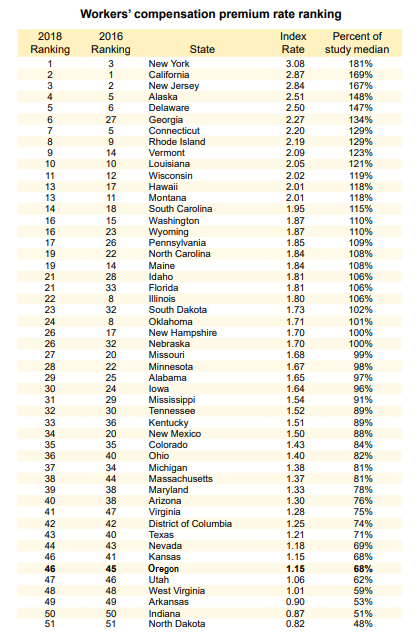

New York Passes California as the Highest Insurance Rate State

There is a new sheriff in town! California has historically, and for some time, been the most volatile State for workers’ compensation. However, as of a recent study in 2018, New York has become the highest State for workers’ compensation rates, with California coming in 2nd.

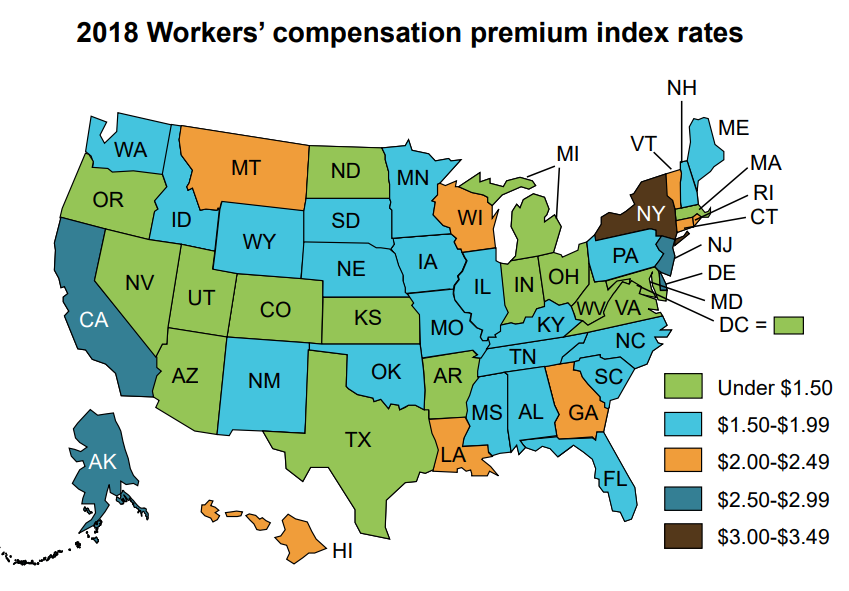

Below is a nationwide insurance rate ranking for workers’ compensation volatility by State.

Insurance Rate Ranking by State

Implications for PEOs

A PEO, especially one that writes blue and grey collar business, should evaluate the workers’ compensation volatility for each State it will conduct business. A PEO is advised to review, at a minimum, the following items simultaneously if it is contemplating entering a new State:

- Market Opportunity

- Competitive Landscape

- Client Segmentation Availability

- Insurance Volatility

- Pricing Elasticity

- Geographic Requisites

- Prospective Growth Rate

The information in this brief article will shed some light on one of the above factors; workers’ compensation insurance volatility per State.

Author

Rob Comeau is the CEO of Business Resource Center, Inc., a business consulting and M&A advisory firm with a niche focus on the PEO industry. You may reach Rob at rob.comeau@biz-rc.com or visit BRC on the web at www.biz-rc.com.