Disclaimer: this article is independent commentary on ADP’s recent earnings release on April 29th. All statistical information contained within this article is public knowledge. The information contained within this article should not be construed as investment advice. As with any investments, material risks should be evaluated prior to investing. The commentary section of this article is solely the opinion of the author and should not be construed as advice.

Opening

Recently discussed in our article titled PEO Industry Statistics 2019 – Part 2, we discussed the potential impact of COVID-19 on the PEO industry. As outlined in the Growth Outlook section of that article, we noted Automatic Data Processing (ADP) (& ADP TotalSource) as one of the major players to have their earnings release for Q1 of 2020 (in ADP’s case, this is Q3 due to the company being on a fiscal calendar). The others, whom we’ve already covered for their earnings release and Q2 guidance, have been TriNet (results found here), Insperity (results found here), and BBSI (results found here). While Q1 encapsulated only a small duration of the quarantine, we look to publicly traded PEOs for some insight into the effect of the shutdown on PEO financials.

ADP TotalSource is somewhat unique to the other players mentioned above in the fact that their payroll and ancillary services are larger than their PEO segment. Therefore, in the Fast Facts section below, we will discuss EPS and revenues for the entirety of the company, but we will look to their financials to segment ADP TotalSource’s division for more clarity and application for our PEO audience.

Fast Facts

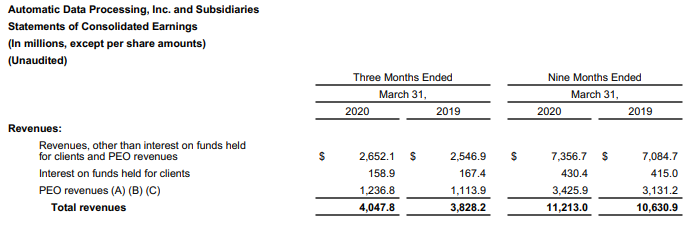

ADP slightly beat analysts’ forecasts for Q1 (their Q3) from an earnings per share (EPS) and revenue perspective. The expected EPS for Q3 was $1.89. ADP reported an EPS of $1.92, equating to a positive surprise of 1.59%. Expected revenue for ADP was 4.03b. ADP reported revenue at $4.05b ($18m positive surprise), equating to a positive revenue surprise of 0.45%.

ADP TotalSource Q3 Year Over Year Numbers

As noted below in Figure 1, ADP TotalSource comprised approximately 30.55% of ADP’s total revenue. This is up from Q3 of 2019 when TotalSource comprised 27.52% of total revenues. Moreover, TotalSource posted a Q3 year over year growth of 11.03%. This means that TotalSource is continuing to gain ground as a revenue driver within the ADP organization.

Figure 1

Material Information/Comments from the Earnings Call

ADP’s Approach to COVID-19

Carlos Rodriguez, President and CEO of ADP opened the call by discussing the impact of COVID-19 and ADP’s response.

Carlos stated:

“First is that ADP is not immune to the global pandemic’s impact on the labor markets. But while we may make tactical adjustments as we navigate through this crisis, we believe our long term strategy is unaffected and we remain optimistic about how we’re positioned over the coming years once the business environment and our client’s return to more normal operations. The second point is that we will continue to serve our clients in the way we know best by offering the tools, resources and support they need to manage their business and their workforce through all types of operating environments, including this challenging one.”

Rodriguez went on to say:

“In March, we took steps to quickly shift over 50,000 of our associates to work from home and now have approximately 98% of our workforce working remotely in a secure manner. In doing so, we leveraged our previous investments in business resiliency and in addition we ordered thousands of laptops, expanded remote access capacity, provided at-home Internet and for those critical personnel that needed to work on site, we took steps to ensure their safety, while they performed those essential onsite tasks. This was a huge undertaking by our global IT, security, legal and HR organizations, and I’m extremely proud of their execution.”

Mission Critical Service

Carlos Rodriguez further discussed the importance of their services, as they process payroll for 1 in 6 Americans.

