Workers’ Compensation Premium Trending in California

Wage inflation is a contributing factor in a prolonged workers’ compensation soft market in California. The WCIRB reports written premiums for the first six months of 2023 were $8.5bn. Scaled out annually, that equates to $17bn for the year. That is up 6.25% from 2022 and 21.4% from 2021. Yet rates have not materially increased to substantiate this premium increase. Why? Wage inflation has taken care of insurer rate increases for them.

California Wage Inflation

According to the Public Policy Institute of California (PPIC), wages as a whole in California have risen by 14% since 2020. Moreover, some industries have risen at a much higher clip. For example, leisure and hospitality have risen 24% and trade, transportation, and utilities have increased 16% on average. These increases in wages are directly increasing workers’ compensation premiums.

Wage Inflation’s Impact on WC Premiums

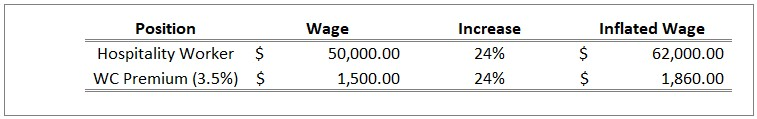

As you will note in the figure below, if a hospitality worker is making $50,000 and their wage increased by 25%, the workers’ compensation carrier benefited by a 24% in premiums to cover the same level of risk as prior to the wage inflation. While ultimate losses in California have seen a slight increase over the past year, they are not anywhere near the equivalent of 24%, or 14% for that matter.

Also, according to the PPIC, even though employees wages have increased, due to inflation, it feels like a 0.5% wage decrease due to the cost of living expenses increasing at a greater rate. Meaning, wage inflation is likely to continue as is elevated premiums.

Average Charged WC Premiums in CA

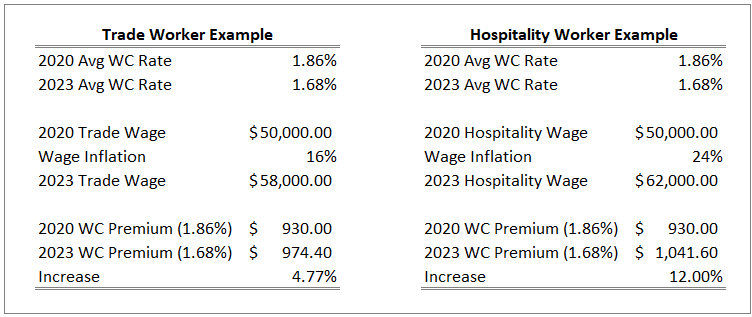

According to the WCIRB filings, “In the September 1, 2023 Pure Premium Rate Filing, the WCIRB proposed an average 0.3% increase in advisory pure premium rates. In the Filing Decision, the Insurance Commissioner approved an average 2.6% decrease in advisory pure premium rates.” The average charged rate for WC in California through 6 months of 2023 has been $1.68, compared to $1.73 from a year ago. In 2020, the average charged workers’ compensation rate was $1.86. Let’s do some math. As you will note in the below example, while charged premium rates have decreased, actual premium has increased. Please note that we utilized average charged rates for this example. Each code may carry greater increase based on its classifications, but this information will suffice to prove our point.

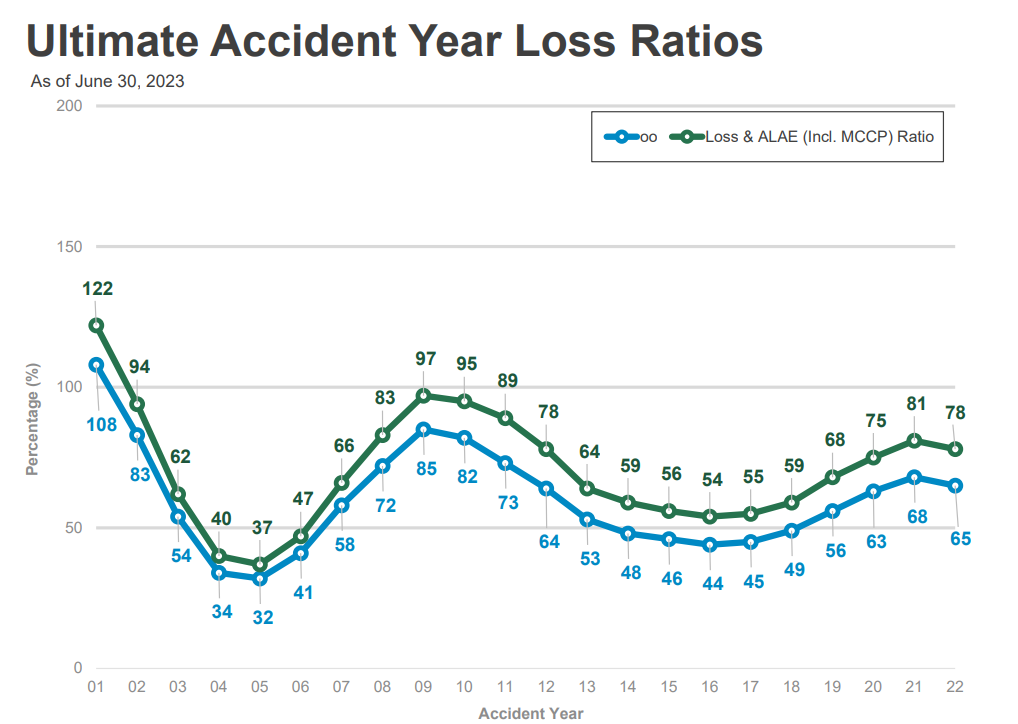

In the hospitality example, insurers are collecting 12% higher premiums in 2023 for a risk profile comparable to three years ago. Ultimate loss ratios have risen 3% in the past 3 years, not 12%.

Conclusion

If you’ve wondered why California has remained in a “soft market” as it pertains to rates per $100 of payroll, while ultimate loss ratios have increased by over 20 percentage points since 2016 and 2017, you need look no further than wage inflation and a bull-market. However, consider this scenario. When the market corrects and our economy begins a downward trend, unemployment will increase, market returns will decrease, post-termination CT claims will increase, and wage inflation will stagnate or decrease. This means that an insurer will have less margin to combat higher claims. The result, in this author’s opinion, will be a hardening of the California workers’ compensation market.

Author

Rob Comeau is the CEO of BRCI, a business consulting and M&A advisory firm. He is also a partner in ESG and Halcyon HR (California and Texas based PEOs with master workers’ compensation programs and solutions). Comeau is a minority partner in legislative- and insure-tech companies, and he is a frequent guest author and speaker. To contact Rob, you may email him at rob.comeau@biz-rc.com.

using WordPress and

using WordPress and