PEO Valuation & Contributing Variables

If you own a PEO, at some point you have likely asked yourself: What is my PEO worth? In this article we will explore some variables that will help you determine how the valuation process works and what you can do to improve your odds of securing a more favorable price upon your exit.

Common Valuation Method – PEO

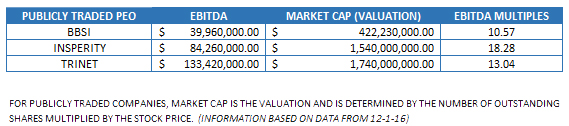

The most common method of valuation in the PEO space is a multiple of EBITDA (earnings before interest, taxes, depreciation and amortization). Many PEO owners want to know what the multiples are for a PEO of their size. While size is definitely an important factor, it is not the only area that can impact your multiples. Before we jump into these other factors, let’s take a quick look at three publicly traded PEOs to identify what their EBITDA multiples are.

Publicly Traded PEO Multiples

The three examples we used were Barrett Business Services, Inc. (NASDAQ:BBSI), Insperity (NYSE:NSP) and TriNet (NYSE:TNET). We used these and not others as these three are for the most part, purely PEO business which made it easier to not have to back out PEO business from other business segments as would be the case with ADP TotalSource or Paychex HR Solutions.

With a publicly traded company, the valuation has already been determined by the market cap. The market cap (or current valuation) is a simple formula to grasp. Take the stock price, multiplied by the shares outstanding and you will have the market cap.

In the below example, you will find the EBITDA and Market Cap per example company. Simply take the market cap divided by the EBITDA to receive the EBITDA multiple

Non-Publicly Traded PEO

With publicly traded companies the process is simple enough. However, when a private PEO’s valuation isn’t determined by the market cap, how do you determine your valuation range prior to going to market? What multiples can you expect? Also, what are the variables that can support or detract from your sale price when exiting the business? These are the areas that we will explore at a high level in the remainder of this article.

Multiple Determination

The most common information I see on multiple ranges is based on the PEO size or WSE count. While this is certainly a main contributing factor, it is not the only factor. Often, buyers and sellers will look at comps to help determine a proper range. Think of selling your house and the realtor pulling comps for your neighborhood based on square footage. However, with a PEO, like a house, other contributing factors play a role in determining your valuation (upgrades, location, length of time in existence, etc.) We’ll explore some of the variables below.

EBITDA

First off, why is the multiple often based on EBITDA? A good rationale of using EBITDA is explained by www.investopedia.com.

“EBITDA is essentially net income with interest, taxes, depreciation and amortization added back to it. EBITDA can be used to analyze and compare profitability between companies and industries because it eliminates the effects of financing and accounting decisions.”

Therefore, many investors believe that EBITDA is a more true sense of the PEO’s profitability.

EBITDA to Sales Ratio

A recommendation is that you look at your EBITDA as a percentage of Revenue or Sales. The EBITDA to Sales Ratio allows an investor to see how much profit is generated from revenue driven. If your PEO is generating more EBITDA per Sales Dollar, your PEO may be worth more money as you are able to generate more profit than competitors. However, be careful not to only use this ratio as a standalone tool. Many companies have tried to slash overhead prior to a transaction in order to make their EBITA to Sales Ratio more impressive. A proper due diligence team will flush this out and you won’t receive the benefit you may expect. Additionally, running too thin in order to bolster your EBITDA to Sales Ratio likely won’t help your cause either. When a PEO runs too thinly, service often suffers which equates to a lower client retention rate. When we have done due diligence projects in the past, if a company has a preferable EBITDA to Sales Ratio but poor client retention, it is an indicator that they are running too thin with their staff.

Value Proposition

For most investors, the simple question of “what problem does your company solve” is an important factor in buying a company or investing capital. You and your team should be prepared to answer this question concisely and accurately. What value does your PEO offer and what problems does that value solve for your existing and perspective clientele? Again, during the due diligence, we will cross reference the illustrated value proposition with other factors. If the PEO’s value proposition is favorable, that should be reflected in a high client retention, propensity for organic growth and favorable margins. Basically, if your value prop is good, you will keep your clients, grow more quickly and be able to charge a premium (higher margins).

Revenue Growth Trending

You may know that the PEO industry is a consolidating market with larger players buying up regional PEOs. While an acquisition costs money, it comes with the benefits of increased size, expanded geography and increased offering variables for the acquiring PEO. Additionally, the acquiring PEO should be able to recognize synergies post assimilation which will increase EBITDA. This is all expected with acquisition growth.

However, if you are selling your PEO, the focus will likely be on your organic growth (unless you’ve made acquisitions prior to sale). Unfortunately, it is not uncommon when reviewing an acquisition target to view a pro form that has the hockey stick affect with projections.

