Disclaimer: this article is independent commentary on Insperity’s recent earnings release on May 4th. All statistical information contained within this article is public knowledge. The information contained within this article should not be construed as investment advice. As with any investments, material risks should be evaluated prior to investing. The commentary section of this article is solely the opinion of the author and should not be construed as advice.

Opening

Recently discussed in our article titled PEO Industry Statistics 2019 – Part 2, we discussed the potential impact of COVID-19 on the PEO industry. As outlined in the Growth Outlook section of that article, we noted Insperity (NSP) as the second of the major players to have their earnings release for Q1 of 2020 (TriNet was the first to release earnings and their results can be found here). While Q1 encapsulated only a small duration of the quarantine, we look to publicly traded PEOs for some insight into the effect of the shutdown on PEO financials.

Fast Facts

Insperity beat analysts forecasts for Q1, both from an earnings per share (EPS) and revenue perspective. The expected EPS for Q1 was $1.57. Insperity reported an EPS of $1.70, equating to a positive surprise of 8.38%. Expected revenue for the quarter was $1.17b. Insperity reported revenue at $1.23b, equating to a positive surprise of 5.53%. As compared to analysts’ projections, Q1 was the best quarter for Insperity in the last four quarters, dating back to Q2 of 2019.

Material Information/Comments from the Earnings Call

The following insights were pulled from Insperity’s earnings release call on May 4th, 2020.

Revenue Increase | Health Plan | COVID-19

According to Paul Sarvadi, Chairman and CEO of Insperity, the company increased the number of trained sales professionals by 13% and increased sales efficiencies by 10%. This equated to Q1 coming in at 122% of budget, which equated to a 25% increase over the same period in 2019.

Sarvadi also commented on Insperity’s improved results within their master health plan, stating:

“The other important development evident in the first quarter results is the improvement in our benefit plan as the elevated number of large claims we experienced last year continue to decline toward historical levels and our benefits allocations continue to outpace our expectations.”

Paul further commented on Insperity’s response to the COVID-19 outbreak by stating:

“Our decisive response proved to be critically important for our clients, their employees and families. We believe our rapid and pivotal reaction to the pandemic, combined with the quality of our client base has caused Insperity to experience a relatively less severe impact in layoffs and ultimately in paid worksite employees than would have otherwise occurred. The best empirical evidence is our paid worksite employee decline in April, which was only 3.3% lower than March.”

Paul went on to give more color into the WSE reduction, resulting from COVID-19 by stating:

“Since March 9, through the end of April, 25% of our clients have reported layoffs totaling approximately 22,000 employees or about 9% of the total worksite employee base. 35% of these layoffs were processed as permanent layoffs. In 65% as furloughs or temporary layoffs expecting to be rehired in the coming months. Approximately 15,000 of these layoffs were reported before the end of March with the remaining 7,000 in April as layoffs moderated. Over the same period, we’ve already seen approximately 2,200 employees or 10% of the total rehired, which we believe is somewhat due to our early success with clients in the Paycheck Protection Program.

Keep in mind these terminated employees typically get a final paycheck after the reported layoff and rehires get paid on the next pay date. So, there is a lag in the paid worksite employee impact from both types of these reported changes. You also have to factor in paid worksite employees pluses and minuses from terminating clients, new clients, voluntary and involuntary terminations and regular hiring in the base. With all these factors in and finalized at the end of April, the result was the 3.3% reduction in paid worksite employees for the one — that I mentioned earlier.”

Adjusted EBITDA | Large Healthcare Claims

Douglas Sharp, SVP of Finance, CFO, and Treasurer, commented on the companies adjusted EBITDA and large healthcare claims, among other financial updates. Sharp stated that Insperity reported an AEBITDA of $101m in Q1, 2020. He also commented on the reduction in large claims on their health insurance plan by stating:

“As for large healthcare claim activity, we continue to see a decline in the number of claims over $100,000 since the initial spike in the second quarter of 2019, although it’s still slightly elevated from a historical perspective. Also, our Q1 claim trend associated with normal smaller healthcare claims came in near targeted levels. Now an outlier in Q1 was a shift in the timing of approximately $4 million of pharmacy costs into the quarter. As you may be aware, as a result of the COVID-19 stay-at-home orders, many benefit plan participants across the country accelerated their pharmacy refills with many extending the refill period from 30 to 90 days.”

