Overview

While this article will provide potential scenarios that could occur in and around the PEO industry, it is solely opinion and should not be construed as investment advice. As with any forward-looking statements, they are subject to a number of variables and degrees of risk. With that said, hopefully this article will provide insight into potential trends within the PEO industry. As a point of note, I do not have a crystal ball to know exactly what will happen. If I did, I would have already earned the title of Galactic President Superstar McAwesomeville.

Effects of the Economy on the PEO Industry

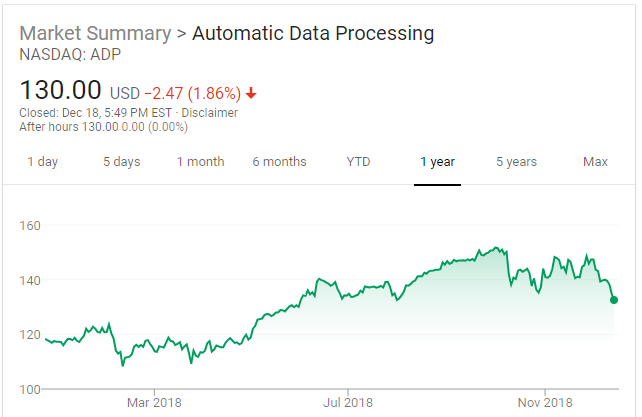

The United States has experienced the longest bull-market in decades. However, it appears that this run is coming to an end. As you will note in the below figures, the market, as well as a number of PEOs, are trading lower than one year ago. While we may still see a rebound of some sort, it is likely that we are entering a bear-market. For more information on how the PEO industry performs during a bear-market, click here.

High level, when the economy dips, we can expect a reduction in same store sales at the PEO level. Eventually this reduction will likely be offset by new business added. However, depending on the depth of impact the market has on SMBs, the industry may experience a short period of negative year over year growth. However, historically the PEO industry has rebounded quickly from a recessed economy. For historic PEO industry statistics during varying economies, click here.

Figure 1

Figure 2

Figure 3

Figure 4

Figure 5

Figure 6

Figure 7

Figure 8

Mergers & Acquisitions

The PEO industry has been ripe with M&A activity in recent years. Moreover, valuation multiples have appeared higher than in past years. Access to capital has been relatively inexpensive in the past 5+ years. However, if the economy flips and the Fed increases rates, we may see a slowdown in activity. Moreover, this country hasn’t seen significant inflation in 30+ years. This could have an affect on business and slow the M&A activity within the industry. I believe that we will continue to see a movement of consolidation with the largest players but the frequency in acquisitions may slow a bit in coming years. Moreover, EBITDA multiples may take a dip as well if public comps drop and same store sales dip due to a down economy. This will likely effect valuations.

Automation Within the PEO Model

In most PEO models, the structure is a combination of outsourcing and consulting. This courts an infrastructure of human capital and technology. While some PEOs gravitate toward one or the other, most have both elements within their business model. As most are aware, we are seeing an increase in machine learning and A.I. As this technology continues to develop, it is logical that some repetitive functions of the PEO model, which are currently handled by human capital, may be replaced with automation. If/when this occurs, a PEO may be able to automate certain functions which will reduce internal overhead. The resulting factor will be increased margin, decreased market pricing, or both.

Externally, depending on what elements of the PEO model automation impacts, the industry may see alternative competition spring up. This could take the form of automated insurance procurement, automated functions of HR, etc. A PEO that plans for this scenario should be well positioned to capitalize on emerging technology while mitigating external alternative competition.

Globalization

In recent years, we have seen more global PEO players emerge. With an industry SMB average WSE count of around 25, the global PEO market is not currently a large percentage of industry revenues. However, if globalization continues to grow, larger clients whom have a global footprint, may be more inclined to consider a global PEO partner. As a result, we may see a future trend in larger clients partnering with PEOs that can service on a global capacity. The likelihood is that this will remain a niche focus and continue to be a very small part of industry revenues.

Model Advancement

It is likely that we will see the PEO model further evolve in the next ten years. This could take form in technology advancements, expanded scope of offering, etc. As business needs change and grow, the PEO model will likely follow suit. Those that are ahead of the curve will likely capitalize on the changing needs of SMBs. We may see an increase in niche focus, be it as a PEO or as a division of a larger PEO. We may also see expanded offerings that cover more than what the traditional PEO model offers today. I believe that innovation, scale, and execution are key elements for PEOs to distinguish themselves from competition in the coming years.