A solid historic organic growth trend will justify future growth projections. If a historic favorable trend does not exist yet the PEO growth projections skyrocket, there better be justification to the projections. Even if the justification is determined valid, not having some uptick in revenue as a result of the change may cause doubt in an investor’s mind.

Insurance Platform Affects

There are two ways that insurance programs are often viewed. 1) As a price competitive vehicle to achieve higher margins, and 2) as a liability through risk baring programs with future claims inflation. A risk baring platform, be it with workers’ compensation or health insurance will provide the PEO with the ability to offset some administrative fees and remain more market competitive. Additionally, since the PEO is paying cents on the dollar due to the high deductible program, an opportunity for increased margin is present for PEOs that properly mitigate claims and reduce risk. The flip side is true as well with risk baring insurance platforms. If a company poorly underwrites and/or mitigates claims, a tail can negatively impact the PEO’s profitability for the quarter, year or greater. A risk baring platform isn’t a deterrent for buyers. Poor claims trending is.

Workers’ Compensation vs. Health Insurance

Which is more risky? While many of the investors I speak with gravitate towards believing health benefits may be the safer bet, I would suggest otherwise. I personally believe that it is easier to mitigate risk through appropriate workplace safety programs and control the work environment than it is to make people change their lifestyle on their own time. However, regardless of which camp you are in, appropriate underwriting coupled with a proactive approach to claims mitigation with a superior track record of positive returns on your insurance platform will bode well for your sales price. Negative trending will hurt your sales price.

Executive Team

Often, a PEO’s Sr. Executive Team is part of the discussions and negotiations of a potential transaction. Whomever is placed under the umbrella (those that are allowed to know about the potential transaction), will be evaluated by the buyer. This is especially true if some or all of the executives are to remain post-closing. While an earn out is typically tied to the purchase price, the buyer may be evaluating the team’s impact beyond the 3 to 5 year payout schedule. An executive team that can effectively communicated in harmony, the direction, value proposition, financials and innerworking of the organization benefit the seller. A poorly run or disjointed executive team is generally a precursor that additional problems have permeated throughout the organization. As the old saying goes “A fish rots from the head down.”

Service Model

A big question from a buyer whom is already in the PEO space, be it a larger PEO or a private equity with an existing PEO in their portfolio is; “will this target align with our current operations, future initiatives and what we are trying to achieve as a whole?” If a PEO’s service model is unorthodox, it can hurt your sales value unless great synergies post acquisition exist. If your service model is cutting edge, strategic or malleable to the acquiring entity, it can benefit the sale of your PEO.

A service model often supports the risk baring factors of a PEO. This is either by design or out of necessity. For example; a PEO that focuses on a superior health insurance platform generally goes after high wage, white collar business. This means that the tech platform the PEO utilizes may be more important to their model than a blue collar focused PEO. Also, health benefits centric PEOs often have a higher focus on HR consultation whereas it may be more important for a blue collar centric PEO to have a greater emphasis on Risk Management services to protect their workers’ compensation risk. Most PEOs have both Safety and HR offerings but the emphasis is generally determined by the risk the PEO encounters with insurance liability.

Another differentiation in service models is the high tech vs. hi touch difference. While most PEOs have a combination of each, the emphasis can determine the PEO’s ability to scale. Example: a high touch, consultative PEO requires local service professionals to service the accounts. This means that if the PEO is to organically expand geographically, it requires local personnel at the new locations. A high touch PEO may court higher retention rates due to the quality of their deliverable platform but may be required to scale and expand at a slower pace than a high tech model. A high tech model has the ability to essentially expand overnight if they utilize a remote service model. Example: a PEO that utilizes an online tech model with a call center support service team, assuming they are able to write insurance in all 50 States, can service a National book of business from one location. This means that if the PEO is licensed in a State and has insurance coverage there, they can begin driving a book of business the next day. The high touch model would require time to set up operations in any State they decided to do business in. A high tech model, if not coupled with price efficiency and phenomenal remote support, could expand more quickly geographically but could suffer a lower client retention rate.

Go-To-Market Strategy

Some of my other articles in this blog cover the contrast between direct sales and channel sales so I won’t belabor the point. However, at a high level, the method a PEO utilizes may determine the propensity for a higher growth rate. For example, a PEO that only uses a direct sales force will achieve a greater profit per sale but there are downsides. The PEO’s sales force has a smaller reach unless the PEO hires a lot of sales people. If the PEO hires a lot of sales people, there is natural attrition during the validation period. If a PEO utilizes a channel partner strategy, its reach grows exponentially due to the fact that a PEO sales person can work with hundreds of referral partners. The downside is the reduction in profit per account to pay referral partner commissions and the potential for the channel partners to negatively brand the PEO by providing misinformation. A hybrid of direct and channel is suggested so that the PEO has a greater reach, isn’t dependent solely on once strategy and can effectively manage the channel partners while reducing the necessity for a ton of internal sales professionals thus reducing the validation curve attrition issues.