Rodriguez stated:

“We provide a mission-critical service and process payroll for one in six Americans and over 40 million workers around the world, and to offer immediate support, we provided a number of online resources, including an Employer Preparedness Toolkit and webinars attended by tens of thousands of clients. We also quickly made available, for free, the payroll costs and headcount reports necessary to apply for forgivable loans under the Paycheck Protection Program of the CARES Act. And these reports have been downloaded hundreds of thousands of times…

… Service is more important than ever in times like this. We saw call volumes increased significantly beginning in March and had nearly 2 million inbound requests across our service channels in a matter of weeks, with clients looking for help for the variety of issues including adding custom pay code related to COVID-19, redirecting checks to different locations and requesting new time tracking hardware that doesn’t require physical contact. In many cases, they were simply seeking general guidance in understanding new legislation.”

Philanthropic Efforts

ADP’s CEO also discussed the organizations approach to assisting the community by stating:

“And in support of our local communities, ADP has made over $2 million in donations to relief efforts, including a dedicated relief fund for ADP associates that needed assistance, as well as donations of medical supplies for hospitals, food banks and their workers. With all that said, the significant impact of COVID-19 is — it is having on the broader economy is in turn having an effect on our reported metrics and in a much more abrupt fashion as compared to previous macroeconomic slowdowns.”

Sales Reduction

ADP’s CEO gave insight into the sales (bookings) for the quarter and provided outlook for the remainder of the fiscal year by stating:

“This quarter, we reported a decrease of 9% as we saw bookings declined significantly and rapidly in mid-March when we typically would have expected to close many deals for the quarter…

… But to calibrate your expectations, we are guiding for a full year ES New Business Bookings — our ES New Business Bookings to be down 20%, which implies our fourth quarter (Q2 on an annual calendar) bookings will be down by more than 50%. With all that said, we remain confident in our product portfolio and optimistic about our ability to drive sustained growth in ES Bookings in a sounder economic environment.”

TotalSource Results and Outlook

Kathleen Winters, ADP’s Chief Financial Officer gave an overview of the results specific to TotalSource, along with guidance for ADP’s fiscal year Q4 (Q2 in a calendar year).

Kathleen stated:

“Our PEO segment margins grew 11% for the quarter to $1.2 billion and average Worksite Employees grew 7%, to 595,000 ahead of our expectations and driven by strong year-to-date New Business Bookings. We were pleased with this reacceleration in our Worksite Employee growth in the third quarter and believe we would have been positioned for further acceleration, exiting the year, if not for COVID-19. Revenues, excluding zero margin benefits pass-throughs, grew 9% to $490 million, and continued to include pressure from lower workers’ compensation and SUI costs and related pricing. PEO margin expanded 10 basis points in the quarter, in line with our expectations.”

Winters went on to say:

“For our PEO, we saw good momentum up through the end of March and as I mentioned earlier, we believe, we were on track for continued acceleration exiting the year but are now layering in our expectation for layoffs and furloughs, and additional out-of-business losses. As a reminder, in our PEO segment, we earned revenues as a percent of the gross payroll we process. And as a result, we are more directly tied to changes in our clients headcount and hours worked as compared to our Employer Services segment. As a result of these assumptions and our expectations for lower Q4 PEO sales, we are lowering our average Worksite Employee growth expectation to 3% to 5% from 7% to 8% previously. We are, likewise, lowering our revenue guidance and now expect 5% to 7% PEO revenue growth in fiscal 2020 and 3% to 5% growth in PEO revenues, excluding zero margin benefits pass-throughs. As we also discussed throughout the year, we continue to expect lower workers’ compensation and SUI cost and related pricing to pressure our total PEO revenue growth though we could see those trends change in the coming years. For PEO margin, we now expect to be down 100 to 125 basis points in fiscal 2020.”

