Economic Changes are Coming

In June of 2022, I wrote an article titled Economic Meltdown: Is It Coming?. In this article, we reviewed key economic variables to consider when forecasting economic trends. Over a year later, we will revisit many of these key economic variables, to provide Business Owners with insight into coming trends that will effect their business. Understanding economic variables and trending will allow you to protect your business. The trends we will review are as follows:

National

- US Unemployment Trending

- Federal Interest Rate Trending

- Inflation Trending

- Wage Inflation Trending

- Consumer Debt Trending

- Housing Index Trending

- Stock Market Trending

- Business Failure Rate

California

- CA Unemployment Trending

- Workers’ Compensation Trending

Let’s review national trending and then we’ll review a couple of California specific trends at the end. Understanding these key indicators and the direction they are trending will allow you to protect your business.

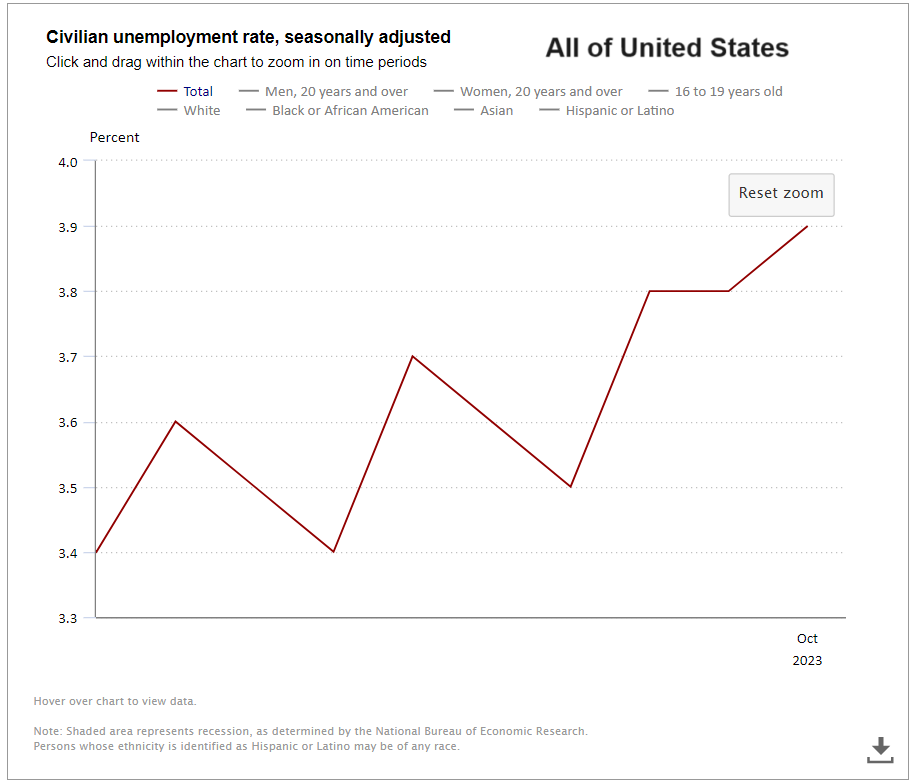

US Unemployment Trending

Unemployment has increased by 15% from 3.4% to 3.9% year to date.

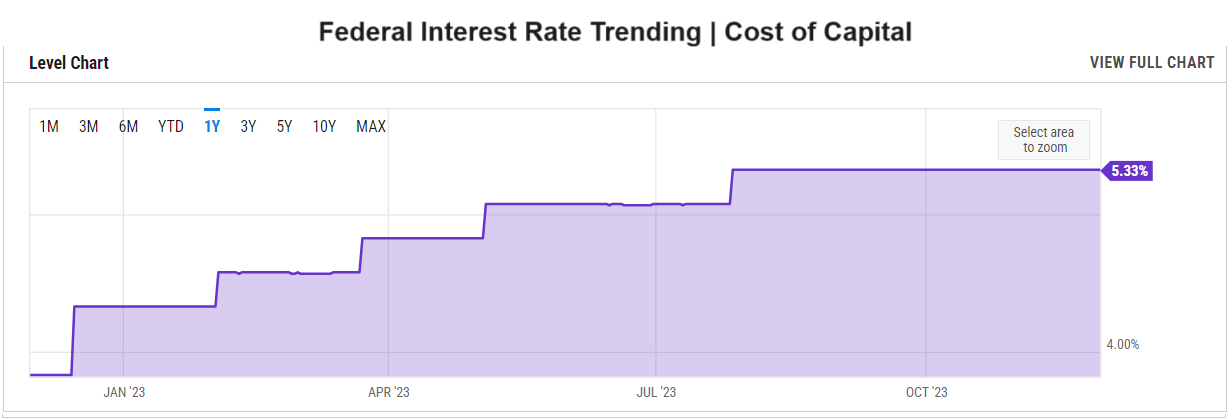

Federal Interest Rates Trending

Federal interest rates have increased by 25% from 4.25% to 5.33% year to date.

