How to Build a Business Model Framework

Creating a business model can be a misunderstood process. Often, the business models I’ve reviewed are overly convoluted and lack continuity. This article will provide a high level step by step guide in creating a business model and conducting a business analysis.

Business Model Creation

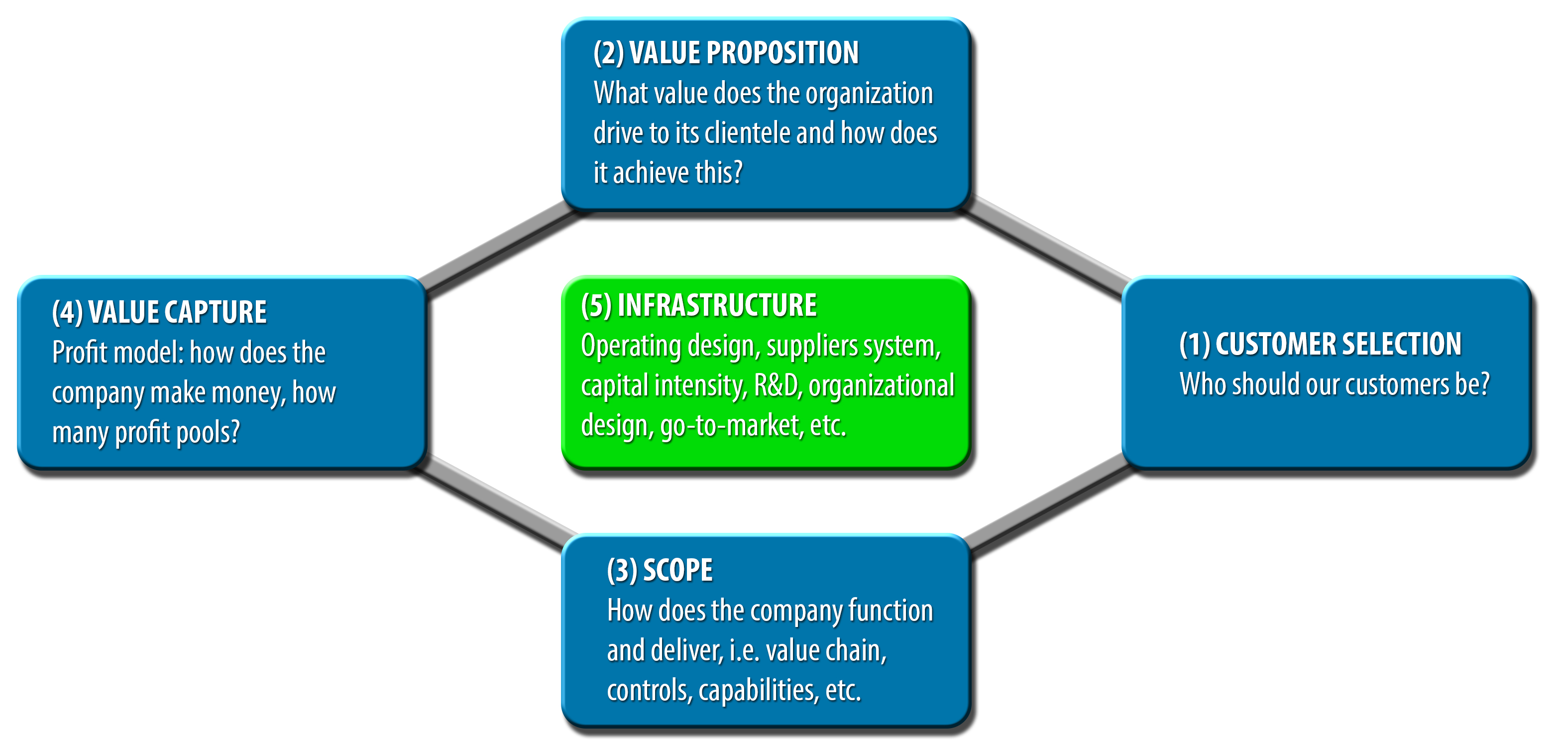

There are five elements for creating the framework of a business model.

- Customer Selection

- Value Proposition

- Scope

- Value Capture

- Infrastructure

Customer Selection

Until a company knows who their customers are, creating a plan is useless. A new or pivoting organization should review who its core customer base will be. The company should also pay attention to the fringe and identify potential customers for the future. These potential customers may come from the segment your industry services or outside of the industry’s current client segmentation.

Value Proposition

Once the target and ancillary client segments have been identified, the next step is to create a value proposition that drives value to this customer base. This value proposition should support and drive value in accordance with the company’s perspective clientele requisites.

Scope

Scope refers to how the company will execute upon its value proposition. In other words, how will the organization deliver the proposed value to its clientele? The scope includes the personnel, tools, resources and delivery method of executing the value proposition.

Value Capture

The value capture is how the organization makes money. How does the company monetize its offering? How many perspective profit pools does the company have? Where does the company price its various offerings? Does the pricing model have elasticity? Is the company pricing off what market competition sets as the “standard” or has it done the requisite research to better price its deliverable?

Infrastructure

The infrastructure is the supporting framework and functions within the organization to allow it to run appropriately and scale in future growth cycles. The infrastructure should include all functionalities of a business such as finance, HR, IT, etc. The infrastructure (5) should be built to support the delivery of the value proposition (2) through the offering scope (3) in order to satisfy the identified client segmentation (1) and ultimately capture value or profit (4).

Sample Business Model Framework

External/Internal Analysis

SWOT (Strengths, Weaknesses, Opportunities, Threats)

While the acronym SWOT is catchy, it can be dangerous. When an executive team conducts this analysis in the order of S-W-O-T, it runs the risk of skewed analysis. For example, when a team reviews the company’s strengths and weaknesses first, it may view the opportunities and threats in light of the current strengths and weaknesses. This process can be flawed and yield bias results.

OTSW (Opportunities, Threats, Strengths, Weaknesses)

The order of O-T-S-W is advised to gain an unbiased assessment of external and internal variables. When a team reviews the external opportunities and threats first, it may then align the internal strengths and weaknesses appropriately. It is able to view opportunities and threats unfiltered through the company’s current capabilities and allows the team to more accurately augment and align the company to match the opportunities and avoid the threats.

Misconception about Weaknesses

The world we live in today gives us the impression that we should always improve upon our weaknesses. That improvement takes time, resources and money. Prior to such improvement efforts, take a look at the pond the company is fishing in. Is there an area to fish that minimizes the relevance of the organization’s current weaknesses? If so, the company can instead spend that time, resources and money to improve upon its strengths since the company weaknesses are not a pivotal factor based on where the company is operating. Time, resources and money are not in endless supply. An executive team should be wise in where it allocates these resources.

For more information on SWOT vs. OTSW, click here.

Final Thoughts

The framework discussed in this article will provide a starting blueprint for ancillary and supporting information inclusive of value chains, supply chains, pro forma and financial modeling, capital requirements, talent acquisition, etc. While a business plan or investment proposal will include more than what was covered in this article, without a solid understanding of the company’s framework for a business model, the organization runs the risk of a disjointed model.

Once a business model is designed, the executive team may then proceed to develop a strategic intent and plan. Without a business model in place, it is virtually impossible to create an effective strategy.

Author: Rob Comeau is the CEO of Business Resource Center, Inc., a management consulting and M&A advisory firm based in Orange County, California. A special thanks for the teaching of Dr. Kurt Motamedi, Professor of Strategy for Pepperdine University Graziadio School of Business and Management’s Presidents and Key Executives MBA program.