Economic Variables

This isn’t a doomsday article, but rather a quick look at key variables to consider when forecasting economic shifts. Whether you are planning for your personal finances, business future, or both, understanding variables within the economic equation will provide insight into opportunities and threats. This article will review some of the key data points that factor into our economy to provide the reader with increased visibility on trending. From there, you are free to make your own decision on the direction of the economy and subsequent moves you may make to mitigate risk and capitalize on opportunity.

Federal Interest Rates

The Federal Reserve (Fed) is expected to raise interest rates multiple times in 2022 to combat inflation. With the cost of capital increasing, access to cheap capital will begin to diminish. Typical results of this shift are slowed growth and lower volume M&A and multiples.

For more information on Federal Interest Rate predictions, click here.

Last week the Fed hiked the federal funds rate by three-quarters of a percentage point, its largest rate increase since 1994, after official data just a few days earlier showed inflation unexpectedly rose despite expectations it had peaked.

Source: Reuters

Inflation

Inflation is at its highest since 1981. With the rise in cost of goods outpacing wage inflation, debt is likely to increase while spending is likely to decrease. Less spending is counterproductive to a robust economy and higher debt can create risk of default which can adversely affect the economy. In addition to our state of inflation, many goods suppliers are creating artificial supply and demand issues to drive prices. COVID-19 was a perfect case study on market dynamics for goods and service producers such as auto manufacturers and airlines. The result, less autos produced, flight schedules cut, price increases as a result of supply issues. This strategy has not been limited to auto manufactures and airlines.

For more information on inflation, click here and here.

Annual inflation rate in the US unexpectedly accelerated to 8.6% in May of 2022, the highest since December of 1981 and compared to market forecasts of 8.3%.

Source: TradingEconomics

Consumer Debt

Consumer debt is breaking $16T. Moreover, the rate of increase in consumer debt is at its highest level since 2007 (right before the Great Recession). Paired with inflation, it is likely that consumer debt will continue to increase due to the higher cost of goods. With many citizens in leveraged positions, disposable income is likely to shrink, especially with inflation outpacing wage increases.

For more information on Consumer Debt, click here.

According to the Federal Reserve (Fed), U.S. consumer debt is approaching a record-breaking $16 trillion. Critically, the rate of increase in consumer debt for the fourth quarter of 2021 was also the highest seen since 2007. – Source: Marcus Lu, Visual Capitalist

mARCUS LU, VISUAL CAPITALIST

Business failure rate

Business failure rate by year 5 of starting a new business is 50%. With many new businesses started during COVID, we can expect at least half to not survive the 5-year mark. This means a likely reduction in available jobs and potential increase in unemployment.

For more information on Business Failure Rates, click here.

The percentage of businesses that fail increases to 31.2 percent in the second year and 38.8 percent in the third year. By the fifth year in 2021, the new business failure rate reaches 49.7 percent.

BLS & SHOPIFY

Unemployment

To date, unemployment has remained steady at approximately 3.6%. Rather than see unemployment increase, we’ve experienced the opposite with the “War for Talent” over the last 2 years. However, with many other variables trending in a negative direction, don’t be surprised if unemployment jumps in 2023.

To learn more about Unemployment Trending, click here.

The Great resignation

The “Great Resignation” (while I hate that term), is real. We’ve seen an unprecedented exit from workers which in turn has been a key factor in creating the “War for Talent.” Having mass employees exit, and in turn having companies overpay for talent, does not appear logically to be sustainable. We will likely see adjustments in the coming years from wage and unemployment numbers.

For more information on the Great Resignation, click here.

In 2021, according to the U.S. Bureau of Labor Statistics, over 47 million Americans voluntarily quit their jobs — an unprecedented mass exit from the workforce, spurred on by Covid-19, that is now widely being called the Great Resignation.

HARVARD BUSINESS REVIEW

Wage Trending

Wages have increased and are likely to maintain this trend in the near future. However, with a bear economy looming, access to cheap capital diminishing, and cost of goods on the rise, working capital may shrink at many companies. As a result, they will not have the same levels of dispensable cash to pay higher than market rates for workers. Meaning, we could see wage slippage as unemployment grows.

For more information on Wage Trending, click here.

Housing Price Index

The cost of housing continually increases. While subprime loans are down from their levels pre-Great Recession, we are seeing an emergence of these types of loans increase now that the Fed is hiking interest rates. They may package them under a different title, but they are still greater risk loans. Most real estate professionals are bullish on the housing market. However, if you look at the cost of capital increasing, housing prices are likely to decrease. There is a supply and demand issue currently with inventory, but as the economy dips, distressed sales are likely to increase. I am not bullish on the housing market as it is drastically higher than it was in 2006. It is not sustainable in my opinion. The average person cares about their monthly payment amount, and with everything else costing more due to inflation, and with people in debt, their ability to afford higher housing payments will diminish.

For more information on the Housing Price Index, click here.

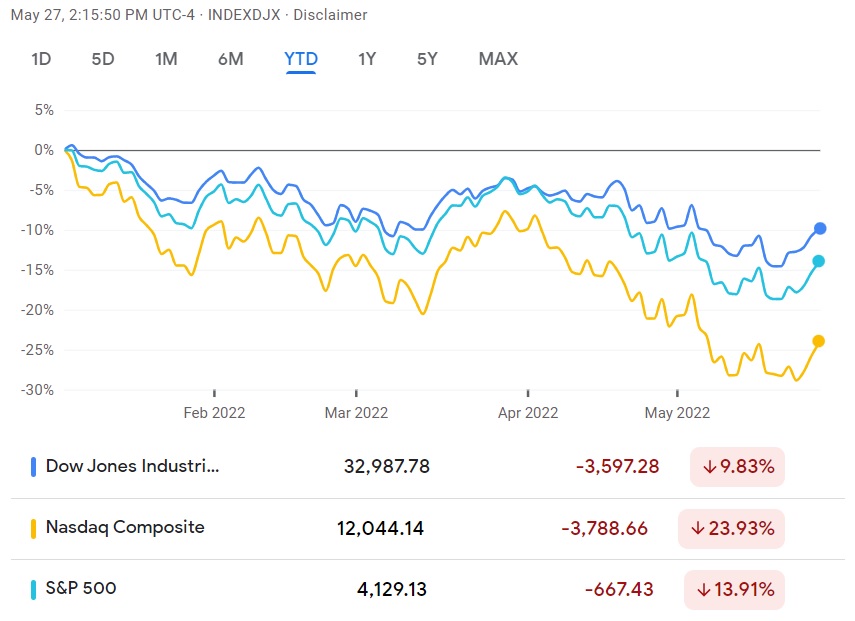

Stock Market

As you will note in the charts below, major markets are slipping (as is Crypto if you invest in that direction). As markets slip, so do people’s retirement amounts. While a bear-market may only last a few years, when it is combined with other negative economic factors, it can prove harder on people and businesses than if it was an isolated scenario. See Figure 1 for YTD trending with the Dow, NASDAQ, and S&P 500.

Figure 1

Conclusion

Typically, this is where I insert my opinion on the variables discussed within this article. However, as I stated in the beginning of the article, I will present some of the key variables in the equation, and you come to your own conclusions.

Regardless of which side you fall on this matter (bullish or bearish), it is advisable that you prepare personally and with your business. Being ahead of the curve will position you in the best possible position to capitalize on shifts.

Author

Rob Comeau is the CEO of Business Resource Center, Inc., a business consulting and buy-side M&A advisory firm. To learn more about Business Resource Center, and our consultative offering, visit us at www.biz-rc.com.