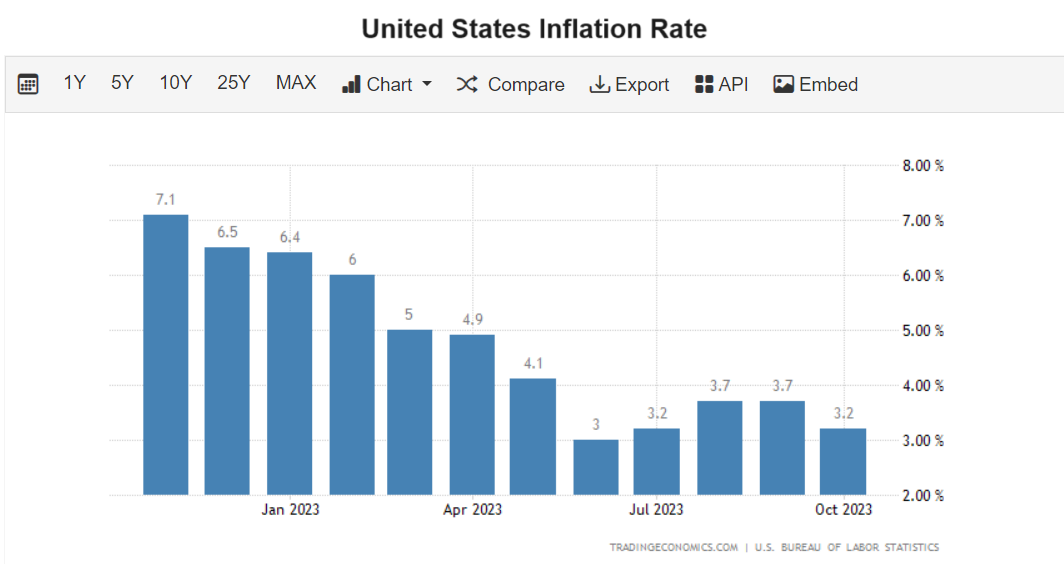

Inflation Trending

Inflation has lowered to 3.2%, but is still at elevated levels.

Wage Inflation

Wage inflation reduced in 2023 but is showing an upward trend in recent months.