Client Impact

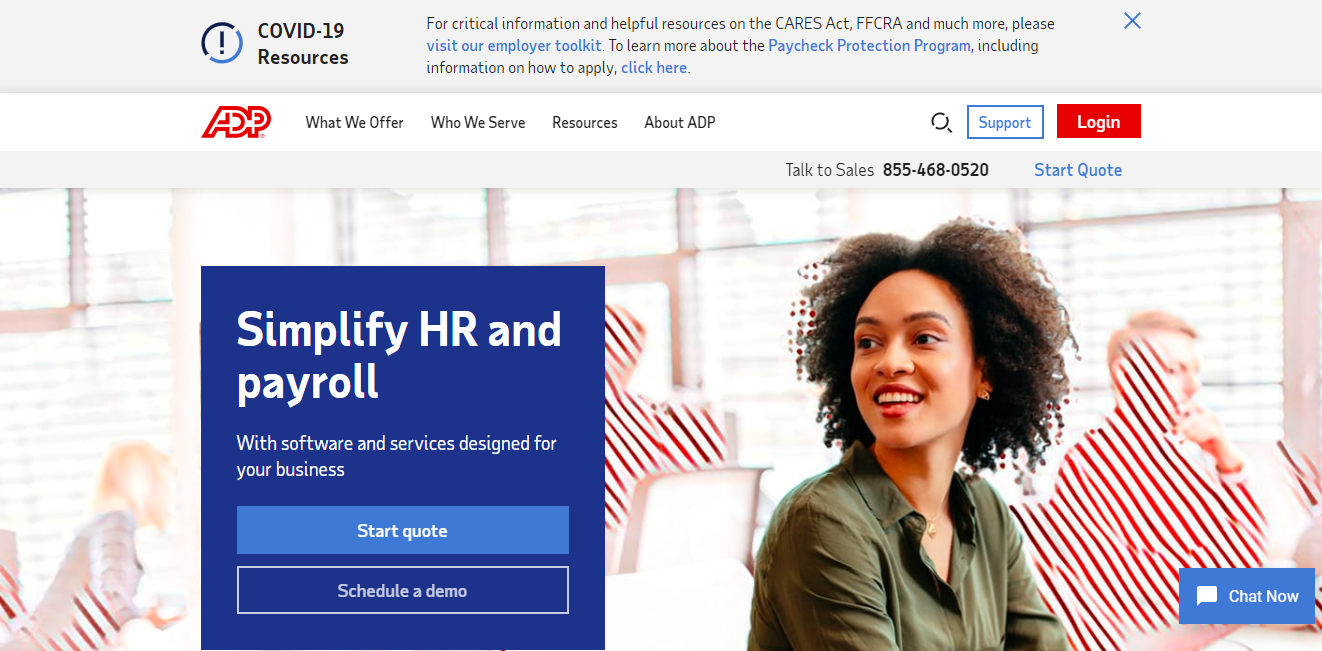

Carlos concluded the presentation portion of the earnings call by reading a recent client testimonial, which he felt encapsulated what ADP is trying to provide for their clientele. The client testimonial is directly below, followed by a snapshot of the screen the client referenced, outlined in Figure 2.

Carlos stated:

“I just wanted to share with you an excerpt of one of the many notes we receive from our clients that captures how we want to define ourselves. This one said, we are a small business that has used ADP for quite a few years now. Every time we call, there has been a knowledgeable professional at ADP that immediately solves the problem and answers the question. We recently needed payroll data to apply for the COVID-19 Payroll Protection Program. I immediately went to ADP’s website to see how I should go about selecting and downloading the required payroll data. Imagine the relief when opening the screen, there was a COVID-19 pop-up that proactively provided your clients with the payroll data needed. I was floored. This type of customer service is unheard of these days. We just want to tip our hats to everyone at ADP for a great job.”

