PEO Industry Statistics, 2019 – Part 2

The most recent industry report, released by IBISWorld, on the PEO industry is from August 2019. This article is a snapshot of the highlights of the report, followed by commentary by our Founder and featured Author; Rob Comeau.

Fast Facts

Gross revenue for the PEO industry in 2019 was listed at $198.8b, of which, an estimated $175.1b represented worksite employee (WSE) wages. Projected profit for the industry was listed at $9.1b. The annual growth rate from 2014 through 2019 was listed at 6.1%.

These updated stats were pulled from the IBISWorld PEO Industry Report, dated August of 2019. IBISWorld revised its stats from its previous report released in March of 2019. Most notably, revenue slightly dropped but industry profit increased materially.

Industry Structure

According to the report, the PEO industry lifecycle stage is in growth, with revenue volatility being medium. Regulation is medium while barriers to entry are also considered medium. Competition levels remain high, while industry globalization remains low.

Historic Industry Growth

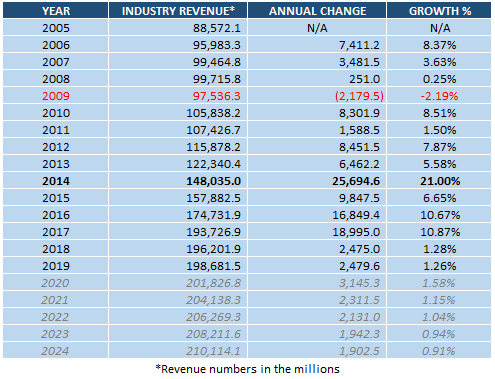

Figure 1 illustrates the historic gross revenue growth for the PEO industry from 2005 through 2019, coupled with forecasted growth (in grey) through 2024. As noted from previous reports, 2009 was the only negative year over year revenue change in the last fifteen years.

Figure 1

Projected Growth Rate, 2019-2024

According to IBISWorld, the projected annual growth rate from 2019 to 2024 is listed at 1.1%. Please note that this report was released prior to the COVID-19 pandemic.

Market Segmentation

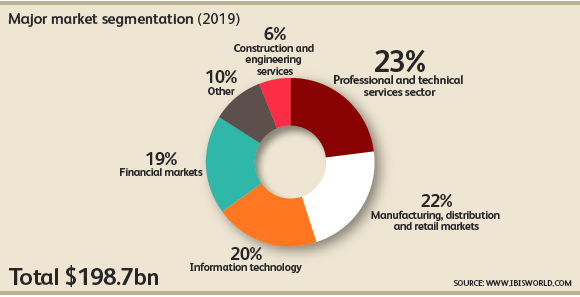

The market segmentation illustrates roughly two-thirds of macro client segmentation within white-collar industries. The remaining one-third is concentrated in either blue- or grey-collar industries as noted in Figure 2.

Figure 2

PEO Business Locations

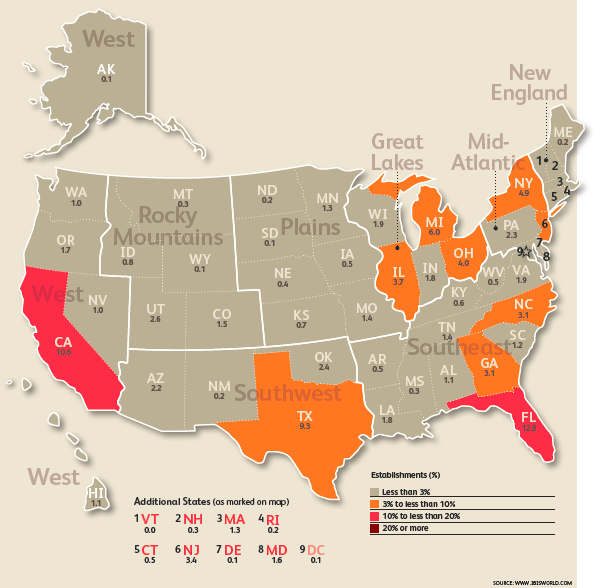

Figure 3 provides insight into PEO business locations. The map provides each state’s percentage of total PEO operations within the United States.

Figure 3

Major Players

IBISWorld identifies three major players within the industry. The report states that no major player has a large portion of industry revenues. Further, it lists these three major players and their market share as the following; Insperity 2.2%, ADP TotalSource 2.1%, and TriNet 1.9%.

Opinion | Commentary by Rob Comeau

The data referenced prior to this section was from the IBISWorld Industry Report 56133, Professional Employer Organizations in the United States, dated August 2019. The following commentary is solely the opinion of this website’s Author; Rob Comeau, pertaining to the information provided in the IBISWorld Report.