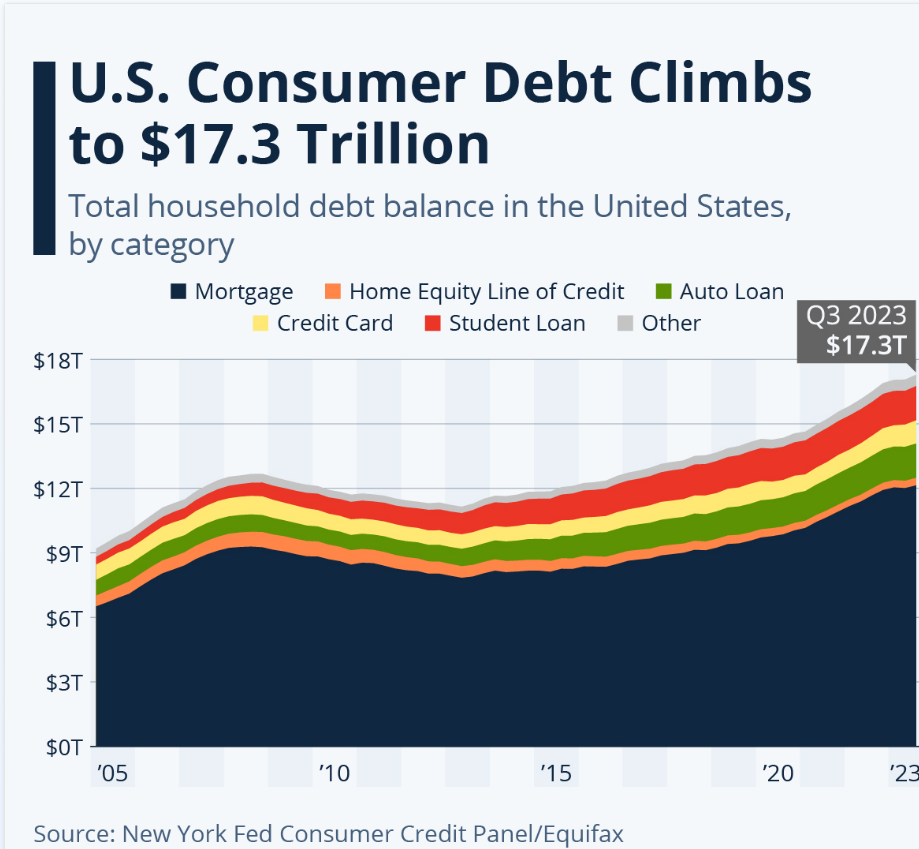

Consumer Debt Trending

Consumer debt continues to climb, and as of Q3 2023 is at $17.3 trillion.

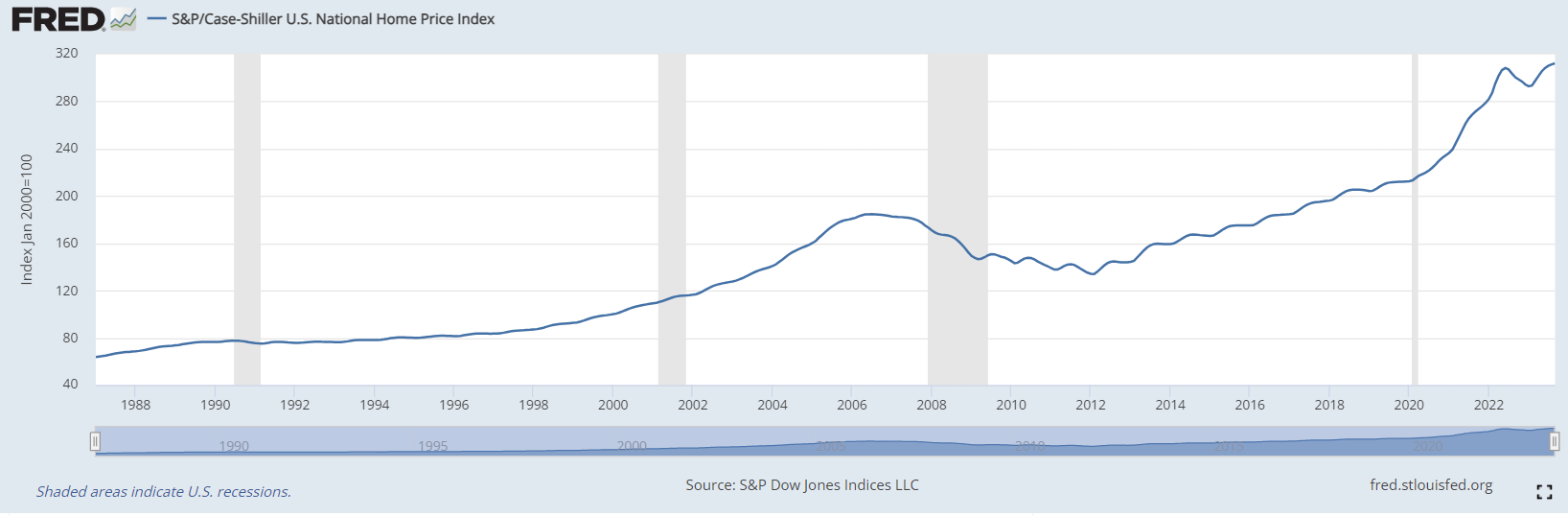

Housing Index Trending

Housing prices continue to climb and are at an all time high.

