Disclaimer: this article is independent commentary on PAYX’s recent earnings release on July 7th. All statistical information contained within this article is public knowledge. The information contained within this article should not be construed as investment advice. As with any investments, material risks should be evaluated prior to investing. The commentary section of this article is solely the opinion of the author and should not be construed as advice.

.

Opening

Recently discussed in our article titled PEO Industry Statistics 2019 – Part 2, we discussed the potential impact of COVID-19 on the PEO industry. As outlined in the Growth Outlook section of that article, we noted Paychex as one of the major players to have their earnings release for fiscal Q4 of 2020 (in Paychex’s case, this is most comparable to Q2 calendar year, due to the company being on a fiscal calendar). The others, whom we’ve already covered for their earnings release and guidance, have been ADP TotalSource (results found here), TriNet (results found here), Insperity (results found here), and BBSI (results found here). Q4 for Paychex encapsulated a large duration of the quarantine, and we look to publicly traded PEOs for some insight into the effect of the shutdown on PEO financials in general.

Paychex is similar to ADP but somewhat unique to the other players mentioned above in the fact that their payroll and ancillary services are larger than their PEO segment.

.

Fast Facts

PAYX very slightly beat analysts’ forecasts for Q4 from both an earnings per share (EPS) and revenue perspective. The expected EPS for Q4 was $0.60. PAYX reported an EPS of $0.61 ($0.01 positive surprise). Expected revenue for PAYX was $910.68m. PAYX reported revenue at $915.10m ($4.42m positive surprise).

.

Earnings Call Opening Comments

Martin Mucci, CEO of Paychex kicked off the earnings call with an overview of the company’s performance, in light of the impact from COVID-19. He stated that Paychex has seen positive trends in key metrics, inclusive of paid employees and number of WSEs within the HR their HR outsourcing clientele. Martin also commented on client retention in light of the pandemic.

“One particular bright spot is client retention. Now more than ever, our clients are experiencing their value proposition of Paychex as we help them navigate through this very challenging time. I credit the dedication of our Paychex IT, development, product, marketing and service teams, who have worked tirelessly to ensure a seamless transition to remote working for us while providing the products and service to our — to support our clients and their CPAs during a time of great concern for their businesses, in fact, many times their business survival. When the paycheck protection program was introduced, we were the first in our industry to release an online payroll report to help simplify the filing of the application for the loan.”

Martin further explained that Paychex processed the PPP payroll reports over a half a million times for their clientele while also partnering with three fintech companies (Biz2Credit, Pondera, and Lendio) in order to provide their clientele with access to alternative lenders for PPP loans if they didn’t want to go through their own banking partner. Ultimately, Paycheck processed over one-hundred million dollars of loans through these partners.

Mucci further expanded on the paycheck protection flexibility act by stating:

“On June 5, the paycheck protection program flexibility Act was signed into law, relaxing the original requirements for the — for businesses using — use of the PPP loans while continuing to qualify for loan forgiveness. Shortly after, we launched the PPP loan forgiveness estimator. This tool which I feel is the most comprehensive in our market, simplifies the complicated process for our clients and again, pre-populates the Paychex client data and provides a very simple way to add non-payroll data to satisfy the new forgiveness requirements. Our service teams have provided excellent responsiveness to our clients, 7/24, even with much higher call volumes and call complexity, all while maintaining and even improving our client satisfaction and retention performance.”

With regard to Paychex’s HR Outsourcing segment of business, Martin had this to say:

“We are also experiencing increased demand for our outsourced HR services, both PEO and ASO, due to the complex demands of the current environment. Our leading suite of customizable solutions allows us to help any business, large or small, simple or complex, do it yourself or fully outsourced, with today’s challenges. The COVID-19 pandemic has been a challenge to our business. However, this challenge confirmed that the investments we have made in the recent past were the right investments.”

With many workforces working remotely during this pandemic, Mucci commented on Paychex’s technology suite and its ability to allow its clientele to manage a remote workforce by stating:

“Faced with a rapidly changing business environment and market uncertainty, providing clients with access to clear, accurate information is critical for them to make decisions about future — about the future for their businesses. Recent updates to our analytics suite provide additional insights on labor costs and workers’ compensation information, workplace illness and injury trends and other HR details such as employee record updates and performance feedback.”

As it pertains to the internal Paychex staff working remotely, Martin commented on the company’s go forward strategy of remote workers by stating:

“In regard to our Paychex family, we have an ongoing commitment to our employees to ensure their safety. At this time, we still have over 95% of our workforce continuing to work remotely, and it has been going well. Given this success, we are accelerating some of our strategies to leverage a more distributed workforce. We are implementing plans to reduce our physical location footprint, among other expense savings initiatives. These plans have recently been announced to our employees, and we are moving forward with these initiatives.”

.

Financial Results

Paychex CFO Efrain Rivera commented on the financial performance of the company for fiscal Q4.

.

