PEO M&A Insight

Whether you are an experienced veteran of mergers and acquisitions or a novice, this article will provide insight about the M&A process in the PEO industry. At Business Resource Center, Inc., we provide industry expertise and M&A advisory services to PEOs and private equity firms. We’ve worked on PEO acquisitions ranging from regional firms to national players. This article will help the reader understand, with greater clarity, some essential factors that go into determining valuation and executing a deal.

First, let’s understand one simple truth. Sellers try to maximize their ROI at the time of transaction. Buyers try to maximize their ROI post-transaction. This dichotomy creates friction that is typically overcome with deal mechanics, i.e earn out provisions, employment contracts, and equity roll over requirements. These mechanics are designed to better align interests of the seller and buyer.

This article will not cover all facets of the M&A process, but rather hit some of the pressing areas that impact a valuation and deal execution.

Type of Process

A seller will go-to-market in one of two ways. Either in a broad auction scenario or an exclusive arrangement. A broad auction is typically initiated by an Investment Banker whereas an exclusive deal may arise via relationship. Each process takes a lot of time and work from the seller’s team. There is often more work with the broad auction due to the seller dealing with multiple buyers. However, multiple buyers can sometimes drive a higher valuation due to competition among buyers, though this is not always the case.

Type of Deal

There are different types of deals in the buyer’s mind. They may view the PEO as a merger, platform, tuck-in, strategic, or client list acquisition. A merger is typically two like-size PEOs coming together to form a larger entity. A platform is a PEO that will act as the “anchor store” for future acquisitions to be folded into the platform investment. A tuck-in is a smaller PEO that will be folded into the macro PEO entity. A strategic acquisition is a PEO that has a desirable innovation or geography that will benefit the macro PEO entity. A client list acquisition is a purchase of a PEO’s client list without buying the PEO itself.

Most PEO acquisitions are tuck-in acquisitions. Many PEO Owners want to be a platform acquisition. To do so, they must have an element of size/scale, a solid leadership team, and show a history and propensity for growth and solid profit margins.

Valuations

One of the top questions M&A professionals get is the request for EBITDA multiple ranges. Many M&A professionals are hesitant to provide insight on this because there are a lot of variables that go into this equation. However, from our experience, valuations in recent years have been higher than in the past. There is more interest than ever in the space from private equity buyers, publicly traded PEO valuations are high, and there is a supply and demand problem for PEOs of size. However, a buyer is not going to buy up to pay a higher multiple for a PEO whom they don’t feel will provide the appropriate ROI upon the buyer’s exit.

Having realistic expectations about your PEO’s valuation is important to getting a deal done. While timing certainly helps or hurts with valuations, the quality of the PEO carries more weight. Items a buyer will look for when determining the valuation of a PEO will include size/scale, EBITDA per WSE, insurance platform profits and liabilities, organic growth trending, quality of leadership, value prop/model, innovation, client retention, legal liabilities, geography, WSE to EE ratios, comps, etc. The more a seller can improve upon these areas, the better their chance of driving a justifiable higher valuation. As a buy-side advisor, we review potential deals to determine, among other things, if the EBITDA is justified or inflated due to a seller prepping to sell. It becomes obvious as we do our diligence work if this number is inflated.

