Opening

Let me state from the beginning that this will be a longer article. There is a lot of ground to cover on this topic. This piece will be chalked full of valuable information for those that want to create and/or grow a successful professional employer organization. You will note as you read further that all of the segments woven through this article are interrelated. One aspect affects the other and vice versa. The creation and execution of a successful PEO model requires harmony among multiple facets within the business model. Also, at the end of each section there will be key takeaways. These takeaways will be action items that your team may use, if it chooses to do so, to improve upon within your existing or perspective operations.

High-Level Industry Overview

It is estimated that the professional employer organization industry is comprised of over seven hundred PEOs. However, according to the most recent IBISWorld PEO Industry Report, over half the market revenue is driven by the industry’s top three players; TriNet, ADP TotalSource and Insperity. If we extend this revenue out to the top ten players which would include others like Oasis, Paychex, CoAdvantage and BBSI, it is likely that three quarters of the industry revenue is driven by less than two percent of the PEOs in existence today.

However, the market is not yet saturated. Most experts estimate a market penetration rate of less than ten percent. This means that while the industry is top heavy with larger players and in a state of consolidation, there is still a massive amount of the market that is still untapped. Conversely, while there is a vast amount which is untapped, most prospects that review the PEO option review more than just one. In other words, having a lot of untapped market potential doesn’t mean that there won’t be competition. This competition, if you are a smaller or regional PEO, generally comes in the form of a larger player with economies of scale that your organization may not currently possess. This article will provide your executive team with insight to create and drive a successful PEO model and compete in a manner that will allow your PEO to win business more consistently. Like with anything worth doing, it will take some work. However, if your organization is willing to put in the work, improved results will follow. For further industry insight and statistics, click here.

Coverage Points

The topics that will be covered within this article are as follows:

- Customer Selection

- Business Model

- Value Proposition

- Talent

- Technology

- Sales Engine

- Cash Flow from Operations

- Controls

- Strategic Intent

- Scale

- Executive Leadership

- Exit Strategy

Each of the aforementioned topics are interrelated. This means that one affects the other and vice versa. It is essential that all facets of a PEO work harmoniously to achieve optimal results. We’ll take each segment one by one and then tie it all together at the end of the article.

Customer Selection

Until a PEO knows its desired client segmentation, it cannot craft a model that will consistently beat top competition. A business model starts with ideal client selection and builds from there. Often a PEO may fall into a trap of servicing all undefined prospective clientele in an effort to bolster revenue growth. This is a mistake. PEO models differ based on the client segmentation serviced. A misaligned model to a particular client segment may yield unfavorable close ratios, poor client experience, higher insurance losses, damage to brand equity, etc. For example, imagine a PEO that is heavily focused on white collar business. If it begins to write a lot of blue collar business without augmenting the scope of its offering, it runs the risk of poor performing clientele. The white collar focused PEO may not have the appropriate risk mitigation strategies, staff or insurance platform to best accommodate the blue collar client segment. Moreover, a competitor PEO with a well-defined customer selection process whom focuses on blue collar clientele and possesses knowledge in the client industry vertical will likely win out over a PEO without a well-defined customer selection process.

Key Takeaways

- Discuss among your executive team, who should be your target client segments. Be sure to seek feedback from your sales and operations teams before finalizing your target clientele.

- Conduct an OTSW analysis to determine the opportunities/threats in comparison to your strengths/weaknesses. For more information on how to do this, click here.

- Once the client segmentation is decided upon, identify what would need to change within your value proposition, growth engine, marketing and brand efforts, technology, insurance, etc.

Business Model

Once the desired client segment(s) is identified, the PEO’s business model should be designed to support driving value to the client segmentation and profit to the PEO. A concise business model can be made up of five key elements; customer selection, value proposition, scope, value capture and supporting infrastructure. A PEO’s business model is a combination of internal capabilities and external alliances which collaborate to drive value to the end user. Internal capabilities are contingent upon superior talent which possesses the ability to consult and service the target client segmentation. External alliances are partnerships where the PEO can utilize the value of third party services and resources to consolidate into the PEO’s macro value proposition. Some of these external alliances would be in the form of insurance carriers (workers’ comp, health, EPLI, ancillary benefits), technology (payroll, HRIS, CRM, ACA calculations), retirement options (401(k)), claims management (TPA, nurse on call, investigatory services, wellness programs, etc.), and more. It is pivotal that a PEO integrate the internal and external offerings to put forth a unified value proposition in line with the target client segmentation requisites. For further information on creating a successful business model, click here.