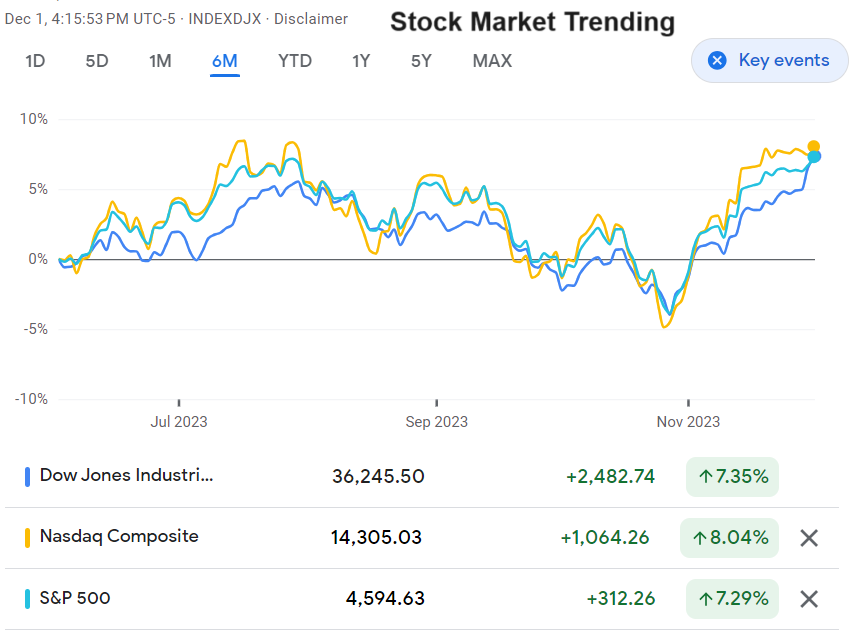

Stock Market Trending

The stock market thus far has remained on an incline. Once this trend flips, it will impact other economic variables.

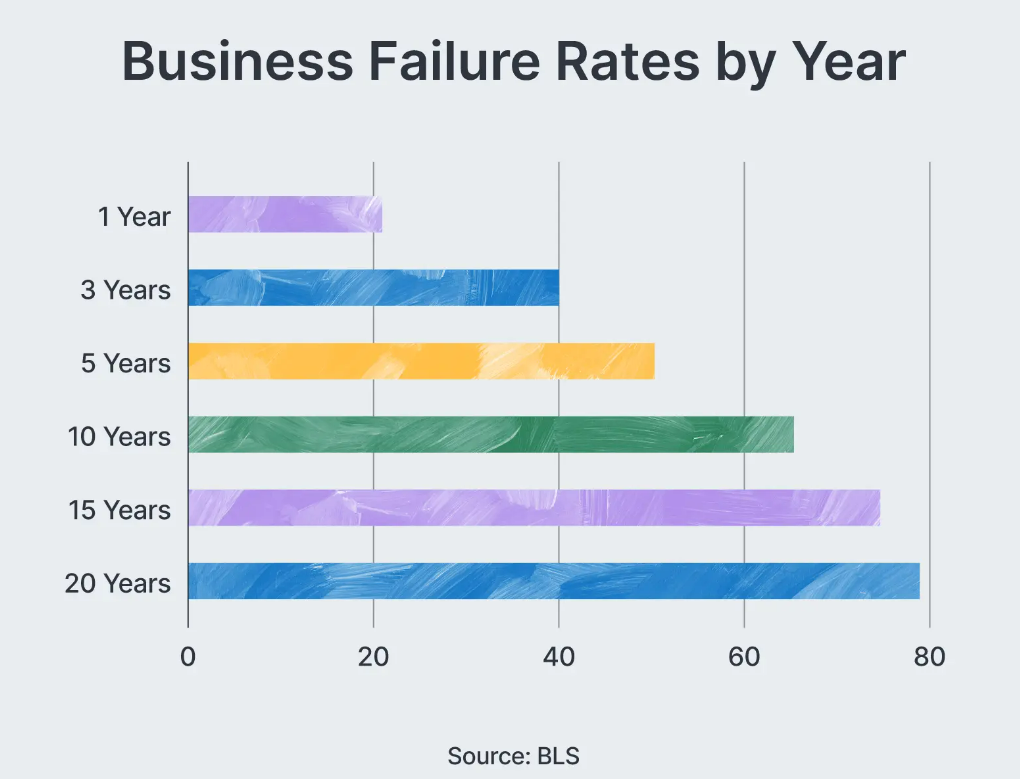

Business Failure Rate

Business failure rates climb with the tenure of business as noted below.

