Overview

I was recently asked for my insight on cyclicality within the PEO industry. Cyclicality may be defined as a business or stock whose income, value, or earnings fluctuate widely according to variations in the economy or the cycle of the seasons. This article will cover the various forms of cyclicality within the PEO industry. The types of cyclicality that will be reviewed will include: economic, seasonal, universal master plan renewal, tax caps and PEO tax rates, and quarterly/annual SMB renewals.

Economic

The economy affects businesses in general. Whether it is a robust economy or a sluggish economy, a bull market or a bear market, businesses must adjust and prepare to capitalize on economic shifts. Moreover, some industries are impacted in a greater capacity than others when the economy shifts. New construction, real estate, and oil industries are good examples of industry verticals that experience cyclicality more drastically than other industries.

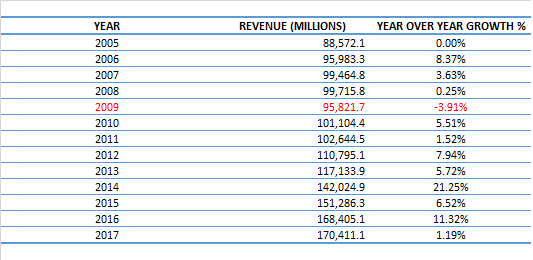

The PEO industry historically has experienced low volatility with economic cyclicality. As denoted in figure 1, during the great recession, the PEO industry only posted one year of negative year over year revenue change in 2009. That year was followed by an industry eight-year revenue growth totaling 78%.[i]

Figure 1

So why has the PEO industry rebounded so quickly during down economic times? First, it is important to understand the value proposition of a PEO and how a down economic shift impacts PEO revenues. We’ll start with the latter.

How a Downward Trending Economy Impacts the PEO Industry

When the economy takes a turn for the worse, Small & Medium Sized Businesses (SMBs) need to act to remain profitable and stay in business. Historically, SMB cost reductions have taken the form of layoffs, reduction in hours worked, employee pay reductions, and seeking out cost effective vendors and partnerships. SMBs are a PEOs primary customer and the PEO pricing model is generally constructed as a percentage of an SMB’s gross wages. If people are laid off, have their hours reduced, and/or see pay reductions, it negatively affects a PEOs gross and net revenues. As a result, if SMB payroll reduces, so does PEO revenues. This was evident during the start of the great recession in 2008, which impacted PEO revenues for 2009.

The PEO Value Proposition

Now let’s take a look at the PEO value proposition. A PEO provides an SMB with the ability to focus on core competencies by assisting with compliance requirements, tightening back end administrative functions, providing employment guidance, and streamlining insurance procurement. Moreover, a PEO has generally achieved a certain level of economies of scale which can benefit an SMB. As a result, a PEO is often a type of cost savings vehicle for an SMB. Whether that savings takes form in cost savings, in saving business owner’s time with administrative, workforce, and compliance expertise, or both, the PEO is a viable vehicle to assist an SMB with weathering a down economic cycle. This makes the PEO an attractive option to SMBs during a poor economy. During tough economic times, business owners look for solutions to assist the business with survival and profitability. The PEO model is positioned extremely well for this scenario. Moreover, SMBs with a PEO are 50% less likely to go out of business than those whom are not partnered with a PEO.[ii] As a result, new business growth can and has flourished for the PEO industry in a tough economy.

Historic Performance

In review, when the economy slows, same store sales reduce within the PEO industry. Same store sales may be defined as revenue from existing customers. However, new business growth continues to thrive. As a result, new business growth is positioned to offset the reduction in same store sales, thus reducing the rebound time for a negative industry year over year revenue change. During a down economy, a PEO will generally widen its client base through new business. Client retention within the PEO industry is high. It generally ranges between 88% and 90% annually. This means that once a PEO partners with a new company, there is high probability that SMB will be retained as a client.

When the economy turns for the better, same store sales will increase due to hiring, increased hours worked, and/or increased wages. This applies to the existing client base of the PEO when the economy slowed as well as the new business adds obtained during the down economy. Due to a wider client base, high client retention, and new business added, when the economy flips, industry revenues soar. Beyond the aforementioned items, any major regulatory shifts which require new SMB compliance bode well for the PEO industry. This is evident with the ACA compliance enactment and subsequent PEO industry year over year revenue growth in 2014 of over 21%.

Exceptions

The exception to mitigating cyclicality within the PEO industry is a PEO that is too heavily focused in an industry which is drastically impacted by economic downshifts. For example, if a PEO is heavily focused on new construction clientele, they may feel a greater impact with economic shifts. This is both a positive and negative. For example, when the economy is booming, and new construction is flourishing, the PEO reaps the benefits. However, when the economy tanks and construction SMBs experience massive layoffs, the PEO may be impacted by reduced revenue, increased unemployment claims, and increased workers’ compensation claims. The PEO can rebound but it may be a slower curve than for its counterparts whom have greater diversity in their client mix.