Key Takeaways

- Review if the internal capabilities of your PEO and the external partnerships are congruent. Are there areas that are disjointed which require your attention?

- Is your business model designed to appropriately support your desired client segments?

- As your PEO scales, what areas may change with regard to what your PEO handles internally versus what you outsource to a third party? How would these changes benefit your PEO?

Value Proposition

What is a value proposition? Is it a menu of services a PEO offers or is it the actual value driven to its clientele? The answer is the latter. While the menu of services should be designed to support the value the PEO drives to its clientele, the services themselves are not the value proposition. The value proposition would be better defined as the benefit the client experiences by partnering with the PEO. We’ll take a look at a couple of examples to better explain this thought process.

A PEO that provides risk management consulting may look at the services as the value proposition. However, from the client’s perspective, the value proposition of this service is a safe workforce, a reduction in lost productivity time, a regulatory compliant operation and protection against injury for its workforce.

A PEO that provides a sophisticated tech platform may look at the features of the technology as the value proposition. However, a client will value streamlined efficiency, greater transparency on workforce variables, increased management capabilities, connectivity among its workforce, greater speed at execution, etc. The capabilities of the tech offered by the PEO is the instrument that allows the company to drive the value to the client. It is not the capabilities themselves that are the value proposition but rather the impact it has on the clientele. For a further breakdown of the facets that make up a PEO’s value proposition, click here.

Key Takeaways

- Does your PEO have a solid understanding of what its value proposition is?

- Does your value proposition need to change to better service your target clientele?

- What within your value proposition sets your PEO apart from competition? If the scope of the value proposition isn’t better than larger competition, the execution of the value proposition by your internal talent better be superior.

Talent

The PEO model falls within the business services field. This means that while some aspects of the model are more mechanical in nature (technology, insurance, etc.), a large part of the model is driven by consultative talent with applicable business acumen and experience. Even the mechanical aspects of the model are influenced by the talent supporting it, such as technology design, training/support, and insurance claims handling, mitigation and strategy. To a large degree, the value proposition of the current PEO model is business improvement and efficiency revolving around human capital management.

A business owner who is going to trust in a partnership with a PEO needs to feel confident with the capabilities and experience of its PEO servicing counterparts. Otherwise, the client is often choosing a PEO for insurance or tech. An insurance or tech buy will not yield the same high retention rates as a human capital management partnership. Client facing talent, behind the scenes talent and third party partnerships talent will drive the overall customer experience. This will impact the brand equity of a PEO and affect future client referrals, customer satisfaction rates and long-term revenue growth.

A PEO that is too restrained on paying for superior talent will likely have inferior results. If a PEO is cautious about paying higher rates for superior talent, it can design its compensation structure to include bonus capabilities which are a byproduct of the company’s increase. This will protect the PEO against frivolous spending and incentivize the talent to drive superior results. A PEO should be sure to design the bonus structure in a way that doesn’t promote behavior that is unethical or misaligned with the company mission, vision and values. For further information on talent alignment and company culture, click here.

Key Takeaways

- Are there any current talent gaps within the PEO?

- What talent will be required as the organization scales?

- What training and development does the PEO offer to its internal talent and external third party talent?

- What expectations has the PEO set for talent to research on its own so that it may infuse this knowledge back into the PEO talent pool?

Technology

Technology is an essential function within the PEO model. With advancements and innovation consistently occurring in the tech space, a PEO must remain abreast to developments that could impact and/or benefit its target clientele. Technology allows a PEO to better manage its external clientele and run more efficiently internally. It is generally technology that a PEO looks to first in order to improve upon its internal to worksite employee (WSE) ratios. Improving upon this ratio generally equates to increased profitability for the PEO. In addition to the technology available to a PEO today, the PEO should also be up to speed on alternatives that the client has the ability to choose. While a PEO offers more than just a payroll service for example, the tech of a PEO should not be brutally inferior to its payroll counterparts. Moreover, the advancements in technology can have a major effect on the PEO industry in the future. Advancements in machine learning and artificial intelligence (A.I.) can certainly disrupt the PEO model in the future. A PEO should be aware of the possibilities so that it gains a competitive advantage over competition when it sees the market indicators that allow it to be a first mover on new tech. For more information on improving internal to WSE ratios, click here. For more insight into potential market disruptors, inclusive of A.I., click here.

Key Takeaways

- Review your PEO’s current technology and capabilities to ensure it is best suited to service its client segments.