Sharp concluded his comments on the healthcare plan by stating:

“Now on the pricing side, our benefit allocations were also favorable. So, in conclusion, we exited the quarter ahead of plan in our benefits area.”

Stock Repurchase | Organizational Liquidity

Douglas Sharp commented on the company repurchasing shares and the organizations liquidity position. Sharp stated:

“Now let’s discuss our cash flow and liquidity. During the quarter, we repurchased a total of 878,000 shares at a cost of $61 million. These repurchases included those shares bought in the open market and under our corporate 10b5-1 plan in mid-February and early March and shares repurchased in connection with tax withholdings upon the vesting of employee restricted shares. We also paid $16 million in cash dividends under our regular dividend program and invested $16 million in capital expenditures. While we continue to have a strong balance sheet and liquidity position in the latter part of the quarter, we drew down $100 million from our credit facility to provide further flexibility in this uncertain business environment. So, we ended the quarter with $167 million of adjusted cash and $130 million available under our $500 million credit facility.”

It is encouraging to see a publicly traded PEO repurchase material amounts of stock. While some company’s in the past have utilized this tactic to try and manipulate the market, Insperity appears to be the real deal in their repurchasing efforts. This may provide insight into the fact that the company feels the stock will be worth more in the future than it is today. I personally agree and believe that Insperity’s stock has a high ceiling for investors willing to wait three to five years for a substantial return.

Q2 Guidance

The following guidance was provided by Insperity’s leadership team on their earnings call dated 5/4/20.

WSE Count

Douglas Sharp:

“And based on the details that Paul just shared on our expected worksite employee levels, we are now forecasting a 1% to 5% decrease in the average number of paid worksite employees for the Q2 stand-alone quarter and a 1% to 6% decrease for the full-year 2020 as compared to the 2019 periods.”

AEBITDA | EPS

Douglas Sharp:

“For the full-year 2020, we are forecasting adjusted EBITDA in a range of $215 million to $250 million, which is flat to down 14% from 2019. As for adjusted EPS, we are forecasting a range of $3.19 to $3.86. And this assumes an effective tax rate of 28% in 2020 as compared to a rate of 20% in 2019.”

Sharp concluded the outlook by providing Q2 guidance when he relayed:

“Now as for our Q2 earnings guidance, we are forecasting adjusted EBITDA range of $65 million to $79 million, a 15% to 39% increase over Q2 of 2019 and adjusted EPS in a range of $1 to $1.29, an increase of 23% to 55%.”

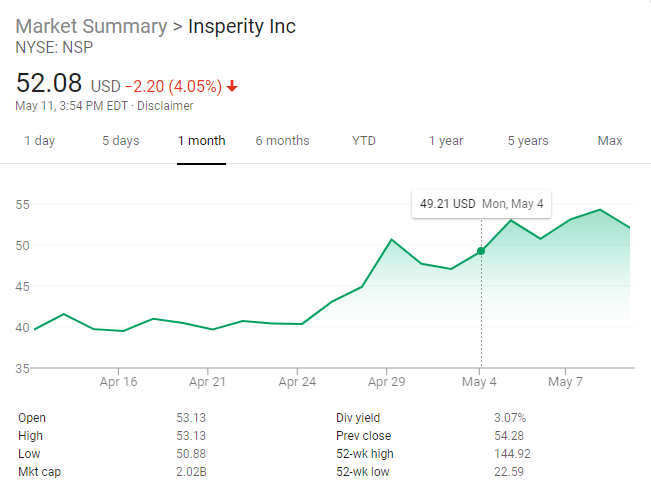

Insperity Stock Trending

About Insperity

Insperity, a trusted advisor to America’s best businesses since 1986, provides an array of human resources and business solutions designed to help improve business performance. Insperity Business Performance Advisors offer the most comprehensive suite of products and services available in the marketplace. Insperity delivers administrative relief, better benefits, reduced liabilities and a systematic way to improve productivity through its premier Workforce Optimization™ solution. Additional company offerings include Payroll and Human Capital Management, Time and Attendance, Performance Management, Organizational Planning, Recruiting Services, Employment Screening, Financial Services, Expense Management, Retirement Services and Insurance Services. | www.insperity.com

