Disclaimer: The following article is solely the opinion of the author and is not based on insider or non-public information. The author is not privileged to insider information and there is no disclosure of information that is not readily available to investors within this article.

Overview

A year ago, I wrote an article commenting on the Paychex and Oasis deal. This article is a brief review of how the company has trended a year since the acquisition.

Stock Trending

Since the announcement and subsequent acquisition of Oasis Outsourcing, PAYX has trended positively with its stock as noted in Figure 1. In our article last year, which can be viewed here, we compared Paychex with ADP. As noted in Figure 2, for the TTM, PAYX has outperformed ADP. Three days prior to the acquisition announcement (11/23/18), PAYX stock closed at $67.26. Today, the stock closed at $84.51. This represents a gain of almost 26% in valuation for the past year.

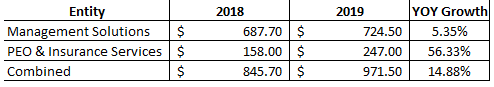

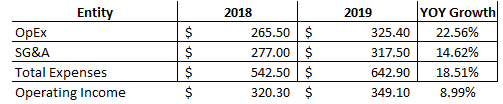

The company has 357.94M outstanding shares. Applied to the price on 11/23/18, that equated to a market cap of $24.075B. Applied to today’s stock price, it equates to a market cap of $30.249B. This represents a valuation increase of $6.174B. While not all of this growth is solely attributed to the acquisition of Oasis, it does appear that the purchase price of $1.2B for Oasis has paid off well in a relatively short amount of time. We reviewed the company’s most recent quarterly statement, by business segment, and noted a much higher growth rate in the PEO business as illustrated in Figure 3. While much of this growth is likely due to the addition of Oasis, it will be interesting to see the growth numbers for the quarter ending August 31st in 2020, to identify organic growth post acquisition. From an expense perspective, expenses grew at a higher clip than revenue year over year for the most recent completed quarter as noted in Figure 4. As a result, operating income grew at a slower rate than revenue growth for the time period.

Figure 1

Figure 2

Figure 3

Figure 4

Employee Reviews (Glassdoor)

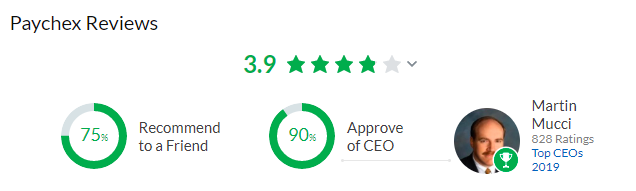

As noted in Figures 5 and 6, the Glassdoor reviews for Paychex and Oasis are both generally positive. However, when we compare the Glassdoor ratings from today with the snapshot we took on 1/18/19 in our article titled Publicly Traded PEO Companies, you will note that there has been some movement at Oasis. Paychex has remained exactly the same from a year ago with a 3.9 star rating, 75% recommend to a friend, and 90% CEO approval rating. Oasis has dipped slightly in all three categories since the acquisition. On 1/18/19, Oasis had a 3.7 star rating, 68% recommend to a friend, and 94% CEO approval rating. Today (12/10/19), the company has a 3.4 star rating, 62% recommend to a friend, and 89% CEO approval rating. Typically, when a company is acquired, there may be some disgruntled employees and a level of culture shock. Time will tell if this slippage trend continues, or if ratings rebound for Oasis.

Figure 5

Figure 6

High-Level Conclusion

From a stock trending perspective, Paychex/Oasis has been a great deal. The stock has posted positive gains for the TTM and is showing no signs of slowing down. The revenue growth for the PEO segment has been impressive year over year at 56.33%. It will be interesting to see what the year over year growth will be for the quarter ending August 31, 2020. That will provide a better indicator for future PEO organic growth at the company. Profit has increased for the combined entity but is slower than revenue growth percentages due to higher year over year OpEx and SG&A costs. Time will tell if expense ratios reduce over time due to synergies realized post acquisition. If expenses do reduce, the company will experience an uptick in profitability which will likely bode well for stock valuation, depending on analysts’ projections.

It appears that there has been a bit of a slip with employee reviews for Oasis, at least according to Glassdoor. Time will tell if this slippage is temporary or indicative of future trending. From an investment perspective, if you bought PAYX stock right after the Oasis Outsourcing Acquisition announcement, you’ve experienced a nice gain year over year. It appears, when we look back at the acquisition one year later, that Paychex made a smart move with the acquisition of Oasis Outsourcing and the company has experienced favorable gains post acquisition.

Author

Rob Comeau is the CEO of Business Resource Center, Inc., a business consulting and M&A advisory firm to the PEO industry.