- Are there changes within your current technology or by selecting alternative technology that would allow your PEO to improve upon its internal to WSE ratios?

- Is your PEO using its technology to its fullest extent?

- Is your data adequately secure to protect your PEO and its clientele from data breaches?

- What contingency plans are in place if your PEO has a power outage or technology disruption?

Sales Engine

Regardless of whether your PEO utilizes a channel or direct go-to-market strategy, or a hybrid of each, educated sales talent is a requisite. A PEO sales professional is limited to sell on what the value proposition can deliver. When reviewing the sales engine, first review the company’s value proposition to ensure viability. Once that is achieved, a thorough sales engine review is possible. Ten highly qualified sales professionals will outperform 20 mediocre reps every day of the week. Quantity isn’t a viable long-term solution. Quantity of quality is. If the choice has to be made between quality and quantity, take quality.

Let’s suppose your PEO has a 20% prospect to close ratio. In this scenario, 80% of the businesses which have interacted with your PEO, have likely done so only with your sales rep. In other words, your sales rep carries a lot of weight in how the market perceives your organization. They are heavily influential on your PEO’s brand equity. I have seen an M&A deal go south due to one sales rep’s poor judgement. Meaning, this one sales rep that was perceived to have made a poor judgement years prior affected a transaction worth tens of millions of dollars. A PEO should not discount the impact sales has on its organization both internally and externally.

Once a PEO decides whether it will utilize a channel, direct or hybrid approach, it should structure its hiring requirements and compensation design to best support its sales engine. The type of person a PEO hires for sales and the attributes it looks for within a successful sales candidate will vary to certain degrees depending on the go-to-market strategy the PEO chooses. To learn more about a successful approach to sales and the difference in go-to-market strategies, click here. To learn more about the impact a sales professional may have on brand equity, click here. For an intro on getting into PEO sales, click here.

Key Takeaways

- Is your current go-to-market strategy yielding desired results for revenue growth? Why or why not?

- Does your PEO select the appropriate sales professionals based on your go-to-market strategy?

- Does your PEO have training, mentorship, and development processes in place to grow your sales force and increase your ROI per sales professional?

- Is your PEO’s value proposition favorable to allow your sales force to differentiate from competition?

- Is your compensation model in line with achieving desired results and promoting best practices?

Cash Flow from Operations

First off, what is cash flow from operations? According to www.investopedia.com “Cash flow from operating activities (CFO) is an accounting item indicating the money a company brings in from ongoing, regular business activities, such as manufacturing and selling goods or providing a service. Cash flow from operating activities does not include long-term capital or investment costs.”

The residual nature of the PEO model is designed to generate consistent cash flow from operations. This cash flow allows a PEO to scale, entice superior talent, invest into its infrastructure, make acquisitions, and create an enticing EBITDA number if/when it decides to exit. Cash flow from operations is heavily influenced by four key areas: revenue growth, pricing, operational efficiency and claims mitigation.

Revenue growth expands upon the size of volume of cash flow from operations while pricing optimizes the revenue growth base. Operational efficiency helps maintain overhead levels so that more from gross profit funnels down to net profit. Risk and claims mitigation helps protect against the potentially most volatile aspect of the overhead expenses and creates a better opportunity for increased cash flow.

One of the most enticing aspects of the PEO model to potential investors is the PEO’s ability to generate positive cash flow from operations. Protecting and maximizing the PEO’s cash flow is not only beneficial in operating the PEO today but also positions the PEO in a favorable light if/when it decides to sell the organization.

Key Takeaways

- What objectives can your executive team identify to increase the level of cash flow from operations?

- What estimated level of cash flow would be required to scale your organization or make a future acquisition?

