PEO Industry Statistics

Updated, 2017

A recent industry report was released on the PEO industry with updated statistics through 2016. This article is a snapshot of the highlights contained within that report followed by author commentary.

Fast Facts

The PEO industry gross revenue for 2016 was $168.3bn, of which $145.4bn represented work site employee (WSE) wages. This equates to an average PEO client markup of 15.75%. Profit for the PEO industry in 2016 was $1.5bn. The annual growth rate for 2012 through 2017 in the industry was listed at 8.7% and is projected to grow by 2.6% annually from 2017 through 2022. [1]

Industry Structure

According to the report, it states that the industry life cycle stage is growth with revenue volatility being medium. Regulation is medium within the industry and barriers to entry are also considered medium. Competition levels are considered high and industry globalization is low. [2]

Historic Industry Growth

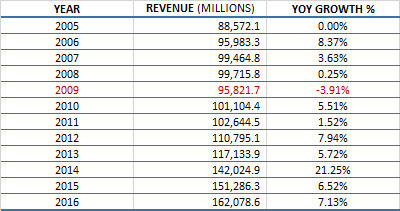

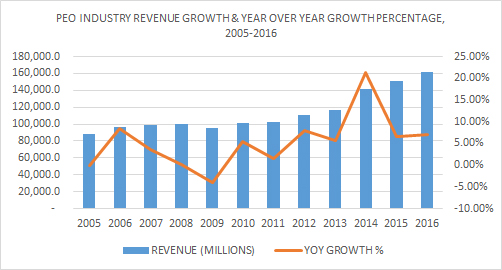

Figure 1 illustrates the PEO industry growth from 2005 through 2016. As noted, 2009 was the only negative growth year. [3] This represents a compound annual growth rate (CAGR) of 5.65% from 2005 through 2016. Figure 2 illustrates the industry’s growth by gross revenue with a year over year growth percentage overlay.

Figure 1

Figure 2

Projected Growth Rate

The report projects that the industry gross revenue will grow over the next five years by an annualized rate of 2.6% to $191.0bn in 2022. [4]

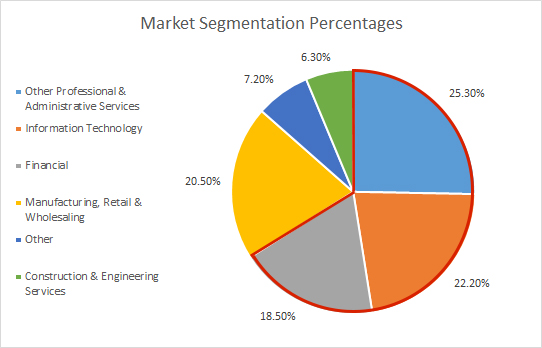

Market Segmentation

The market segmentation in the report shows the industry is roughly 2/3 white collar focused as illustrated in figure 3.

Figure 3

Industry Leaders

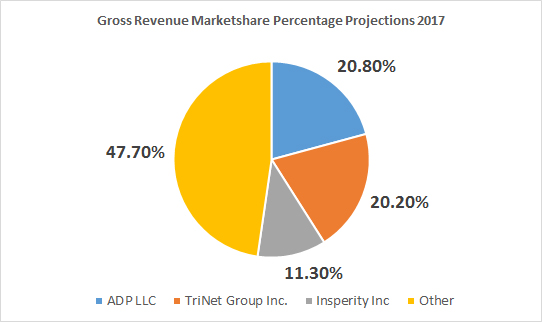

The industry report states that the PEO market is currently dominated by three major players; ADP Totalsource, TriNet and Insperity which which it projects for 2017 will have gross revenue market share percentages of 20.8%, 20.2% and 11.3% respectively as noted in figure 4. [5]

Figure 4

Opinion/Commentary

The data in this article was pulled from the IBISWorld Industry Report 56133, Professional Employer Organizations in the United States. The below commentary is solely the opinion of the blog author; Rob Comeau, with respect to the aforementioned data in the above article.

Market Leaders: The IBISWorld report market share is based on gross revenue projections for 2017 which shows ADP and TriNet as much larger than Insperity. However, on a net revenue basis (gross revenue less WSE payroll) as in accordance with GAAP, you’ll note that the three are much more similar in size. These three having more similar net revenues and largely different gross revenues is likely achieved via Insperity commanding higher pricing than the others.

Major Players: According to IBISWorld, over half the market’s gross revenue is controlled by the top 3 players; ADP Totalsource, TriNet and Insperity with the remaining 47.7% controlled by the rest of the field.

I believe this metric is more drastic than illustrated in the IBISWorld report. Oasis (private) is a massive player in the PEO space and one of the market leaders along with ADP, TriNet and Insperity. Other PEOs of size that weren’t mentioned in their report were BBSI (public), CoAdvantage (private), PEMCO (private), Paychex (public) and G&A Partners (private) to name a few. These additional PEOs coupled with a few others would likely further skew the market share imbalance toward larger players controlling the vast majority of the market in 2017.

Industry Growth Projections: IBISWorld projects the industry to grow at an annualized rate of 2.6% from 2017 through 2022. I believe, barring any major economic downshifts over the next five years, that the industry will grow at a slightly higher clip.

The basis for my position is outlined below:

- A current robust economy (time will tell if the economy continues to flourish)

- Increased growth in the higher wage white collar segment (assuming sales trajectories remain the same, an increased emphasis on higher avg WSE wage business will likely help increase gross revenues)

- Expected increases in minimum wage (19 States increased minimum wage in 2017, including CA, MA, NY, NJ, FL & MI).

- Increased industry recognition resulting from the SBEA and CPEO

- Increased market penetration from major and emerging players

- The potential for regulatory compliance changes if a new government healthcare mandate is enacted. (historically there was a spike in revenue within the PEO industry when ACA compliance was mandated, this could potentially happen again)

- Low unemployment which protects against existing client base WSE headcount reductions (during the great recession, PEOs experienced a reduction in same store sales due to client WSE layoffs, hours reduced and wage reductions. When unemployment is low, the existing client base headcount should be more predictable than in a volatile economy which helps protect the existing revenue base).

Segmentation: IBISWorld believes that more growth will occur in the white collar client segment than the blue collar segment. They attribute this to manufacturing being outsourced abroad. Larger PEOs have seemed to increase their focus on white collar business in recent years. Historically, the three main components of a white collar PEO offering are HR, Tech and Health Benefits. If this trend continues, the reform of healthcare from the US Government could further affect the industry revenue depending on the regulatory impact and compliance requirements for small and medium sized businesses (SMBs).

[1]IBISWorld Industry Report 56133, Professional Employer Organizations in the United States

[2] IBISWorld Industry Report 56133, Professional Employer Organizations in the United States

[3] IBISWorld Industry Report 56133, Professional Employer Organizations in the United States

[4] IBISWorld Industry Report 56133, Professional Employer Organizations in the United States

[5] IBISWorld Industry Report 56133, Professional Employer Organizations in the United States

Author: Rob Comeau is the CEO of Business Resource Center, Inc., a management consulting and M&A advisory firm to the PEO industry.