Revenue

Rivera commented on the financial performance for the quarter. From a revenue perspective, Efrain outlined the performance by stating:

“For the fourth quarter, let’s start there, total revenue, as you saw, decreased 7% to $915 million, largely due to volume declines impacting revenue across our HCM solutions. Total service revenue decreased 7% for the fourth quarter to $890 million. Within service revenue, management solutions revenue declined 6% to $662 million and PEO and insurance solutions revenue declined 11% to $228 million.”

While total revenue for the company declined by 7% to $915m, PEO and insurance revenues dipped by 11% to $228m. Based on these figures, the PEO and insurance segment of Paychex equates to roughly 25% of total revenues for the company.

.

Expenses | Operating Income | EBITDA

Rivera commented on the company’s expenses, operating income, and EBTIDA by stating:

“Expenses decreased 8% to $615 million. The decline was largely impacted by reductions in discretionary spending as a result of companywide expense control. Op income decreased 5% to $300 million and reflected an operating margin of 32.7%. EBITDA decreased 5% to $351 million with an EBITDA margin of 38.4%.”

.

Fiscal Year Financial Results

Rivera then discussed the full year fiscal results, outlining the company’s performance pre-COVID (9 months) and post-COVID (3 months).

“Through the first nine months, results were solid. Our full-year growth though was tempered as a result of COVID in Q4, but the year still reflected solid progress. Total revenue increased 7% to $4 billion. Service revenue increased 7% again to $4 billion, with management solutions growth of 3% to $3 billion and PEO and insurance solutions growth of 22% to $991 million. management solutions benefited from higher revenue per client. PEO and insurance solutions benefited from higher revenue per client — I’m sorry, from the full year of Oasis results, while insurance solutions remained challenged by lower workers’ comp premiums. Interest on funds held for clients increased 8% to $87 million driven by higher realized gains partially offset by lower average investment balances and lower average interest rates. Op income increased 7% to $1.5 billion. Operating margin was at 36.1% comparable to the prior year. Net income and diluted earnings per share each increased 6% to $1.1 billion and $3.04 per share, respectively. Adjusted net income increased 5% to $1.1 billion and adjusted diluted earnings per share increased 6% again to $3 per share.”

.

.

Fiscal 2021 Outlook

Rivera next commented on the company’s outlook for the fiscal year 2021. He provided the disclaimer that the outlook is volatile due to COVID-19 and they anticipate a harder hit in the first half of F2021 than the second half due to COVID-19. Regarding the outlook for F2021, River noted:

“Our outlook is as follows: Management solutions revenue is anticipated to decline in the range of 1% to 4%. PEO and insurance solutions revenue is anticipated currently to decline in a range of 2% to 7%… Total revenue is anticipated to decline in the range of 2% to 5%. Adjusted operating income as a percentage of total revenue is anticipated to be between 34% and 35%… adjusted EBITDA margin for the full-year 2021 is expected to be between 39% and 40%.”

Rivera further commented on Paychex’s plan to reduce its geographic footprint, as Martin had eluded to earlier in the call as a result of the shelter in place mandates from COVID-19. Rivera stated:

“In addition, we’re planning an acceleration of our long-term plan to reduce our geographic footprint, and this is the majority of the charge that I’m about to describe. We anticipate recognizing one-time costs in the neighborhood of $40 million, most of which will be incurred during the first quarter. Our guidance for adjusted operating margin, adjusted EBITDA margin and adjusted diluted EPS which I’ll remind you again are non-GAAP measures, excludes these one-time costs. Again, $40 million, we expect it to be primarily in the first quarter, and it is primarily directed at geographic optimization, a plan that we had in place and that we’ve decided to accelerate given current conditions.”

.

Material Insight from the Earnings Release Q&A

.

Organizational Direction

Mucci: “…we’ve continued to move more toward being an HR company. And HR, I think many times, people still think of us as small business payroll. But as you could see, the way the revenues have grown, we’ve become more and more of an HR services company for small and midsized businesses. I think that will continue.”

.

Client Retention

Mucci: “…the retention is around 83%, so an all-time high for us. Now we’re conservative. So when you look at that, and we still have the suspended clients, even though they’re less than half of where they were at the peak, this is still rapidly changing.”

.

M&A Opportunities

Mucci: “…we’re still very interested. Obviously, we think the PEO business, it’s a growing part of our business, and we do think that there’s M&A opportunities out there. We’re staying in touch.

.