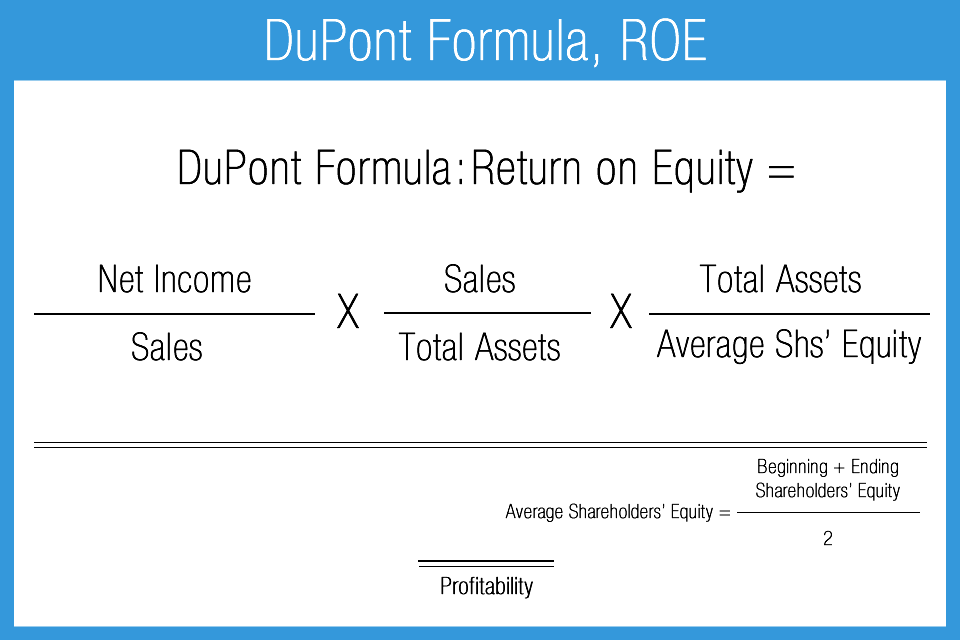

- How could the Dupont Formula for Return on Equity bring light to decisions to drive greater return for internal shareholders? (formula illustrated below)

DuPont mathematically expanded upon the return on equity formula to bring greater transparency in the areas a business can impact its ROE.

Controls

Implementing appropriate financial and regulatory controls within the organization is essential to ensure appropriate action and compliance. Controls should be put in place for accounting, tax filing, etc. PEOs have external controls available also. Many voluntarily choose to become ESAC accredited, apply to become a certified professional employer organization and conduct regular audits. Having appropriate internal and external controls is essential and protects against an occurrence that could financially impact the organization or its clientele. Such a negative occurrence could hurt profitability, client retention, brand equity, talent retention, etc.

Key Takeaways

- Review your organization to make sure it has the necessary controls in place.

- Designate the appropriate internal stakeholders to take charge of these controls and have redundancy or separation. One person shouldn’t have the key to all controls.

- Align with the appropriate external parties to ensure proper controls where appropriate.

Strategic Intent

This topic will be covered at a high level because to fully develop a strategic intent for your PEO would vary per PEO and take up the bulk of this article. Therefore, high-level, the first step in developing a PEO’s strategic intent, after it has created its business model is to conduct a SWOT analysis. However, we recommend that you reverse the order of SWOT into OTSW. This allows a PEO’s executive team to view its strengths and weaknesses in light of the market opportunities and threats and not vice versa.