Figure 2

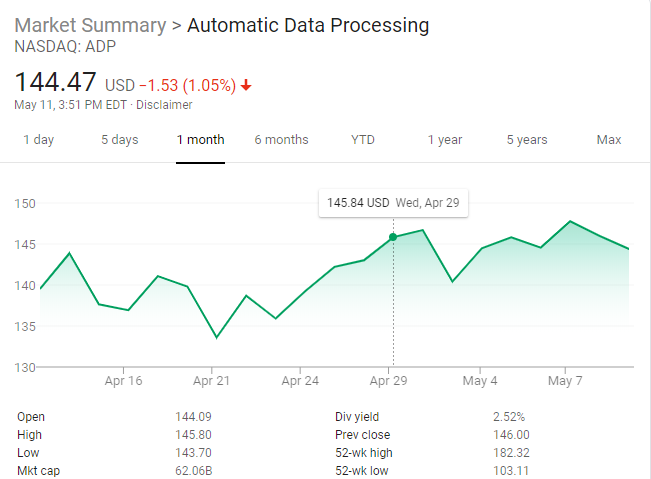

ADP Stock Trending

About ADP

ADP is a comprehensive global provider of cloud-based human capital management (HCM) solutions that unite HR, payroll, talent, time, tax and benefits administration, and a leader in business outsourcing services, analytics and compliance expertise. ADP’s unmatched experience, deep insights and cutting-edge technology have transformed human resources from a back-office administrative function to a strategic business advantage. | www.adp.com

Independent Commentary by Rob Comeau

Rob Comeau is the featured Author of www.netprofitgrowth.com

ADP is the largest player in the United States for payroll and PEO services. ADP currently provides payroll for one out of every six Americans according to their CEO. Further, TotalSource’s year over year revenue growth is outpacing that of its partner segments within the ADP portfolio of services.

It appears that ADP has set the bar for response measures in light of COVID-19. This is due to the combination of resources and speed in which the organization pivoted to deal with this scenario. Considering the massive size of ADP, this is impressive. Like all organizations, ADP is taking a hit as a result of COVID-19. However, due to a strong third quarter, ADP has only revised its annual projects for its PEO segment by a two to four percentage points. It appears that the PEO segment is holding stronger than the payroll segment of ADP’s book as Q4 guidance for the company versus Q4 guidance for the PEO segment differed materially. The company as a whole has revised guidance down 20% through their fiscal year (one quarter remaining). However, as stated above, PEO guidance does not appear to be taking that dramatic of a hit within the company.

It appears that TotalSource will be on the low end of our recent projections for the impact of COVID-19 on the PEO Industry. As the largest player in the space, with roughly 595,000 WSEs, this is good news for the industry.

Net Profit Growth’s guidance on the PEO industry can be viewed in the Growth Outlook commentary section of our PEO Industry Statistics Article. In the commentary of that article, we provided a range of the likely reductions PEO may face as a result of COVID-19, as illustrated in the Industry Revenues section of that article.

Excerpt from our Industry Statistics Article

Industry revenues are down year to date in 2020. While we don’t have specific statistics on these numbers to date, every conversation I’ve had with various PEO ownership teams state that revenues are down between 10% and 30%. Depending on the macro client segmentation, certain PEOs have been affected more than others. Blue-collar centric PEOs have likely felt the greatest hit as many of their clients are not currently operating. Grey-collar focused PEOs have felt the hit as well, especially those focused on hospitality. White-collar focused PEOs have experienced a dip, though likely not as great as blue- and grey-collar PEOs. Furloughs and layoffs will be drivers to a reduced year over year revenue change in 2020. The duration for how long the pandemic lasts will determine the severity of revenue reduction for the industry. Considering that roughly two-thirds of the industry’s macro client segmentation is contained within white-collar centric businesses, the industry may weather the storm slightly better than some other human capital industries.

The final publicly traded player that we will cover, from an earnings release perspective, is PayChex | Oasis (PAYX). Considering their fiscal Q3 ended in February (prior to the COVID-19 impace), we will cover their Q4. The earnings release for PAYX Q4 is estimated to be held on June 24th.

Author

Rob Comeau is the CEO of Business Resource Center, Inc., a business consulting and M&A advisory firm to the PEO industry. Rob is the featured Author and Founder of this PEO online publication. To contact Rob, you may email him at rob.comeau@biz-rc.com. You may view Business Resource Center’s offering at www.biz-rc.com.