If you are interested in learning more on this subject, please click here. For information on compensation structures and the impact to your PEO on direct or channel sales, please click here.

Outliers

Legal and Tax. These are potential deal killers if serious enough. A PEO that has run into tax or legal issues can deter buyers from completing a transaction. Due diligence teams will flush out issues, so if issues exist, be transparent. Don’t waste your time keeping a skeleton in the closet that will pop out right before closing. If issues are present, be prepared to speak to these issues accurately. Do PEOs get sued? Yes, sometimes they do. Are the reason(s) they got sued valid? Sometimes yes, sometimes no. Taxes shouldn’t be an issue unless the PEO has mismanaged its processes or is an unethical entity. However, if previous tax issues have existed, explain what controls have been put in place to mitigate these issues from ever happening again. The bottom line is to be prepared to accurately speak to any outliers that could kill the deal.

Competition of Buyers

If you went to an auction and there was only one buyer, he or she would determine the price of each item. If there were multiple buyers, the price would be determined on the quality of the item plus the demand and willingness to pay a premium. Competition breeds better results. Think of it this way. If your PEO was quoting a desirable account with no competition, your pricing would need to be suitable but there would be no driving force for your PEO to make reductions. If there were multiple PEOs vying for the same piece of business, the competition would result in a better price for the buyer. With acquisitions, the same principals apply but instead of the purchase price going down, it often goes up. Multiple qualified buyers bidding for your PEO will often result in a higher purchase price for your exit.

Timing of Profit

Simply put, sellers want to maximize their profit at the time of sales, buyer want to maximize their ROI post acquisition. This means that if a PEO is successful in all of the areas mentioned in this article and courts multiple buyers, they will receive a higher purchase price. Since the PEO has been successful in all of the aforementioned areas of this article, the buyer believes that the target has a propensity to drive future profit thus providing a component for maximizing their Return on Investment (ROI).

Financials

Know your financials. Owner your P&L, balance sheet and statement of cash flows. The PEO model can offer an excellent platform to generate cash flow from operations. Attrition and the insurance liability factor are the bleed points to generating cash. Your balance sheet will be a good indicator for your spending and efficiency. The Dupont Formula may be a good place to start in order to identify where your PEO can work on driving a better return on equity which ultimately will help drive a greater valuation. I also recommend that prior to a sales, review your multi-year financials both horizontally and vertically. Example, profit increased year over year (horizontal evaluation) but profit as a percent of revenue decreased during the same year over year time period (vertical evaluation). Buyers will likely look at your financials in this manner and your executive team should be prepared to discuss why your financials are trending in the direction they are.

Closing

While there are other topics that we could continue to cover on this subject, hopefully the information shared will provide some insight into areas of focus for increasing your PEO’s valuation. If you are looking for EBITDA multiple ranges based on WSE size, there are plenty of articles and firms that you can tap into for this type of information. Investment bankers active in the space are a good resource for historic multiples, though the good firms will want to evaluate your PEO prior to committing to a range and rightly so. The point of this article is to show PEO owners that size is not the only contributing factor to expected EBITDA multiples or a PEO valuation. Ultimately, the PEO that doesn’t need to sell due to its superior success but chooses to exit will often command higher multiples. The same principal applies to lending. It is often the companies that don’t need the money that qualify for the best lending terms. Therefore, if possible prior to selling, taken inventory of the adjustments your PEO can make to create a more attractive buying opportunity for investors and allow a bit of time for results to show a positive trend.

A couple of parting thoughts; don’t ignore your culture. This is often an overlooked aspect of M&A that can be a blessing or curse with assimilation. Second, your brand is important. It is the story the market tells about your company. A solid and truthful brand will give your PEO “curb appeal” to buyers. Finally, doing appropriate prep work prior to a sale will help uncover areas that need to be addressed before you are in front of a buyer. Think of it this way, when you walk through your house, you don’t see every item wrong with it the way you would if you were walking through the first time you considered the purchase. Additional perspective from an internal task-force, consultant and/or investment banker can help shore up the areas that could reduce the purchase price of your PEO.

Author: Rob Comeau is the CEO of Business Resource Center, Inc. BRCI is a consulting firm to the PEO space and works with private equity firms currently in or looking to enter the PEO space. You may reach BRCI at www.biz-rc.com or (949) 888-6627.