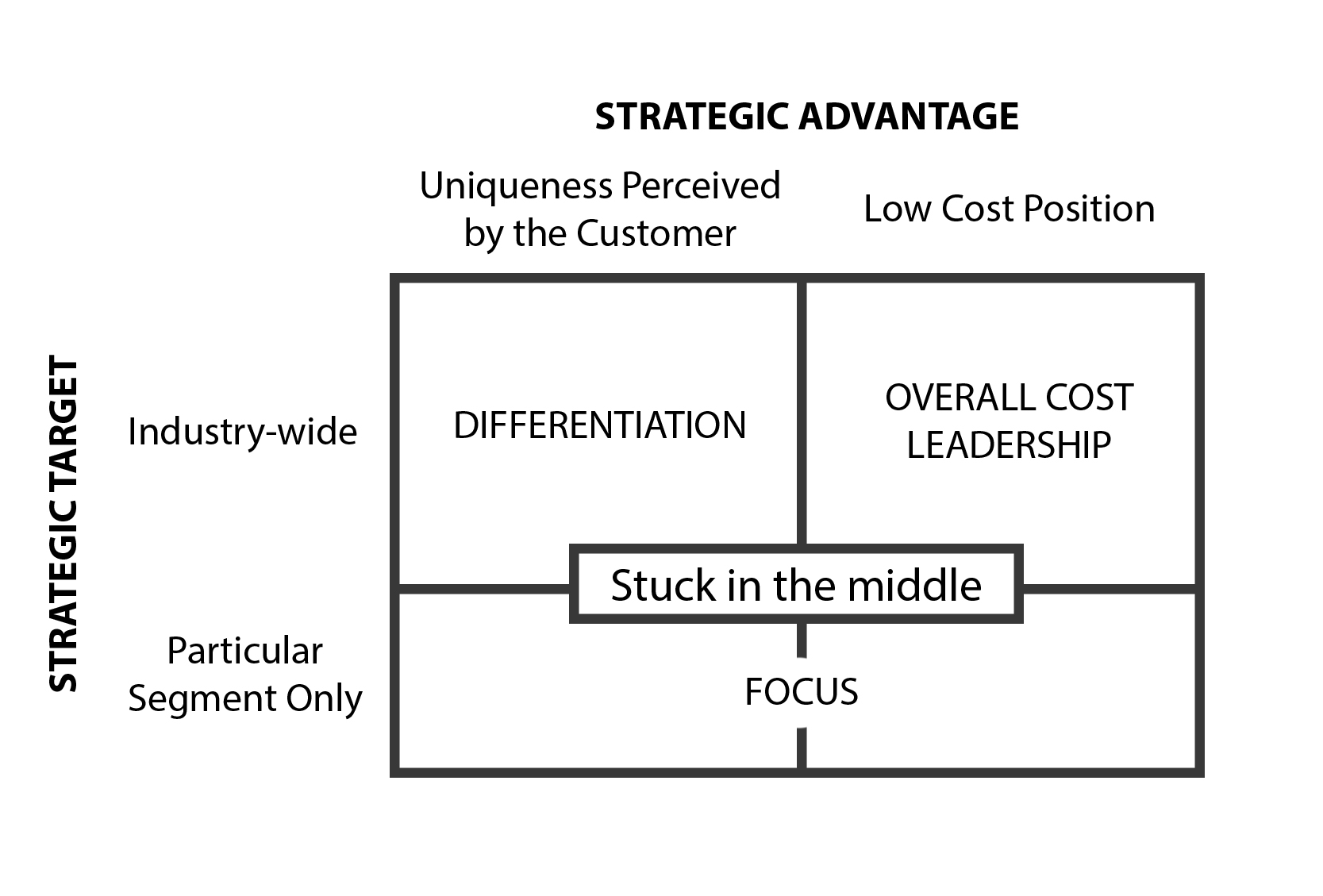

Once an OTSW is complete, the PEO must identify what space it will play in and how it will play in that space. It must identify who the industry competition is and also who are the alternatives that a prospective customer segment may choose from. At which point, the PEO may decide its generic strategy and build from there. An example of Michael Porter’s generic strategies is illustrated below.

The strategic intent process is an intense process but will yield superior results to companies which take the requisite time to fully develop their strategy. Another area to analyze your PEO is by ranking your company and industry by using Porter’s Five Forces, illustrated below. This will allow your team to better understand where and how it should compete against competitors and alternatives. While the following link is in no way intended to supplant the process of creating a strategic intent for your PEO, for some insight into how a smaller PEO may compete with larger PEOs, click here.

Porters Five Forces. A company can rank in each category whether it has an advantage, disadvantage or is neutral.

Key Takeaways

- Does your PEO have a clearly defined strategic intent currently?

- Have you conducted a recent SWOT, OTSW or competitive analysis?

- Is your business model clearly designed so that your PEO may develop a strategy?

Scale

As a PEO grows, it will scale its operations. How the PEO scales its operations will play a role in determining its operational efficiency and net profit as a percentage of net revenue. The most common method of scaling within the PEO industry is the creation of regional operating centers to support client facing branch operations. A regional operating center allows a PEO to consolidate certain functions within the backend service team to achieve scale. For example, a PEO may consolidate its payroll, benefits administration and claims management teams into a regional operating center. This allows that operating center to have acute focus on these operations driving greater efficiency. A PEO may be inclined to consolidate its HR functionalities as well. However, before a PEO makes this decision for HR consolidation, it should review the affect that an HR consolidation would have on its value proposition. If the delivery method for HR consultation is designed to happen in person, consolidation would have an adverse effect on the whole of the business.

The other benefit to scale is purchasing leverage. A review of Porter’s Five Forces in the previous section Strategic Intent, will help your team identify where purchasing leverage may be available. Some obvious areas where scale benefits a PEO’s leverage to negotiate are insurance, technology, TPA, etc. Ultimately it is the combination of scaling internal operations and purchasing leverage that will allow a PEO to drop more profit to the bottom-line. For information or ideas on scaling business units in conjunction with or in lieu of regional operating centers, please click here.

Key Takeaways

- What are the key factors within your PEO that are indicators as to when you should scale?

- Is a regional operating center right for your PEO? Why or why not?