Moreover, the United States has been trending toward becoming a service country in lieu of a production country. Roughly 2/3 of the country’s businesses are in a service field. The PEO industry has mirrored this shift. According to the IBISWorld PEO Industry Report, roughly 2/3 of PEO client segmentation is in white/grey collar business. If this trend continues, we will likely see a continued shift toward a PEO offering that will resonate with these segments of business. In contrast, if the majority of large PEOs migrate more toward white-collar business, we may see a service gap in blue collar industries. This could create an opportunity for PEOs that are well equipped to service the blue-collar industry verticals.

Emerging Competition and/or Alignment

The PEO model, when designed and executed properly, inherently has a solid risk mitigation structure. In the coming years, we may see carriers and/or large insurance brokerages build out their own PEO models. We may also see more carriers enter into relationships with PEOs, be it with workers’ compensation or health benefits.

If a carrier builds out a PEO (or variation thereof) model, it is creating a further degree of risk mitigation to protect against its premium bleed on claims. Likewise, if a carrier partners with a PEO, it can offset some of its risk with the PEO. This risk offset can take two forms. 1) The offset of risk due to the risk mitigation strategy/execution of the PEO to mitigate claims, and/or 2) The reduction in risk to a carrier with PEOs whom are on a deductible program.

Large insurance brokerages may decide to build out a PEO or variation model for several reasons. 1) Through the PEO model, the brokerage may increase client retention. 2) The PEO model offers phenomenal differentiation from competition for the brokerage. 3) If insurance procurement goes the way of automation, similar to how retailers have been impacted by Amazon, large brokerages will need an augmented offering to remain relevant with business clientele.

Bottom-line, I wouldn’t be surprised if the industry sees increased alliances or an emergence of carriers and brokerages looking to build out their infrastructure. This may cause increased resources and/or competition within the space.

Market Share

Market penetration is likely to increase in the coming years. While industry reports predict growth at an annualized rate of 0.4% from 2018 through 2023, I believe the industry will grow at a higher clip. For more information on industry statistics and commentary, click here. While the PEO industry is fragmented, industry revenue is not. It is likely that we will see a continued trend of the largest players dominating industry total gross revenues for the foreseeable future. There is a lot of white space left in the industry for expansion. This leaves opportunity for the largest players to get larger and for emerging players to capture increased market share.

Regulation

Regulatory shifts have historically boded well for PEOs. A recent example was in 2014 when the industry grew year over year by over 21%, largely due to ACA regulatory requirements impacting SMBs. Any regulatory changes that impact SMB compliance has historically been a good sign for PEO industry revenue growth. The future is likely to hold new regulatory changes for SMBs. The question remains, what and when these changes will be. Major changes will likely increase PEO year over year revenues.

Within the industry itself, emerging regulation has occurred with the adoption of the CPEO program and more recently with the PEO Model Act. As the industry continues to grow, regulations will likely increase at a State and Federal level. Whether or not future regulatory requirements are viewed by industry insiders as a positive or negative remains to be seen.

Wrap Up

Below is a summary of the key elements within this article.

- The United States is likely entering a down economy. The PEO industry may be impacted in the short run but will likely rebound more quickly than other industries.

- M&A activity may slow during the down economy and valuations may temporarily take a dip.

- Machine learning, A.I., and automation are likely to affect the future of the PEO model.

- Continued globalization is likely to occur albeit as a small percentage of industry gross revenues.

- The PEO model is likely to develop (technology and/or scope expansion) and it is probable that the industry will continue its trend toward white-collar business.

- The industry may have additional insurance carriers enter the space. It may also see increased competition from carriers and/or large insurance brokerages within the next ten years.

- The industry will likely remain fragmented while revenues will likely continue to remain consolidated. Continued market expansion is expected.

- Any regulatory shifts that impact SMBs will likely help drive PEO revenue growth. Increased regulatory requirements affecting the PEO industry are likely, and the impact of said requirements is not yet known.

The elements discussed in this article are scenarios that may affect the PEO industry in the coming years. Regardless if these topics or others come through to fruition, it is advised the PEO executive teams run varying scenarios to best position the organization to mitigate risk and capitalize on opportunity.

Author

Rob Comeau is the featured Author of www.netprofitgrowth.com and the CEO of Business Resource Center, Inc. BRC is a business consulting and M&A advisory firm to the PEO industry. To learn more about Comeau, please click here. To learn more about Business Resource Center, please visit us at www.biz-rc.com. If you have questions on the PEO industry, feel free to visit our open forum “Ask the Beard” by clicking here.