Opening Comments

The most recent IBISWorld report was released in August of 2019. Obviously, the report doesn’t cover the potential impact of COVID-19. However, there is insight that can be gained by analyzing historic information (inclusive of the great recession) to project scenarios that may assist a PEO with navigating these uncertain times. We have never experienced a global shutdown in our lifetime, so we do not have a base of reference for what to expect. However, planning for future scenarios may position a PEO to be nimble and pivot when/where necessary to best serve its clients, WSEs, employees, and stakeholders.

COVID-19

Our current situation is unprecedented. We as an industry are navigating uncharted waters. Without having insight into the future, I think it is safe to assume that we can expect certain adjustments as a result of COVID-19.

Industry Revenues

Industry revenues are down year to date in 2020. While we don’t have specific statistics on these numbers to date, every conversation I’ve had with various PEO ownership teams state that revenues are down between 10% and 30%. Depending on the macro client segmentation, certain PEOs have been affected more than others. Blue-collar centric PEOs have likely felt the greatest hit as many of their clients are not currently operating. Grey-collar focused PEOs have felt the hit as well, especially those focused on hospitality. White-collar focused PEOs have experienced a dip, though likely not as great as blue- and grey-collar PEOs. Furloughs and layoffs will be drivers to a reduced year over year revenue change in 2020. The duration for how long the pandemic lasts will determine the severity of revenue reduction for the industry. Considering that roughly two-thirds of the industry’s macro client segmentation is contained within white-collar centric businesses, the industry may weather the storm slightly better than some other human capital industries.

Unemployment

According to the US Department of Labor, as reported by CNN, unemployment has risen to 13.5% of the workforce. The influx of new applicants has already begun to cripple the infrastructure of some states’ unemployment system. With unemployment severely on the rise, it is likely that SUTA rates will climb at some point in the future. It is also probable that we will see a potential increase by state in FUTA rates, assuming a state cannot fund its own unemployment levels and requires federal assistance.

Workers’ Compensation

The COVID-19 pandemic could throw many states into a hard market for workers’ compensation by 2021. For example, reported by BusinessJournal.com, workers’ compensation costs in California could increase by $33.6b, which represents 61% of total premium within the state. While California is one of the most volatile states for workers’ compensation, other states will most certainly feel the impact of the virus as well. The question remains, to what degree will the states be affected? Regardless, this scenario is a catch-22 for PEOs. While hard markets usually bode well for the industry with new business growth, especially those PEOs with grey- and blue-collar clientele, the PEO industry itself will likely see an uptick with incurred claims in the 2020 policy year.

Health Insurance

The industry may see an uptick in medical loss ratios (MLRs) in the 2020 year due to the virus. However, some cost reducing protocols may finally gain additional merit. Telemedicine has been available for years, albeit with limited workforce adoption. However, considering we are all living in a virtual world (and I am a virtual girl… sorry, couldn’t help the Madonna pun), people are getting used to dealing via web conference. As a result, we may see a wider adoption of telemedicine after this pandemic, which could play favorably in reducing utilization rates and improving upon existing MLRs.

Expense Reduction

Along the lines of working remotely, we may see an uptick in remote workforces post-pandemic. Businesses that can function while their people work from home may decide to continue this trend. If so, these businesses will likely experience a cost reduction on business expenses, i.e. brick and mortar locations and ancillary expenses.

Commentary, Specific to the IBISWorld Report

Historic Revenue: Pertaining to the IBISWorld Report, industry revenues were adjusted down for the last few years, whereas profit numbers were increased materially. If these revised statistics prove true, the PEO industry had experienced positive gains in profit margins prior to the COVID-19 outbreak.

Growth Outlook: IBISWorld was projecting an annual growth rate from 2019 through 2024 of 1.1%, prior to COVID-19. The industry grew at a CAGR of 5.94% from 2005 through 2019, which included the Great Recession. However, these are unprecedented times. IBISWorld’s projection of an annual growth rate from 2019 through 2024 may not be far off. We can assume that industry revenues will be down, year over year, for 2020. While we don’t yet know by how much, we can assume that there will likely be a drop greater than 15% if this pandemic lasts through the end of the year.

Earnings releases for the publicly traded players should give us additional insight into how the year may play out. While Q2 of 2020 will provide a good indicator into the impact of COVID-19, those results won’t be available until July. Q1 earnings will be released over the next few weeks and should provide a glimpse into revenue reductions, although the shutdown didn’t really take affect until mid-March so the insight from Q1 results will be limited. However, any forecast statements from PEO executives on the earnings calls may shed some additional light into what we may expect going forward.

TriNet is scheduled to release Q1 earnings on April 28th. Insperity will release earnings on May 4th, and BBSI is projected to provide an earnings release on or around May 5th. While TriNet and Insperity have a mixed bag of client segmentation, each are geared more toward white collar business. BBSI, on the other hand, is largely a blue-collar centric PEO. Therefore, the earnings and outlook for each company may provide insight based on macro client segmentation. However, as previously mentioned, Q2 earnings will be a lot more insightful regarding the impact of COVID-19 on PEO earnings.