Seasonal

Seasonal cyclicality is generally based upon a PEO’s client mix and/or adjoining businesses. For example, if a PEO also has a temporary staffing division, it may experience greater cyclicality in combined revenues due to the staffing segment of its business. This would be accentuated if the staffing division has a lot of seasonal clients. This could take the form in seasonal growers, retailers, etc.

If a PEO does not have a temporary staffing division but does service clients whom have greater exposure to seasonal cyclicality this could impact the PEO. For example, if a PEO is largely focused on retail clientele, they may experience a favorable uptick in revenues during the holiday season. Conversely, they may also experience a hike in unemployment claims which could erode profit margins due to increasing SUTA rates. If a PEO focuses on growers, they may see greater volatility in their revenue if their client revenues fluctuate greatly from season to season. If a PEO focuses on staffing companies, they may experience increased revenue volatility depending on how greatly the staffing company clientele fluctuate in revenues. Ultimately, seasonal fluctuations can both benefit and harm a PEO depending on how it manages its risk and whether it diversifies its client base to offset seasonal shifts when applicable. Keep in mind that these seasonal fluctuations may become more predictable depending on the client base and therefore the PEO can plan for revenue fluctuations when appropriate.

Universal Master Plan

PEOs with a universal master plan for insurance have an annual anniversary date. This is the time when a PEOs internal costs go down, remain flat, or increase based on its claims. Some PEOs wait until their client’s individual renewal dates prior to passing on any adjustments in rates while others make the client pricing adjustments on the PEOs renewal date. If a PEO adjusts pricing on a universal renewal date, it may experience some cyclicality on these annual benchmarks. This could take many forms. Client attrition could increase due to an adverse PEO insurance renewal. Margin could increase due to a favorable renewal. New business growth could slow, or increase based on the renewal terms. A PEO could lose its carrier and find itself in a precarious position. A PEO may mitigate negative effects of this cyclicality by ensuring appropriate client selection, underwriting practices, and risk mitigation strategies to make this annual cyclicality favorable.

Tax Caps & PEO Tax Rates

A PEO bills its clientele for FICA, Medicare, FUTA, and SUTA. There are Federal tax caps and State tax caps. Each tax, except for Medicare, has a cap. Some of these caps change each year based on State or Federal adjustments. The variables that can impact cyclicality within this area are: a PEO’s pricing structure, how the PEO files its client’s SUTA, and how a PEO manages unemployment claims.

Pricing Structure

A PEO that prices its business on a bundled annualized rate has chosen to average the payroll taxes over the year as opposed to honoring tax caps. As a result, under this pricing structure, the PEO generally loses money on taxes until SMB employees cross the FUTA/SUTA thresholds. Once the tax caps are met by the SMB workforce, the PEO begins to make money on taxes. This creates a cyclicality in profitability where the third and fourth quarters are generally more profitable than the first and second quarters for the PEO annually.

SUTA Filing

If a PEO files SUTA taxes under one of its own SUTA numbers, it will most closely align the client’s historic SUTA rate with one of the PEO’s SUTA rates. As a result, there may be an initial gap between the client’s historic SUTA rate and the PEO’s SUTA rate creating a profit pool. The PEO must manage the unemployment claims favorably to maintain this margin. Historically, SMBs partnered with PEOs experience a 9% to 14% reduction in unemployment claims.[iii] Both the SMB and the PEO can benefit from partnership in this area. The cyclicality plays a role annually based on how well the PEO manages the unemployment claims. Favorable management can result in a profit increase the following year and/or a reduction in markup for the client. Conversely, poor management may result in profit erosion in subsequent years and a price increase for the client.

Quarterly and Annual Renewals

Those in the PEO industry understand that the beginning of each quarter represents the highest volume of SMB renewal dates with January 1st representing the highest annual SMB renewal date. Many businesses have insurance renewals (workers’ compensation and health benefits) at the beginning of a quarter. As a result, a PEO may see a higher uptick in new business or client attrition on these four dates (January 1st, April 1st, July 1st, and October 1st). A PEO may mitigate risk in client attrition on these dates, and throughout the year, by providing and executing upon a superior value proposition. If a PEO has a large percentage of clients on a singular renewal date, and the PEO experiences issues that may cause client attrition, it may experience a reduction in revenue quickly upon a renewal date. This may create some cyclicality within SMB renewals. However, it is a controllable variable where the PEO may mitigate risk by performing optimally.

Wrap Up

While there are various forms of cyclicality that could impact a PEO, the PEO can position itself to mitigate extended impacts of cyclicality. Historically, the industry has rebounded quickly from the affects of cyclicality. While there are exceptions as illustrated in this article, the PEO industry has proven to rebound quickly from cyclicality thus making it a less volatile industry for investment and funding partners. To learn more about the PEO industry’s historic performance, please see our latest article on the PEO industry statistics by clicking here.

[i] IBISWorld Industry Report

[ii] NAPEO Whitepaper

[iii] NAPEO Whitepaper

Author: Rob Comeau is the CEO of Business Resource Center, Inc. (www.biz-rc.com), a business consulting and M&A advisory firm with a niche focus on the PEO industry.