Process

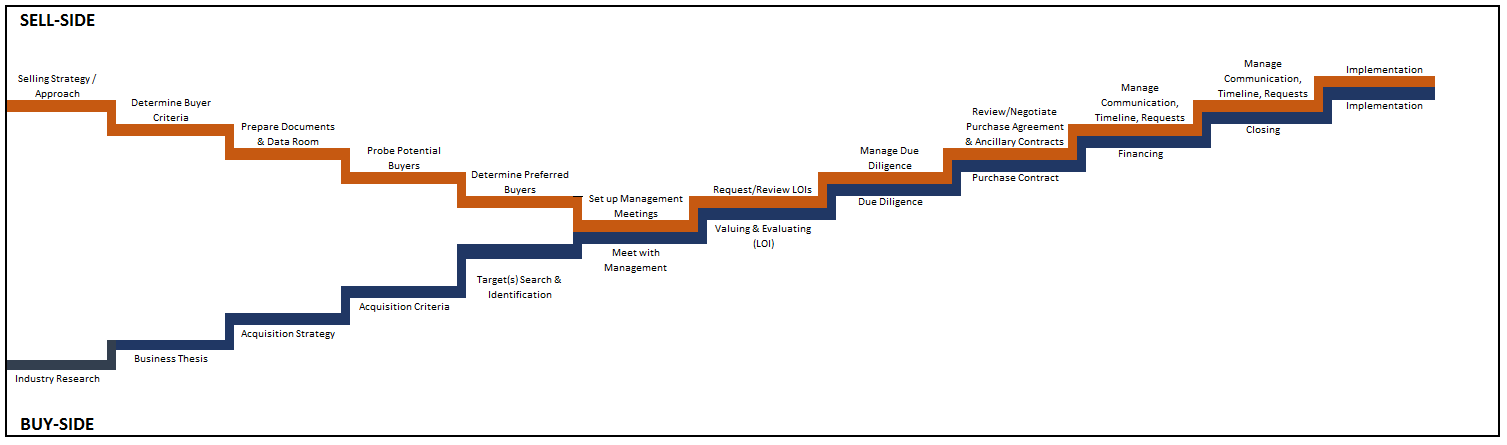

Below is a flow chart overview of the M&A process. While we simplified it below by keeping it high-level, it should provide you with an appropriate flow of the process.

Important Steps

When a PEO owner is ready to sell their business, there are some key areas in the process in which ownership should focus.

CIM & Information

The confidential information memorandum (CIM) and ancillary documents a seller provides prospective buyers will be the blueprint from which the buyer will establish interest and a preliminary valuation. This step should be carefully prepared by the seller.

LOI

The letter of intent received from the buyer(s) will illustrate valuation, equity roll, and earn out provisions among other things. A seller should play close attention to the provisions within the LOI prior to entering an exclusive process.

Due Diligence

This will be a laborious process for the seller. It will detract from day to day operations and require focus, team alignment, meetings, vast communication, and data gathering. A seller should understand this process will be time consuming and be prepared to answer a plethora of questions and data requests.

Purchase Agreement & Ancillary Contracts

This is where the rubber meets the road. The seller and their Attorney(s) should scrutinize these documents to ensure alignment with previously agreed upon framework. Moreover, the seller should make sure they understand the provisions, reps & warranties, terms & conditions prior to executing the purchase agreement, employment contract, etc.

Acquisition Status

As previously discussed in the Type of Deal section of this article, it is important for the seller to understand, from the buyer’s perspective, what type of deal they will be (i.e. merger, platform, tuck-in, strategic, etc.). This will help remove unnecessary friction and/or delays in the integration process.

2nd Bite of the Apple

If an equity rollover is required by the buyer, a seller should discuss projected equity valuation with the buyer. While there are no guarantees on the exact monetary value their equity will be worth at a future date, the buyer should know what multiple they are looking to achieve upon their exit. Often the buyer has produced internal documents that show prospective exit valuations. This information, if obtained from the buyer, can help the seller understand what their equity might be worth in 5 years. Moreover, it will provide the seller with incentive to continue to drive their business forward in order to maximize their 2nd liquidity event.

Funding

The seller should understand the type of funding the buyer is utilizing (internal capital, debt, etc.). They should also be cognizant of any payments that will be required on a go forward basis, from their PEO as a result of the capital structure.

Culture

Culture alignment is important, especially with tuck-in acquisitions and mergers. To the best of their ability, a seller should know the buying PEO’s culture to ensure alignment and help smooth the process for future integration.

Go Forward Role

The seller is probably used to calling the shots for their organization. If their acquisition is a tuck-in scenario, they will likely report to the holding company CEO. This can be an adjustment for the seller and the owner should be cognizant of a modified role within the macro organization.

Closing

Hopefully the information within this article provided you with some high-level insight into the M&A process along with some information on key areas of interest. If you have further questions, feel free to comment and we will do our best to respond in a timely manner. If you are interested in buying or selling a PEO, contact Rob Comeau using the contact information below.

Author

Rob Comeau is the CEO of Business Resource Center, Inc., a business consulting and M&A advisor to the PEO and Private Equity industries. Tel: (949) 510-1126 | rob.comeau@biz-rc.com | www.biz-rc.com

This article covered the topic of PEO M&A and the flow a seller might expect within the PEO M&A process. To learn more about PEO M&A, you may contact Rob Comeau, CEO of Business Resource Center, Inc. BRCI specializes in PEO M&A, buy-side advisory services and business consulting for the PEO and private equity industries.