Cyclicality

Historically, the PEO industry has rebounded relatively quickly during a recessed economy, as evident during the great recession. However, these current times could have a spiraling effect on the economy. If COVID-19 lasts longer than through the end of this year, we could see the global economy slip into a depressed economy. In this scenario, the outlook for PEO growth could be negative through 2024. However, if the economy begins to rebound after COVID-19, what we will likely see is eighteen months to three years of negative growth, followed by two to three years of positive growth. I would estimate that the growth outlook from now to 2024 may be around 3% to 7%, which would equate to an annual growth rate of around 1% on the mid-range. Though this is purely speculation. We do not have prior precedence in the modern era to truly understand the initial and subsequent impact of a global shutdown.

Mergers & Acquisitions

While M&A is still taking place during this time, deal flow has slowed substantially. Many PEs are waiting to see the impact on the PEO industry, and many PEO owners may be waiting on their exit due to suppressed financials. There may be an uptick in distressed sales if this pandemic lasts too long. Those PEs and PEOs that are in a favorable cash position may be able to acquire targets at a reduced cost and ride the upswing in valuation once the economy rebounds. It will be interesting to see if PEs, who currently own PEO assets, will extend their investment period due to the impact of the pandemic.

Major Industry Players

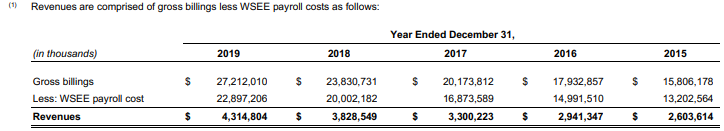

IBISWorld identified three major players in the industry (Insperity, ADP, TriNet). Further, they concluded that the market share for these players was 2.2%, 2.1%, and 1.9%, respectively. We believe this to be incorrect. The report states that industry gross revenues were roughly $198b for 2019. Insperity, for example, at 2.2% of market share, would have revenues at roughly $4b. While their financial statements illustrate roughly $4b in revenues, these are net revenues, in accordance with GAAP standards. Net revenues within the PEO industry do not include WSE payroll. Therefore, if the industry revenue numbers in the report are on a gross basis, we cannot attribute market share to major players on a net revenue basis. Continuing with the Insperity example, as noted in Figure 4, their net billing is roughly $4b whereas their gross billing is closer to $27b. Comparing gross to gross, Insperity would have a market share of around 14%.

Figure 4

Moreover, not all major players were included within the report. The most notable absent party was Paychex/Oasis, whom is one of the largest players in the industry. The other notable publicly traded PEO would be BBSI. From a privately held vantagepoint, Vensure and CoAdvantage would be worthy inclusions in the top players list due to their size. It is likely that these seven players account for over half of industry total gross revenues.

Industry Segmentation

Industry segmentation has remained roughly two-thirds white-collar. However, we may see a shift in these numbers for 2020, depending on the duration of the COVID-19 shutdown. While client count may remain two-thirds white-collar, industry revenues derived from this macro client segmentation may shift higher, in favor of white-collar business. This is primarily since many white-collar businesses can operate remotely whereas many grey- and blue-collar businesses have greater difficulty operating remotely. Regardless, we can likely expect a reduction in revenue across all client segmentation for 2020.

Final Thoughts

While we as an industry and a people are in unprecedented times, I have heard countless stories of PEOs stepping up for their clientele and business partners. Good PEOs have committed a great deal of time and resources to help their SMBs, WSEs, and referral partners navigate through these uncharted waters. Whether it be by providing guidance on employment matters, updates on available loans or government stimulus packages, assistance with fee structures, etc., PEOs have stood out as a valuable partner to SMBs. With the average client size in the PEO industry or roughly 25 WSEs per SMB, PEOs understand that it is likely their clients whom are being hit the hardest with this shutdown. Good PEOs have responded by providing meaningful support to these SMBs during difficult times. Keep in mind that many of these PEOs are providing increased services or insight, despite experiencing a reduction in revenue themselves. Basically, PEOs are doing more while making less money.

While only time will tell how this all will shake out, I can state for certain, that I am proud to be a part of the PEO industry. I’m thankful for all that PEOs have done for small businesses and their employees during this global pandemic.

Hopefully, the PEOs whom have stepped up for their clients will be rewarded with higher client retention rates as a result.

Author

Rob Comeau is the CEO of Business Resource Center, Inc., a business consulting and M&A advisory firm to the PEO industry. Rob is also the Founder and featured Author for this online PEO Publication. To contact Rob, you may comment on this post or email him at rob.comeau@biz-rc.com.