Paychex Recent Stock Trending

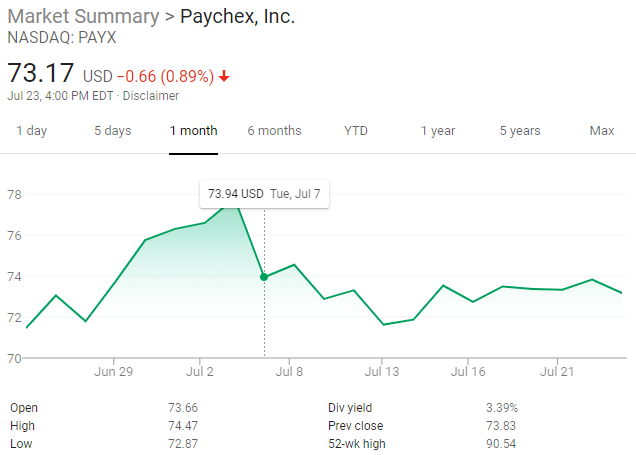

Paychex stock trending, 1 month, with earnings release date highlighted

.

.

About Paychex

Paychex, Inc. is an American provider of human resource, payroll, and benefits outsourcing services for small- to medium-sized businesses. With headquarters in Rochester, New York, the company has more than 100 offices serving approximately 670,000 payroll clients in the U.S. and Europe.

.

.

Independent Commentary by Rob Comeau

Rob Comeau is the featured Author of www.netprofitgrowth.com

Paychex remained in line with most of the publicly traded PEO results due to COVID-19. Revenues were down 11% in the 4th quarter within the PEO segment which is in line with expectations. Some of the areas that stood out from this call were the moves to reduce the geographic footprint in light of COVID-19, their all-time high retention for F2020, and the migration toward becoming more of an HR related organization. Additional material areas included the use of their technology and M&A appetite.

.

Geographic Footprint Reduction

As noted in the earning coverage synopsis we provided, the company plans to accelerate its geographic footprint reduction (i.e. reduce physical locations) in F2021. While this will predominantly take place in FQ1 for Paycheck, the result is an estimated reduction of $40m in expenses. 95% of the company’s workforce is currently working remotely, and in light of revenue reductions due to COVID, expense reduction through reducing physical locations will help offset revenue and profit reductions.

.

All-Time High Client Retention

It is no surprise that client retention has increased for Paychex. While some SMBs have struggled to remain afloat during this pandemic, most PEO clients have truly experienced the value of the PEO model. As a result, Paychex has experienced its highest annual retention to date at 83%. Keep in mind that this number encapsulates payroll clients as well as PEO and ASO clients. What will be interesting is to see if Paychex can ultimately realize higher profits in the future due to pricing elasticity resulting from the HR value proposition validation with their client population.

.

HR Service Migration

Currently, the PEO and insurance segment represents 25% of the organization’ revenue. The acquisition of Oasis most certainly bolstered this percentage. However, Mucci commented on the demand from their client base for more HR related assistance, especially in light of the regulatory shifts from COVID-19. The upward trend of HR related services as it pertains to the percentage of total business at Paychex is expected to continue. We commented on this likely migration two years ago in our article titled Paychex and Oasis Transaction: Commentary and Opinion. In this article we compared the models of Paychex and ADP and the subsequent impact that would likely occur after Paychex’s acquisition of Oasis. It appears that this is coming through to fruition. COVID-19, and the regulatory requirements for SMBs, will likely accentuate this migration more quickly.

.

Technology

Technology has seemed to play a vital role for Paychex in recent times, both from an external and internal perspective. Paychex has utilized technology and 3rd party fintech providers to solve their clients needs pertaining to government stimulus packages and regulatory requirements. Moreover, Paychex itself has seen a progression toward the benefit of remote workers internally and has utilized technology to manage this migration.

.

Mergers & Acquisitions

Mucci stated that the company is still looking to remain active with M&A, albeit with caution due to COVID. He also stated throughout the call that their clients are requiring more HR related services and that their previous acquisitions have been fortunate moves in light of our current environment. It will be interesting to see which PEOs Paychex has on their radars for potential acquisitions, but based on the information learned during this call, ideal target will likely be HR and Tech centric.

.

Final Thoughts

Paychex has been in line with peers as it relates to COVID-19 financial adjustments. I still believe that Paychex is the PEO to watch over the next five years from a growth vantagepoint. If their trend continues to migrate more payroll clients to HR, PEO, & ASO platforms, I would expect higher profit margins over the next five years. Moreover, as their technology advances and they continue to migrate toward a more remote workforce, expense reductions will occur.

Bottom-line, the future may be bright for Paychex due to increased profitability from clients moving to more robust internal offerings coupled with expense reduction via remote workers. If the company continues to make strides with organic growth, moves payroll clients to more robust offerings and make some strategic acquisitions, my guess is that Paychex will mirror a course that ADP took over the last 10 years. The result will be a growing percentage of total business within its HR/PEO/Insurance segmentation, which should lead to increases in revenue and profit margins. Time will tell, but the trajectory is going in that direction.

.

Author

Rob Comeau is the CEO of Business Resource Center, Inc., a business consulting and M&A advisory firm to the PEO industry. Rob is the featured Author and Founder of this PEO online publication. To contact Rob, you may email him at rob.comeau@biz-rc.com. You may view Business Resource Center’s offering at www.biz-rc.com.