PEO Industry Statistics, 2017

A recent industry report was released on the PEO industry with updated statistics through 2017. This article is a snapshot of the highlights contained within that report followed by author commentary.

Fast Facts

The PEO industry gross revenue for 2017 was $170.4bn, of which $148.8bn represented work site employee (WSE) wages. This equates to an average PEO client markup of 14.52%. Profit for the PEO industry in 2017 was $1.7bn. The annual growth rate from 2012 through 2017 in the PEO industry was listed at 9.0%. [i]

Industry Structure

According to the report, it states that the industry life cycle stage is growth with revenue volatility being medium. Regulation is medium within the industry and barriers to entry are also considered medium. Competition levels are considered high and industry globalization is low.[ii]

Historic Industry Growth

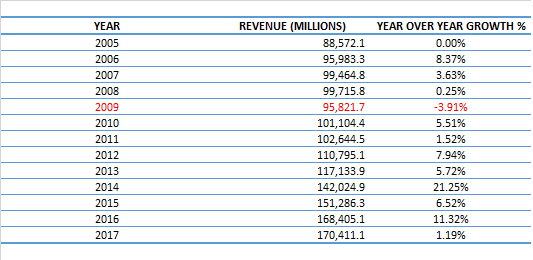

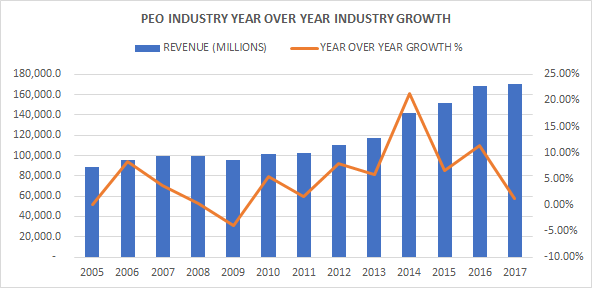

Figure 1 illustrates the PEO industry growth from 2005 through 2017. As noted, 2009 was the only negative growth year. [iii]This represents an average annual growth rate of 7.70% from 2005 through 2017. Figure 2 illustrates the industry’s growth by gross revenue with a year over year growth percentage overlay.

Figure 1

Figure 2

Projected Growth Rate

The report projects that the industry gross revenue will grow over from 2018 through 2023 by an annualized rate of 0.70% to $177.7bn in 2023. [iv]

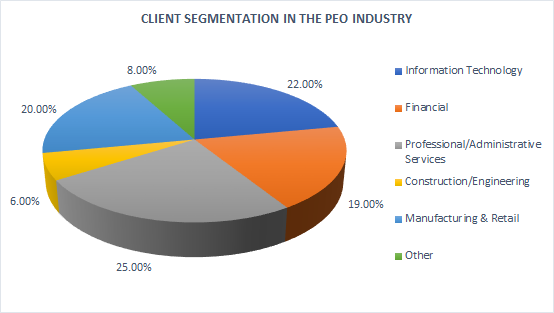

Market Segmentation

The market segmentation in the report shows the industry is roughly 2/3 white collar focused as illustrated in figure 3.

Figure 3

Industry Leaders

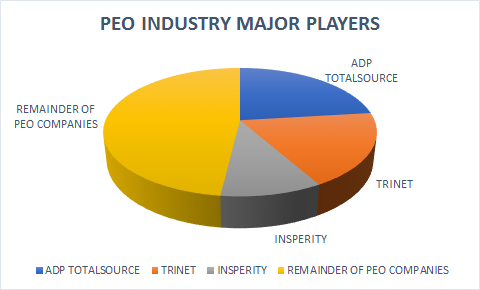

The industry report states that the PEO market is currently dominated by three major players; ADP Totalsource, TriNet and Insperity. The report estimates gross revenue market share percentages of 23.1%, 18.7% and 10.1% respectively [v] as noted in figure 4 and figure 5.

Figure 4

Figure 5

Opinion/Commentary

The data in this article was pulled from the IBISWorld Industry Report 56133, Professional Employer Organizations in the United States. The below commentary is solely the opinion of the blog author; Rob Comeau, with respect to the aforementioned data in the above article.

Major Players

According to IBISWorld, 52% of the industry’s gross revenue is controlled by the top 3 players; ADP Totalsource, TriNet and Insperity with the remaining 48% controlled by the rest of the field. The PEO industry is more top heavy than the report illustrates. Once you factor in Oasis, Paychex, CoAdvantage and BBSI the numbers are more heavily skewed toward the largest handful of PEOs controlling a large majority of industry revenues. This is a trend that is likely to continue through acquisitions and consolidation by strategic and private equity buyers.

Industry Growth Projections

IBISWorld projects the industry to grow at an annualized rate of 0.7% from 2018 through 2023. I believe the industry will grow at a quicker pace. There is a likelihood of an economic downshift and the potential for significant inflation over the next 5 years. That being said, based on historic data, the PEO industry only experienced one negative year over year growth year during the great recession. I estimate the industry will grow from 2018 through 2023 at a range of 1.5% to 3.0% annually.

Macro External Drivers

Some macro external drivers that could affect the PEO industry are major regulatory shifts, major stock market correction, economic downshifts, and inflation. The PEO industry has historically rebounded quickly from a sluggish economy and the industry benefits from major regulatory changes, especially those that affect SMBs. However, the PEO industry has not lived through a state of serious inflation. The last major inflation the United States experienced was in the Carter and Reagan era. It will be interesting to see how the industry responds when this eventuality occurs.

[i] IBISWorld Industry Report 56133, Professional Employer Organizations in the United States

[ii] IBISWorld Industry Report 56133, Professional Employer Organizations in the United States

[iii] IBISWorld Industry Report 56133, Professional Employer Organizations in the United States

[iv] IBISWorld Industry Report 56133, Professional Employer Organizations in the United States

[v] IBISWorld Industry Report 56133, Professional Employer Organizations in the United States