PEOs Are Not An Alternative Market

This article is solely focusing on the insurance component of the PEO offering. While a PEO offers much more than insurance, this article will only tackle how a sales professional can position the PEO as it pertains to insurance and risk mitigation.

PEO sales representatives, when speaking to a channel partner, may position their PEO as an alternative market to standard insurance policies. As a result, the broker partner will typically feature the PEO as an alternative market to prospective clientele. In other words, if the risk doesn’t fit within the broker’s primary markets, the PEO is an alternative. This can create adverse selection for the PEO.

Good PEOs are not an alternative market, they are the evolution of the market. What does this mean? Let’s take a look at the rationale behind the statement; PEOs are the evolution of the market.

.

Are PEOs the Evolution of the Market?

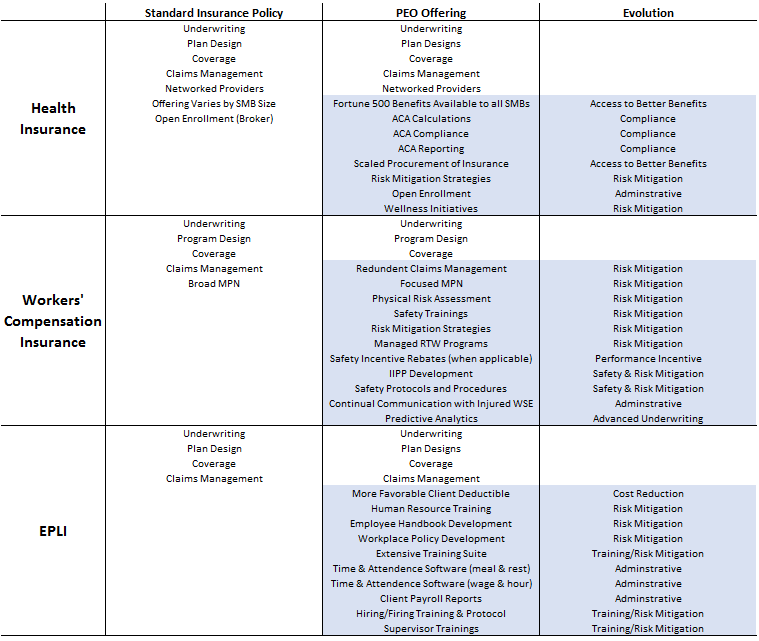

The easiest way to determine if PEOs are an alternative or evolution of the market is to contrast the options an SMB has when procuring insurance. In this example, we’ll review the following insurance lines: Health, Workers’ Compensation, Employment Practices & Liability Insurance (EPLI). This illustration does not include any resources the channel partner (insurance brokerage) may bring to the equation as that varies per brokerage. Let’s take a look at the comparison below in Figure 1.

Figure 1

.

While there is likely more that we could include in all three columns, this illustration provides insight into one common theme. PEOs benefit from reducing their clients’ exposure. Meaning, in most cases, a PEO’s profitability hinges greatly on its ability to mitigate risk and reduce claims. This takes the form of backend profit via claims reduction, resulting in the PEO’s future ability to remain competitive in the marketplace with premiums. As a result, a PEO’s offering is inherently designed to mitigate risk, to the benefit of the SMB and the PEO itself.

.

Misrepresentation

There are a number of misrepresentations that we unfortunately see in marketing efforts with some PEO sales professionals. The two most common that I’ve seen are the low rate play and the write anyone play. Low rate example; we have the best rates in the market (i.e. buying business). Write anyone example; high mod, no coverage, risky class code, no problem! PEOs are not subsidized entities. Either they make money, or they are out of business. A PEO may have the best rates in the market, but if they don’t have a solid risk mitigation platform, those rates will be short lived, i.e. high renewals via high MLR. A PEO may have an appetite for riskier business, but if the risk mitigation strategy is faulty, the tail will catch up with them and can put them under via rate increases, claims payment requirements, and increased collateral.

When a PEO sales representative sells via the path of least resistance, they will often create a poor client selection process for the PEO, court lower client retention percentages, drive lower profitability per client, and have a difficult time selling against a consultative sales professional whom educates their clients on the value prop of the PEO itself.

If a PEO has a competitive advantage, highlight it. But be able to explain why the PEO has the advantage in the first place. Sustainable advantages are a byproduct of innovation and/or favorable systems which drive superior results. This approach creates a higher degree of confidence in the buyer while substantiating the reasons why the client should choose the PEO over its competition.

The PEO model is legit, don’t shortchange the value.

.

Author

Rob Comeau is the Founder and Featured Author of NPG and serves as the CEO of Business Resource Center, Inc., a business consulting and M&A advisory firm to the PEO industry. To contact Rob, please email him at rob.comeau@biz-rc.com.

.

To learn about Business Resource Center’s sales training programs, visit us at www.biz-rc.com, or click the PEO Consulting/M&A Advisory tab at the top of this page.