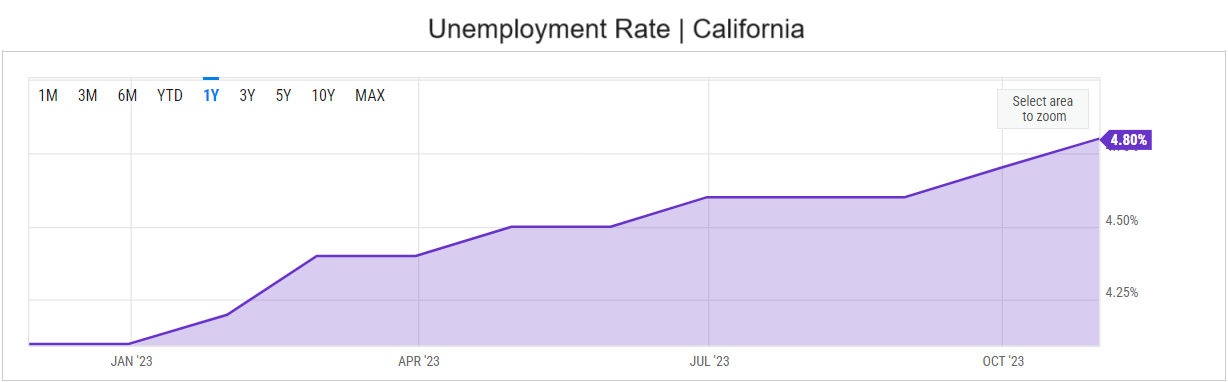

California Unemployment Trending

California unemployment rate is outpacing the Nation.

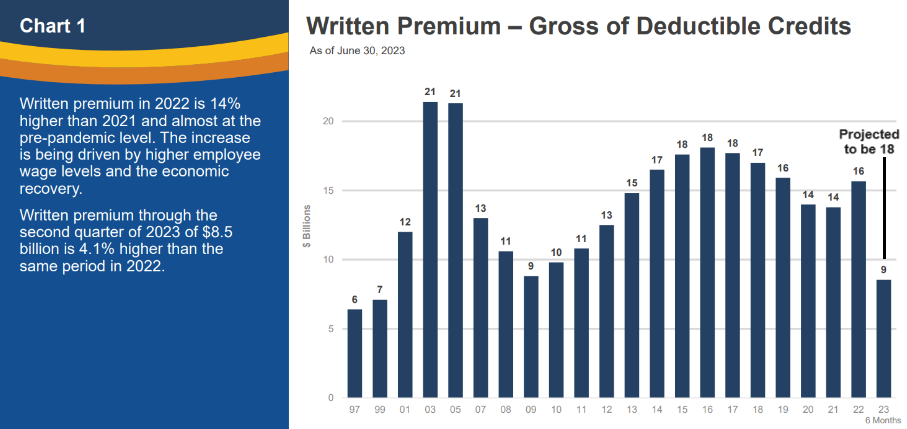

California Written WC Premium Trending

California written premium is climbing. While the DOI isn’t raising rates, wage inflation has moved premiums up materially. For more information on this, read our article about wage inflation’s impact on California WC premium by clicking here.

What is a Business Owner Currently Facing?

Businesses currently have to deal with the following:

- Continuously increasing interest rates which impact the cost of borrowing capital negatively.

- Higher COGS due to inflation, which impact profitability.

- Higher Wage Trending and Employee Burden Rates from insurances (Benefits, Ancillary, WC,) and taxes.

- Increased WC premium levels.

- Higher business failure rates.

What are Employees Currently Facing?

Employees currently have to deal with the following:

- Higher cost of goods.

- Increasing consumer debt.

- Higher interest rates for borrowing and mortgages.

- Higher housing pricing, both purchases and rentals.

- Increasing unemployment.

The Current Economic Model is NOT Sustainable

With personal debt increasing, the cost of capital increasing through higher interest rates, higher cost of goods for businesses and the population, higher housing costs, continuous inflation, and increasing unemployment, our economy is a powder keg in my opinion. The stock market has held steady for the time being. Once that dips, people’s retirement income will drop, business valuations will drop, cash concerns will present for business and people, layoffs will increase, and wage inflation will halt. With the cost of capital being expensive and people already in debt, the housing market and goods costs should drop (how far remains to be seen).

The government can combat this by dropping interest rates and/or higher defense or infrastructure spending to create jobs and stimulate the economy, but that will drive our national debt even higher. If the dollar weakens and/or begins to lose its position as the premier global currency, foreign cost of goods could increase. Businesses that procure goods and raw materials from abroad will be faced with inclining costs. Domestically, people and businesses will already be strapped for cash due to the aforementioned reasons earlier in this paragraph, and they will not have the excess cash to pay higher prices from a weakening dollar.

Please keep in mind that this information is solely the opinion of this author and is not to be construed as investment advice. I encourage you to review the variables for yourself. Protect your business and make strategic preparations for various economic scenarios.

Author

Rob Comeau is the Founder of NPG, CEO of Business Resource Center, Partner of ESG and Halcyon HR, and serves in various board positions. Comeau received his MBA within the Presidents and Key Executives Program from Graziadio Business School at Pepperdine University. Comeau consults with private sector businesses, publicly traded companies, investment firms, and private equity. To reach Rob directly, email him at rob.comeau@biz-rc.com.