- What purchase leverage will your PEO have as you grow? At what size do you feel this leverage will occur?

Executive Leadership

While it is the sum of the parts that makes up the whole PEO, executive leadership sets the tone and precedence for the organization. Therefore, an aligned executive team with common vision, values and focus coupled with superior communication and departmental integration yields better results than those whom lack these components. This is true weather a PEO is large and publicly traded or small and emerging. The difference between the two is that a large PEO already has an established executive team whereas a small PEO may have an executive team but is normally lead by the owner more than the executive team collaboratively.

It is advisable as a PEO scales that leadership development is in place to create and grow a successful executive team. The earlier this is able to happen within a PEO, the better. When an executive team fosters an environment and culture conducive to knowledge transfer, it begins to create a learning organization. In a learning organization, the group IQ should exceed any one individual’s IQ. A learning organization starts with the executive team and permeates through the organization. Creating a learning organization takes practice but pays heavy dividends with culture, morale, departmental harmony and profitability. There is a framework to begin creating a learning organization based on MIT Professor Peter Senge’s book The Fifth Discipline. An executive summary of this framework may be found at the following two links: dialogue and defensive routines and improving executive team communication. When learning to communicate as a team in this fashion don’t expect it to come naturally. This process takes practice but is well worth it when the team is committed to creating this framework within executive meetings.

Key Takeaways

- How optimally is your executive team functioning today? Where does it need work?

- Is creating a learning organization the right recipe for your organization?

- How may your company improve upon leadership development and succession planning?

Exit Strategy

You’ve likely heard the saying “start with the end in mind.” Having a solid understanding of where you desire your PEO to go will help pave the way for the move necessary to arrive at this destination within the desired time-frame. Having a desired endpoint also helps a C-Suite course correct when needed if the organization begins to drift away from the intended destination. An exit strategy doesn’t mean a PEO must sell at some point. What it does mean is that the PEO is prepared for a sale or succession if or when appropriate. PEOs that do not begin with the end in mind may diminish some of the value it could have realized when the shareholder(s) do exit the organization. An exit strategy helps an executive team maintain focus. It puts a timeline to objectives which helps maintain progress and promotes action when progress stifles or growth stagnates. Ultimately, it is to the determination of the shareholders what the exit may look like but all PEOs could benefit from having an exit strategy in mind, whether or not they plan on exiting the organization. For more information on having an exit strategy, click here.

Key Takeaways

- Having a defined exit strategy helps keep the executive team focused and prepares the organization for an exit, if desired.

- Having an exit strategy doesn’t mean you need to exit.

- What would you change within your PEO if you were planning on exiting in five years to maximize your valuation?

- Are there areas of an M&A transaction that you don’t know but would like to? What are those areas and how can you obtain that insight?

Synopsis

If you’ve made it this far in this article, I applaud you. It was a long article but the information contained throughout can help guide and grow your PEO. In summary, begin with defining your customer selection and build your business model to support driving value to this segment. Design your value proposition to support driving value to your customer and execute the delivery of the value prop with superior talent. Ensure that your technology supports the business model and talent of the organization and drives superior internal to WSE ratios. Determine your go-to-market strategy and then hire and develop the appropriate sales professionals while utilizing a compensation structure that promotes results and ethical practices. Review the organization’s cash flow from operations and determine areas to improve upon this number. Ensure the company has the proper internal and external controls to protect against fraud, embezzlement and noncompliance. Spend the time to formulate a strategic intent so that the company is positioned to win and the direction is clear to internal stakeholders. Know how and when to scale and what indicators prompt the timing of scaling the organization. Uncover leverage points when scaling to improve upon cash flow from operations. Align executive leadership and determine if creating a learning organization is right for your PEO. The executive team should be aligned in mission, vision, value and focus with clear direction to execute upon initiatives and provide latitude to express differing opinions. Whether or not an exit from the organization is on the near horizon, develop an exit strategy. This will allow your team to remain focused and determine what facets of the business need to improve to increase valuation. Having an end in sight also provides a constant to determine when the organization is adrift and requires course correction or augmentation of the end destination.

Final Thoughts

Hopefully the information contained within this article will provide your executive team with some key takeaways and actions items that will ultimately guide your PEO towards greater prosperity. For additional information and insight in any of the covered areas, feel free to contact us.

Author: Rob Comeau is the CEO of Business Resource Center, Inc., a consulting and M&A advisory firm to the PEO industry. Business Resource Center’s website is www.biz-rc.com. You may reach them by phone at (949) 888-6627.