WC Trending Update: CA

It is no secret to business owners that premiums have been on the rise in California. The question is, do they know why? More importantly, do they know where they can make an impact in reducing claims exposure and by extension, premium spent?

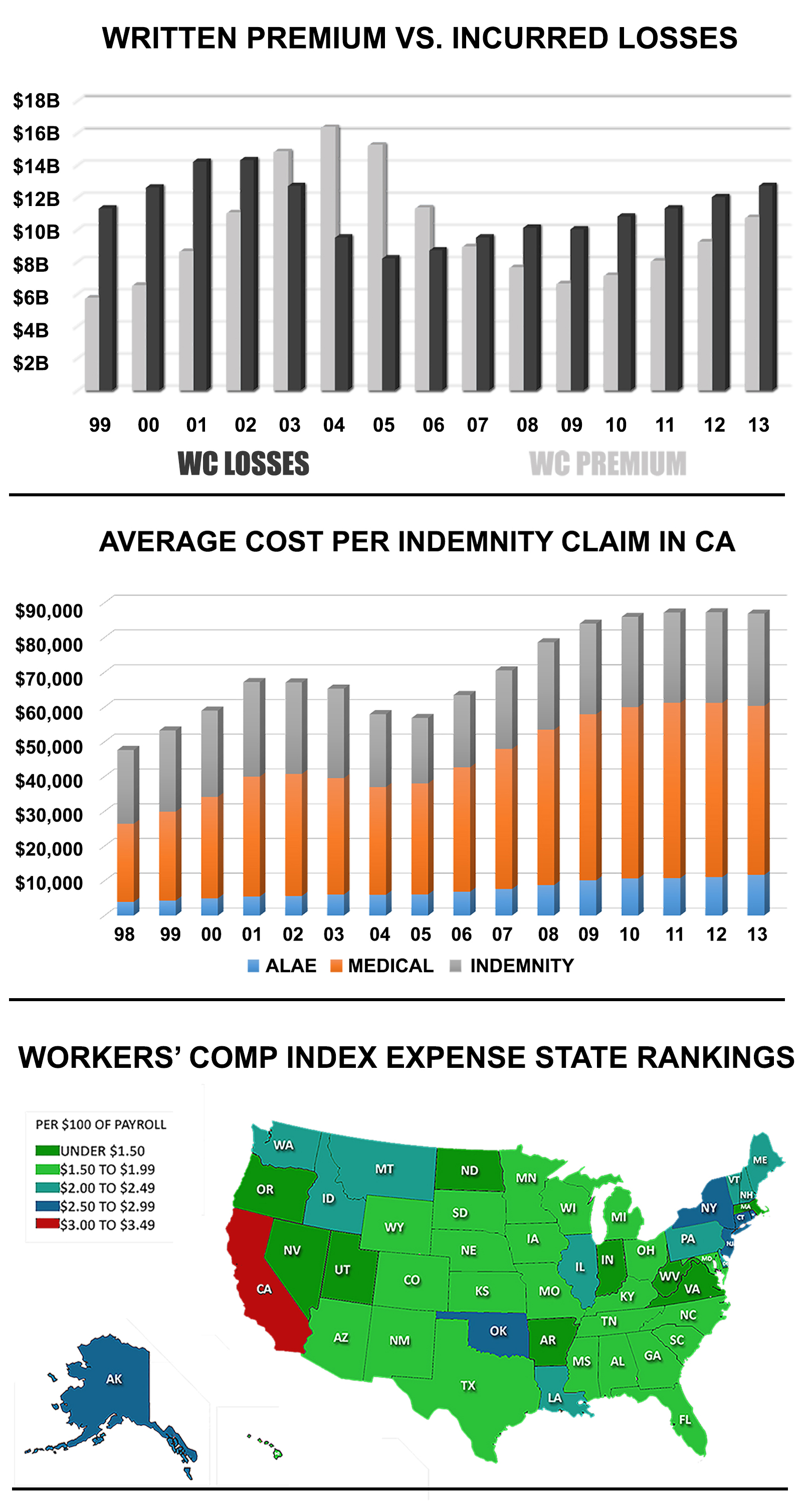

California is ranked the most costly in the United States for workers’ compensation expenses. The system, even with recent reformations, is consistently facing litigation from applicant attorneys against insurance carriers. The increased cost factors to manage claims in California is ultimately passed on to employers in the form of premium increases.

Many business owners feel that alleged fraudulent claims are rampant. One fact that needs to be brought to a business owner or hiring manager’s attention: you don’t have an alleged fraudulent claimant until you hire one. This is why the claims mitigation process should begin with a strict and appropriate on-boarding and vetting process. Some areas, aside from the interview process, that will play a part in reducing bad hires are in the form of pre-employment: background checks, drug screens, physicals and thorough reference checks.

Phase two for ultimately reducing claims exposure is training coupled with accountability and reward programs. You cannot expect an employee to know how to do something appropriately unless trained (with documentation). Once trained, it is essential to have an appropriate chain of command and accountability. The accountability needs to be saddled with a reward based system to balance out the approach. Using only one or the other will be a short lived process and not create a sustainable safety culture needed to mitigate exposure and premium expense inclination.

Phase three is the claims management process. Return to work, light duty programs are pivotal. Not only do they help keep claims from becoming a loss time claim which will push up your reserves, but statistically the injured employee returns to full duty more quickly than when a RTW program is not in place. Communication with an injured employee is very important as well. A percentage of claims filed are immediately litigated. However, the litigation percentage increases on claims that start out through the normal process but eventually go litigated due to lack of communication between company stakeholders and the injured worker.

As I have said before, your workforce is an investment. On the productivity side, this means optimizing your workforce to peak production for a greater yield per position and rewarding them accordingly. However, on the claims side of the coin, not only does an injured worker, that is not on modified duty, equate to no production, but if this employee goes litigated, your company will experience a premium increase lasting 3 years.

Taking care of these employees, ensuring they have appropriate care, instituting a proper RTW program and fostering superior communication lines will benefit your injured worker and your company’s bottom-line.

The statistical information contained in this article was obtained from the insurers’ experience reports at www.wcirb.com