Independent Commentary by Rob Comeau

Rob Comeau is the featured Author of www.netprofitgrowth.com

Insperity came in stronger with Q1 results than anticipated, both from a revenue and EPS perspective. Further, the guidance provided by Insperity’s leadership team is encouraging, considering the COVID-19 pandemic. Insperity is expecting AEBITDA growth in Q2, in comparison to Q2 of 2019, though lower than Q1 of 2020.

The company experienced roughly a 9% reduction in WSEs due to layoffs and furloughs. This will likely impact their Q2 results as only 10% of these furloughed employees were rehired at the time of their earnings release.

Insperity targets a white-collar macro client segmentation. As a result, they have experienced a reduction, but less than what we predict for PEOs with a grey- or blue-collar macro client segmentation. Further, Insperity has experienced a reduction in large medical claims which bodes well for their sustainability with healthcare expenses and cost structure.

Insperity expects to remain relatively flat with internal hiring, with the exception of sales. It appears that the company is still in the mode of hiring new sales talent to bolster revenue growth for 2020.

CEO, Paul Sarvadi, had encouraging words for his staff and their performance in response to COVID-19 and attributes their clientele’s ability to access government stimulus packages in a timely manner to his team’s dedication and hard work.

The outlook for Insperity looks bright due to the minimal WSE reduction to date, the reduction in large health insurance claims, their performance during COVID-19, and the fact that the increase in SG&A appears to be largely due to new sales talent, which ultimately should drive increase to top-line growth. It makes sense that the company repurchased $61m in stock.

In the commentary of our recent industry statistics article, we provided guidance into the likely reductions PEO may face as a result of COVID-19. Insperity’s results and guidance were on the low end of our predictions with reductions, as illustrated in the Industry Revenues section of that article.

Excerpt from our Industry Statistics Article

Industry revenues are down year to date in 2020. While we don’t have specific statistics on these numbers to date, every conversation I’ve had with various PEO ownership teams state that revenues are down between 10% and 30%. Depending on the macro client segmentation, certain PEOs have been affected more than others. Blue-collar centric PEOs have likely felt the greatest hit as many of their clients are not currently operating. Grey-collar focused PEOs have felt the hit as well, especially those focused on hospitality. White-collar focused PEOs have experienced a dip, though likely not as great as blue- and grey-collar PEOs. Furloughs and layoffs will be drivers to a reduced year over year revenue change in 2020. The duration for how long the pandemic lasts will determine the severity of revenue reduction for the industry. Considering that roughly two-thirds of the industry’s macro client segmentation is contained within white-collar centric businesses, the industry may weather the storm slightly better than some other human capital industries.

The next major player to release earnings on May 6th is Barrett Business Services, Inc. (BBSI). It will be interesting to review the contrast between TriNet, Insperity, & BBSI, as TNET & NSP are largely focused on white-collar business whereas BBSI is largely focused on blue-collar. We will provide an overview and commentary on BBSI’s earnings once they have been released. Until then, Q1 results were favorable for Insperity and TriNet, and both have provided encouraging guidance for Q2, in light of the current state of affairs in the world.

Author

Rob Comeau is the CEO of Business Resource Center, Inc., a business consulting and M&A advisory firm to the PEO industry. Rob is the featured Author and Founder of this PEO online publication. To contact Rob, you may email him at rob.comeau@biz-rc.com. You may view Business Resource Center’s offering at www.biz-rc.com.

Insperity’s earnings for Q1, 2020. This article provides an overview of Insperity’s earnings for Q1, 2020 along with their Q2 guidance, and independent commentary by PEO expert, Rob Comeau.