Thoughts

Organic growth is an important facet in any economy. However, during a recessed economy, organic growth can impact more than just revenue increase. Organic growth can offset against revenue reduction, it can mitigate against downsizing the PEO’s staff, it can relieve margin pressure through volume, it can improve cash flow during a climate of high interest rates, and more. Organic growth is always important, but organic growth during a deep recession may just be the difference in the life of the PEO.

Author

Rob Comeau is the Featured Author of NPG, Founder of BRCI a business consulting and M&A advisory firm, and minority partner and board member for several business services and technology companies. To contact Rob directly, you may email him at rob.comeau@biz-rc.com