Sales Commissions: Transactional vs. Residual

How a company pays there sales force in an industry that provides an annuitized revenue stream has been a continuous source of debate. Considering the fact that our company consults heavily in the Professional Employer Organization (PEO) space, we will use this industry as the basis of example for this discussion process. Both models, transactional and residual, carry pros and cons within their structure and motivating factors. This article will explore both options and provide an alternative solution for those that don’t fully gravitate towards one of these two aforementioned options.

Transactional

The transactional model is designed to reward the sales professional for the most recent year’s productivity. It often comes with a higher payout for new business than the residual model and is geared towards driving new production on an annual basis.

- Pro: The premise behind this model is to ensure that your sales force will have to drive results each year to sustain their desired income range, thus promoting new business development annually.

- Con: While the transactional model achieves its desired result for new business development stimulation annually, it lacks the long-term income growth prospective that many top tier business development professionals look for.

Residual

The residual model is designed to reward the sales professional for consistent productivity over their career. It generally comes with a lower payout on new business than the transactional model but yields greater income potential over the course of a career if consistent business development has occurred.

- Pro: The premise behind this model is to drive long-term productivity. Utilizing a residual model saves the company money short-term on those whom don’t last and locks in the productive staff long-term due to the residual payouts in the latter years.

- Con: While the residual model achieves its goals in vetting the underperforming sales reps at a lesser cost and helps lock in productive staff due to higher levels of income, it runs the risk of a productive sales professional getting “fat and happy” with their annual income. This can detract from future production in the later years of tenure.

Contrast

Ultimate income potential for top performers is higher within a residual model. While it will take them longer to surpass the transactional annual income, once eclipsed, the residual model will pay dividends for consistent productivity. The transactional model is more attractive financially for the first few years as the payout is greater upfront and there isn’t a large book of business yet that would pay favorably under the residual model. A transactional model gives the employer a more attractive initial compensation package to speak with candidates about, however the prospects of a residual model provide a reliable growth plan for long-term thinkers.

Our Experience

Within the PEO space, we have noted that if a candidate is new to the industry, either model will suffice depending on your company culture and target candidate. However, if you are looking to entice a tenured PEO sales professional with a high production track record, we have found that that the residual model wins out. It takes a consultative business development professional with a high business acumen to drive optimal results when selling the PEO model. This mindset will normally gravitate towards long-term business solutions, which align well with the residual model. The issue that PEOs face is when a performer begins to have a decline in new business due to the fact that they have somewhat guaranteed income due to the residual model. Therefore, we’ve created a solution to address this and still provide a high performer the ability to create a career pathway that is desirable and lucrative for both parties.

The Hybrid Model

The hybrid model is a residual model with annual production requisites. The model acts like a residual model, but has a built in annual production requirements to ensure the level of payout for the following year. If a sales professional hits the annual production requirement, their following year is paid out at the normal residual percentage. If they miss the requirements, their following year is paid out at a reduced percentage and remains at a reduction until the minimum threshold is met the following year. This model allows the sales professional to drive continual increase based on performance and carries all of the perks of a residual model but protects the employer from lack of future production with a tenured sales professional.

Example:

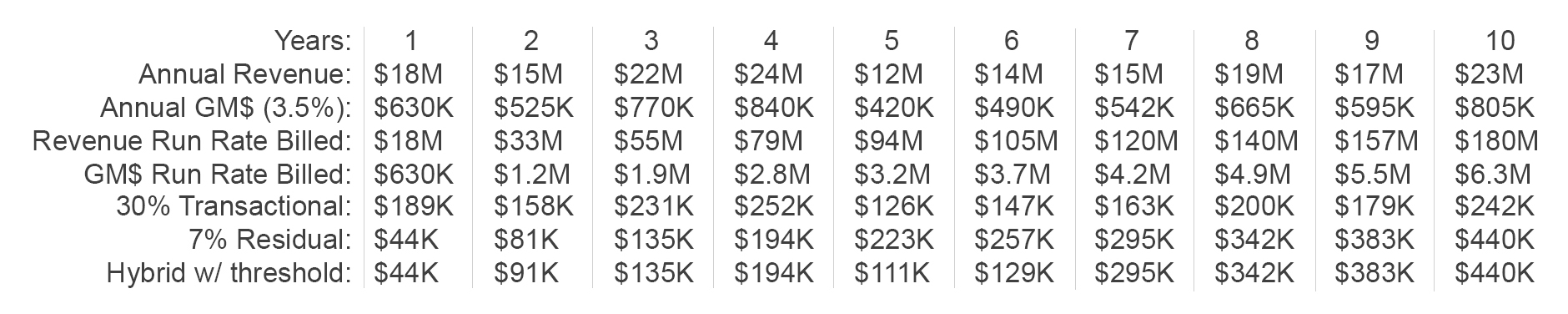

For this example: we will contrast these three models: Transactional, Residual, Hybrid. As you will note from the below example grid, the transactional model carries a payout of 30% annually on all new business. The residual model pays out at 7% on new and renewal business. The hybrid model pays out at 7% on new and renewal business, providing that the sales reps sells at least $15MM in new business revenue annually. Under the hybrid model, if the sales rep does not produce at least $15MM in new business revenue in a year, then their following year and residual commissions drop to 3.5%. Their commission will remain at the lower rate until they exceed the threshold in a year, at which point they will return to the 7% commissionable percentage.

The above numbers are rounded. Total spend on commissions per option equate to the following % of the 10 years of GM$: Transactional 5.51%, Residual 7%, Hybrid 6.30%.

As you will note above, the hybrid model enables a company to offer the benefits of a residual model while still protecting against declining productivity. Over the course of 10 years, the variance in company payout towards commissions is not drastic. Choose the model that best fits your organization and will help stimulate your workforce towards optimal productivity.